Pound at two-week high after spending plan reports

- Published

- comments

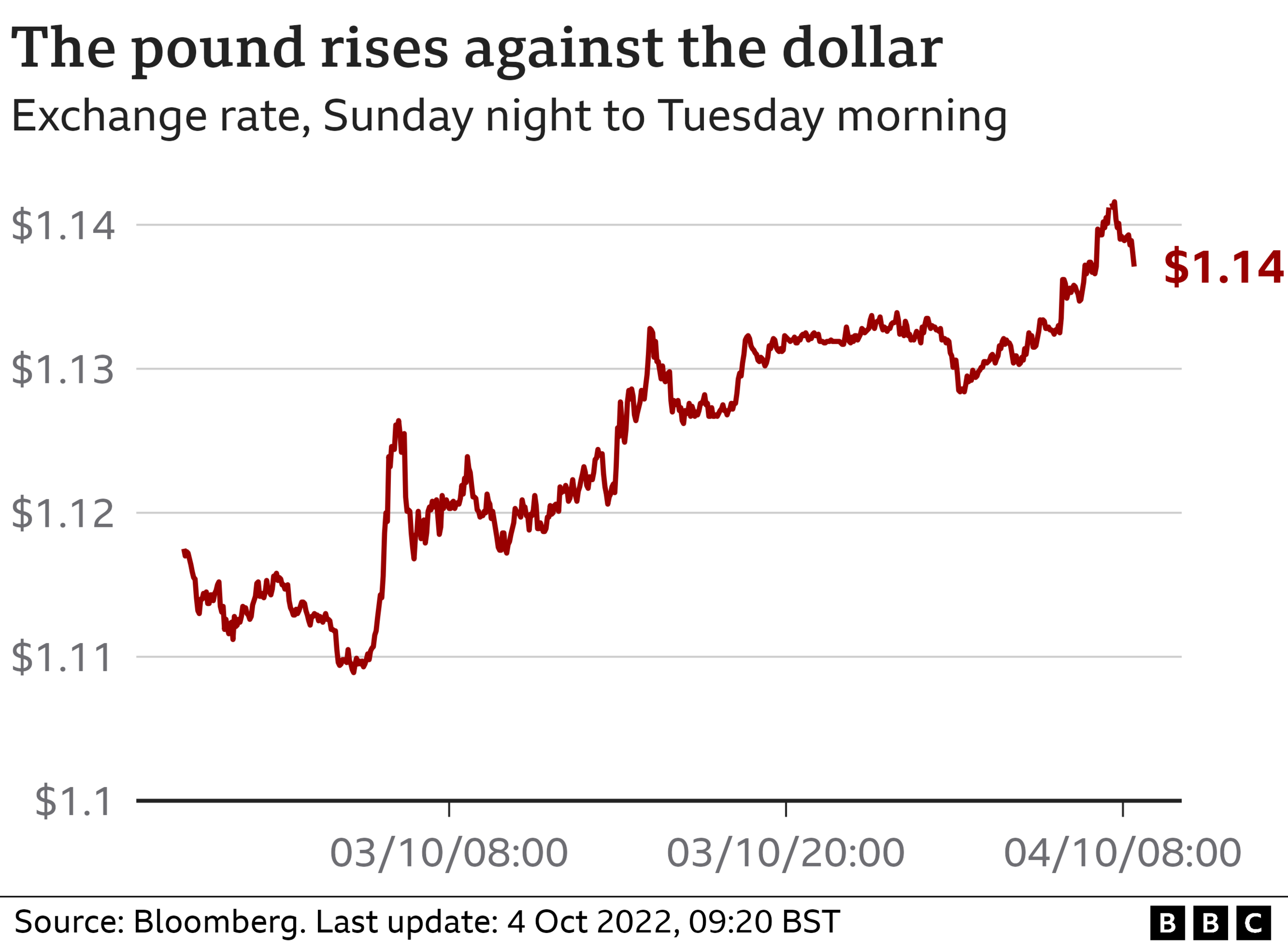

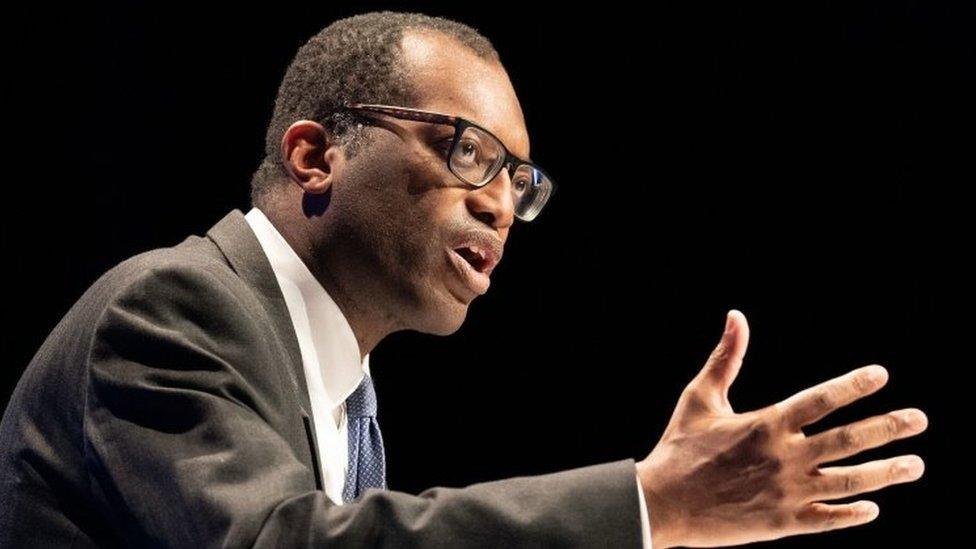

The pound has risen to its highest level for two weeks on hopes Kwasi Kwarteng will bring forward details of how he will cut debt.

It rose to $1.14, recovering after the chancellor's plans to fund tax cuts by extra borrowing rattled investors.

The pound remained high despite confusion over when he would set out his debt-cutting plan.

It is scheduled for 23 November but the BBC had understood that it would be bought forward to later this month.

On Monday, Mr Kwarteng had said his plans for how to boost growth as well as an independent assessment of the economic impact of his tax-cutting plans by independent forecaster the Office for Budget Responsibility (OBR) would be published "shortly".

The new date was expected to be announced once parliament returns on 11 October.

However on Tuesday, both Mr Kwarteng and Prime Minister Liz Truss told GB news the so called "fiscal plan" would still happen on 23 November.

Fears his tax-cutting plans are unaffordable sparked turmoil on markets last week after Mr Kwarteng laid out the measures in a mini-budget.

Conservative MP Mel Stride, chair of the Treasury Select Committee, told the BBC's Today programme the plan to cut debt would be "critical in calming the markets".

In the wake of the mini-budget, the pound slumped to a record low, government borrowing costs surged and the Bank of England was forced to step in and take emergency action after the dramatic market movements put some pension funds at risk of collapse.

Market turmoil was fuelled by the lack of an independent assessment on the impact of the plans, which had been offered by the Office for Budget Responsibility (OBR), but was declined by the government.

Investors also bet interest rates would rise faster than previously thought, leading banks to withdraw more than a thousand mortgage products as the uncertainty made long-term loans difficult to price.

Andrew Montlake, a mortgage broker at Coreco Partners, told the BBC that the beginning of last week had been "a whirlwind of activity and confusion".

His staff worked around the clock to help clients tie down deals before lenders pulled their products or replaced them with more expensive ones.

"If we spoke to a client at nine in the morning and quoted them a rate, we had to phone back two hours later and say: 'It's going in the next hour. You need to make a quick decision if you want it'," he said.

Homeowners about to come off fixed rates were facing huge jumps in their monthly payments, he added.

Tory backlash

