Biden gas prices: What's driving Joe Biden's unusual focus on oil

- Published

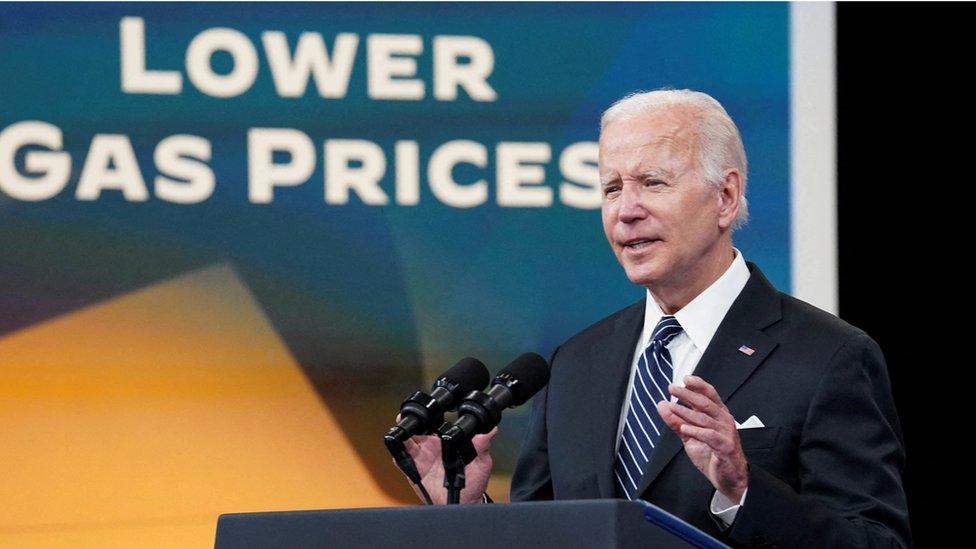

Joe Biden has made bringing down gas prices a priority

When he campaigned for president two years ago, Joe Biden had lofty economic ambitions - shifting the country away from fossil fuels, shoring up its safety net and advancing fairness and equality.

Now two years in, with midterm elections looming in November, there's a more prosaic matter driving his policies: prices at the pump.

On Wednesday, the White House made its latest announcement on the issue, pledging to extend releases of oil from national stockpiles through December - longer than planned - in a bid to tamp down costs of motor fuel. And officials said further releases could happen this winter, if necessary.

The moves are an effort to respond to gasoline prices that have surged since he took office in 2021.

With inflation top of mind for many voters, analysts say it's no surprise the president has made the issue a focus.

But the lengths Mr Biden has gone to to address it remain remarkable - especially since it's a matter largely outside of his control.

"The White House has staked its credibility on being able to lower energy prices," says Ben Cahill, a senior fellow at the Center for Strategic and International Studies, a Washington thinktank. "It's definitely unusual because the reality is that presidents don't control gas prices. They never have and they never will."

How much oil has the US released?

US history is littered with political fortunes shaped by the rise and fall of gasoline prices - a lesson Mr Biden will have learned during decades in Washington.

He was a first term congressman in 1973, when the US faced an oil embargo over its support for Israel. The stand-off helped end the political careers of at least two presidents and sparked shortages and long lines at gas stations that remain etched in the national memory.

Mr Biden has blamed high prices on energy firms and the war in Ukraine, denying his actions are politically motivated.

"For a lot of families, things are still tough. The choices made by other countries are affecting the price of gas here at home. That's why I've been acting so aggressively," he said on Wednesday, pledging to everything in his power to bring prices down.

The steps he has taken so far - releasing oil from national stockpiles, ordering investigations of companies and pressuring major producers like Saudi Arabia to keep up supplies - are not exactly novel.

In fact missions to the Gulf and calls to tap the nation's emergency oil reserves as prices rise - as Bill Clinton did in 2000, George W Bush did in 2005 and Obama did in 2011 - have been part of the Washington playbook for decades.

Mr Biden said during his presidential campaign he would make Saudi Arabia a pariah but visited the country in July amid concern about gas prices

But the scale of Mr Biden's oil releases - roughly 200 million barrels since last year - has dwarfed those of his predecessors, sending stores in the reserves to their lowest levels since the 1980s.

