Income tax to be cut by 1p from April

- Published

- comments

The majority of taxpayers will pay one penny less in income tax in the pound from April next year.

New chancellor Kwasi Kwarteng said the cut in the basic rate of income tax from 20% to 19% would benefit more than 31 million people.

The cut, which applies to annual earnings between £12,571 to £50,270, comes a year earlier than planned.

In a surprise move, the 45% highest tax band for people who earn over £150,000 a year has also been axed.

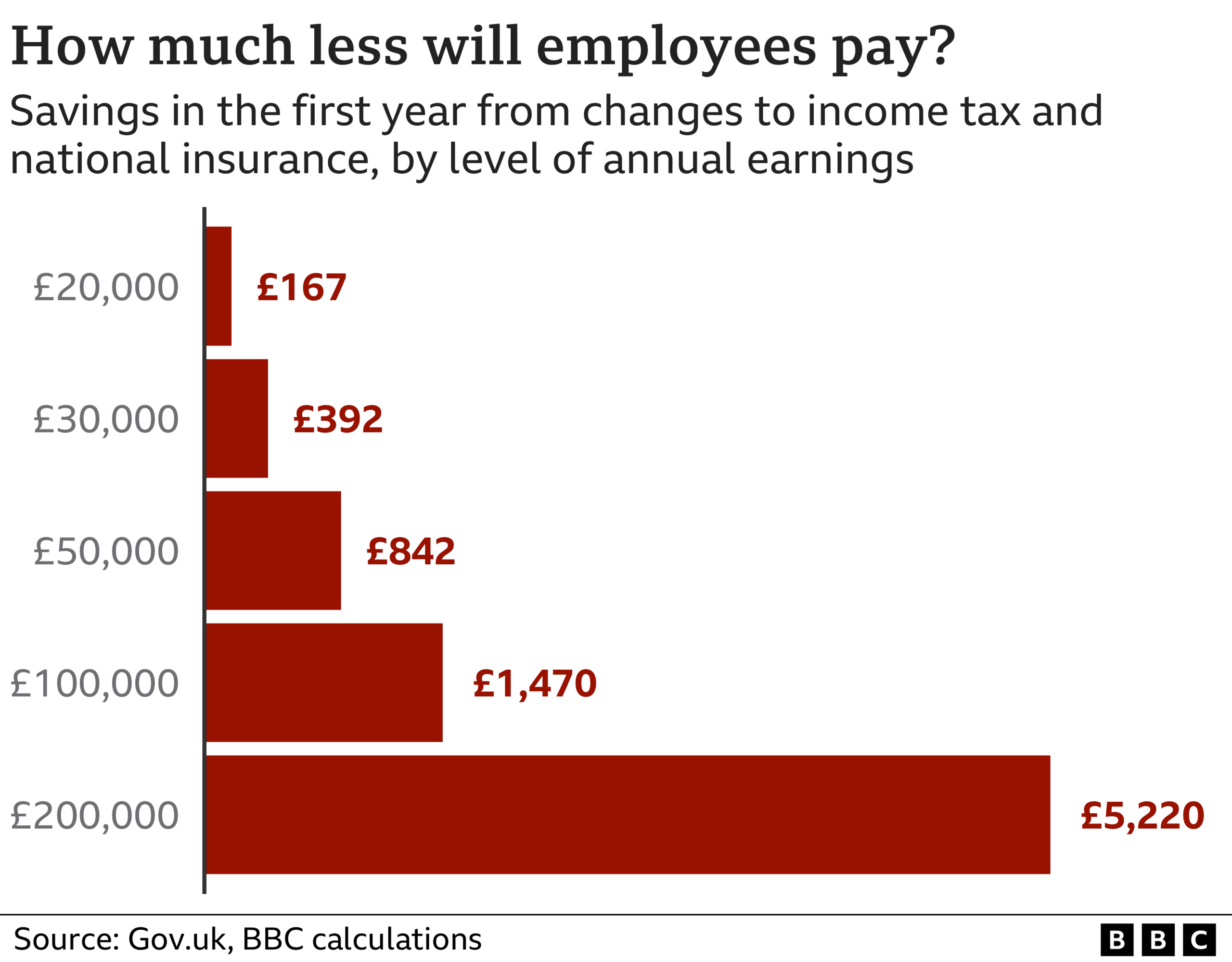

The reduction in income tax, along with the reversal of the National Insurance rise, will see higher earners save more money.

A person earning £20,000 a year will save £167, according to analysts at EY.

Meanwhile, an individual with an income of £40,000 will save £617 and person with earnings of £60,000 will save £969. A person on £100,000 will get an extra £1,469.

During his mini-budget, the chancellor said high tax rates "damage Britain's competitiveness" and reduce incentives for new businesses, arguing that tax cuts are "central to solving the riddle of growth".

Mr Kwarteng said scrapping the highest 45% tax rate would also "reward enterprise and growth".

The policy change means people earning more than £150,000 a year will instead pay the tax rate of 40%, which is applicable to earnings of more than £50,270 a year.

However, the change will not apply to Scotland where income tax bands are different. People in Scotland who earn more than £150,000 a year currently pay a 46% rate. The cut in basic rate tax to 19p in the pound also does not apply in Scotland.

Rachel McEleney, associate tax director at consultancy firm Deloitte, said the majority of taxpayers in England, Wales and Northern Ireland, who currently pay the basic rate of 20%, will see "some savings, albeit less" from April.

Labour shadow chancellor Rachel Reeves said the mini-budget prioritised big business over working people by relying on a theory of "trickle down economics".

"The prime minister and chancellor are like two desperate gamblers in a casino chasing a losing run," she said in response to Mr Kwarteng's plans.

Households across the UK have been feeling the pinch of higher prices in recent months, with higher energy bills and rising food prices fuelling inflation to a 40-year high.

The government has announced support to help with energy costs, limiting the typical household bill to £2,500 a year until 2024, but bills are still set to rise in October.

Rebecca McDonald, chief economist at the Joseph Rowntree Foundation charity, said the government had chosen to "turn its back on millions who are on the lowest incomes".

"This is a budget that has wilfully ignored families struggling through a cost of living emergency and instead targeted its action at the richest," she said.

"Families on low incomes can't wait for the promised benefits of economic growth to trickle down into their pockets."

However, Mark Littlewood, director general at free market think tank the Institute of Economic Affairs, said the axing of the highest rate of income tax would mean higher earners would spend "more time boosting their own productivity"

"The additional rate of income tax (45p) was always performative politics rather than sound economics," he said. "The 1p off the basic rate of income tax will put more money in people's pockets."

The abolition of the highest tax band, which was introduced in 2010, came as a surprise to many economists.

"It really is that kind of rabbit out of the hat..that not only is the additional rate going to be completely abolished, but also the cuts to the basic rate of income tax are going to be brought forward a year," said Michael Brown, head of market intelligence at finance firm Caxton.

Related topics

- Published8 September 2022

- Published23 September 2022

- Published17 October 2022

- Published23 September 2022