Millions will receive £324 cost-of-living payment in November

- Published

More than eight million people will get a cost-of-living payment of £324 in November, the government has said.

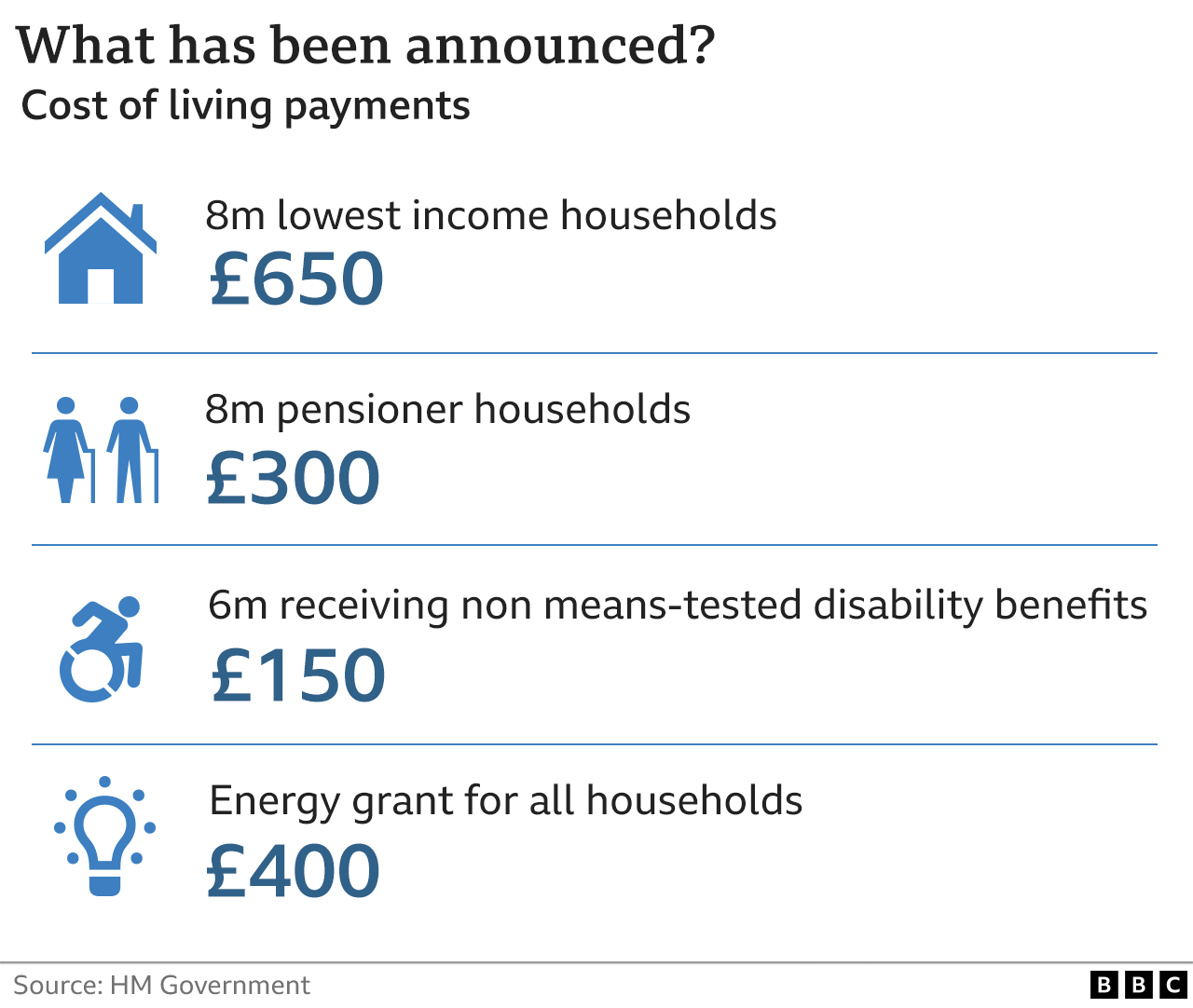

It is the second part of a £650 grant to help low-income households cope with soaring food and energy prices.

Those on means-tested benefits will get it directly into their bank, building society or credit union account, the Department for Work and Pensions said.

The payments will be automatic and will arrive in accounts between 8 and 23 November, the DWP said., external

It said the support was for those on certain benefits including universal credit and pension credit.

The £650 grant is the largest part of a £1,200 government support package for vulnerable households, designed to help with rising prices and specifically soaring energy bills. But there are no rules governing what it must be spent on.

The first payment of £326 was made in July and appeared in accounts as "DWP Cost of Living" and the November transfer is the final part of this particular support.

Who is eligible for cost-of-living payments?

A household may be eligible for the £650 cost-of-living payments if it receives any of the following benefits:

Universal Credit

income-based Jobseekers Allowance

income-related Employment and Support Allowance

Income Support

working tax credit

child tax credit

pension credit

Energy prices rocketed for millions of households on 1 October, but the government stepped in to put a cap on the cost per unit.

It means a typical annual bill based on the average household's usage has gone up from £1,971 to £2,500. That is not as high as once feared but still twice as high as last winter.

The first tranche of the government's £400 energy grant, which is available to all households, has already started to be paid.

The discount will be applied over six months, with a reduction of £66 in October and November, and £67 every month between December and March 2023.

Related topics

- Published1 October 2022

- Published13 July 2022

- Published15 February 2024