Mr Biden decision to use the reserves to shape the market represent a major shift, says Raad Alkadiri, a managing director at the Eurasia Group.

"This is direct intervention in the physical market and that's what's different," he says, noting that Mr Biden has pushed for other interventions as well, like capping the price of Russian oil, to try to reduce the money flowing to Vladimir Putin. "You take that step once and thereafter it becomes much more common practice."

Concerns about gas prices have also shaped key parts of Mr Biden's foreign policy.

Russian energy transactions were carved out of otherwise sweeping financial sanctions the US imposed on Russia after the war in Ukraine to try to soften the price spikes unsettling drivers.

And this month, the White House said it was reviewing the relationship with Saudi Arabia, responding to the decision by the Saudi-led Opec plus group of producers to reduce their oil production.

"For the first time in like maybe 50 years, there's a real chance of a rupture," says Jeff Colgan, professor and director of the Climate Solutions Lab at Brown University.

Has Joe Biden brought down gas prices?

Whether Mr Biden's actions will have a big effect on the domestic politics of the midterm elections, which will determine who controls Congress, is another matter.

Brooke Riske says prices for everything from groceries to dance costumes are rising

While gasoline prices have dropped back since June, when they crossed $5 (£4.50) a gallon, they remain 15% higher than they were a year ago, resuming their upward climb in recent weeks.

Brooke Riske, a 37-year-old from Virginia, says the rising costs have eaten into her family's budget. And while she does not blame the president for the spike, she does fault him for lack of a solution.

"When it comes to our president's ability to manage the country, I don't think he has the ability and I don't think he's doing a good job," she says "The issue of the cost of gas isn't the only thing driving my decision but it certainly helps confirm conclusions that I've already come to."

Does the US need to worry?

Over the summer, the White House pushed to take credit for the fall in prices, trumpeting the change on social media and in speeches.

The Treasury Department issued an analysis suggesting the reserve releases by the US and others had accounted for 17 to 42 cents of the declines.

Republicans say other factors - like concerns about the economy - drove oil prices lower and Mr Biden is playing politics with emergency stockpiles, while neglecting policy changes that would unleash US oil and gas companies.

"His dismal approval rating is not a justifiable reason to continue to raid our nation's oil reserves," Republican Senator John Barrasso wrote on Twitter on Wednesday.

Mr Biden has released unprecedented amounts of oil from national stockpiles amid concerns about high gas prices

The announcement on Wednesday did not add to the barrels being released - just extended the timeline. The 15 million barrels would not even cover a full day of consumption.

Analysts believe the US continues to have ample reserves in the event of an emergency, especially since domestic production has soared since the stockpile was created in the 1970s, reducing reliance on imports.

But that doesn't mean the releases can continue indefinitely.

With two years more in his term and inflation still rampant, that leaves Mr Biden with few levers to pull - especially since he is under pressure from his core supporters to deliver on promises to wean the US off fossil fuels.

"The Biden administration wants lower gasoline prices, but progressives have a lot of reservations about increasing oil and gas production in the US," Mr Cahill says. "It's hard to reconcile those two."

The administration is in negotiations with Iran and officials are reportedly exploring lifting sanctions on oil-rich Venezuela, but analysts said it's unclear how much that country, where the energy industry has suffered from years of mismanagement and disinvestment, would be able to supply.

The White House has also discussed limiting US energy exports - but doing so is strongly opposed by American energy firms, who appear to be Mr Biden's best hope for increasing supply.

Their output has increased, but not as much as expected as companies, facing equipment shortages and concerns about climate change, opt to enjoy fatter profits rather than invest in projects with uncertain long-term demand.

Mr Biden on Wednesday said companies should be using their profits to increase output. He added that the US would offer certainty by pledging to buy oil to refill the reserves for roughly $70 a barrel.

"You still make a significant profit, your shareholders will still do very well. And the American people catch a break they deserve and get a fair price at the pump as well," he said. "We can strengthen our energy security now and we can build a clean energy economy for the future at the same time."

- Published31 March 2022

- Published29 May 2022

- Published7 November 2022

- Published31 October 2022