Mr Stride said if the OBR forecast stacks up then interest rate expectations could fall "which is going to matter to millions of people up and down the country when it comes to their mortgages".

After a backlash from Tory MPs over plans to scrap the top income tax rate for high-earners, Mr Kwarteng made a dramatic U-turn on Monday, declaring he would abandon the move. He then later agreed to bring forward the date of his spending plan.

What does value of pound mean for my finances?

A fall in the value of the pound will increase the price of goods and services imported into the UK from overseas.

That's because when the pound is weak against the dollar or euro, for example, it costs more for companies in the UK to buy things such as food, raw materials or parts from abroad.

Firms could choose to pass on those higher prices to their customers. And that could push up inflation, which tracks how the cost of living changes over time.

This is now due to published later this month, ahead of 3 November when the Bank of England next meets to make its latest decision on interest rates.

Interest rates have risen seven times since December as the Bank tries to curb inflation - the rate at which prices rise. This is currently at a near 40-year-high of 9.9%.

After last week's turmoil, investors were estimating interest rates could reach more than 6% next year - although expectations have since edged back to around 5.4%.

Raising interest rates makes it more expensive to borrow which should, in theory, encourage people to spend less and cool inflation, but it also makes borrowing money for mortgages or other loans more expensive.

Mr Stride said: "If [the OBR forecast] is well received... you might expect the [Bank of England] to come up with a lower level of interest rate rises, which of course once again will be very helpful for those with mortgages, business borrowing and indeed for the cost of the government servicing its own debt."

However, he said there were doubts over whether the OBR would give the government its blessing.

Mr Stride said much would ride on the government proving that its policies can, as promised, boost economic growth to a yearly rate of 2.5% which will be "difficult to do".

Failing that, Mr Stride said the government would have to "row back" on other promised tax cuts or "lean into" public spending cuts at time of soaring inflation, which could meet fierce resistance.

Prime Minister Liz Truss has refused to confirm whether benefits will rise with inflation, a change that would save about £5bn.

But Penny Mourdant, Leader of the House of Commons, has openly opposed the idea telling Times Radio: "We're not about trying to help people with one hand and take it away with another."

- Published4 October 2022

- Published3 October 2022

- Published4 October 2022