What Jeremy Hunt's statement means for you

- Published

By dismantling policies from the so-called mini-budget of just a few weeks ago, Chancellor Jeremy Hunt has rewritten the prospects for your finances.

From income tax to energy bills, various changes will have a direct impact on your money.

This is how the latest decisions will affect you.

Reduced support with energy bills

The government's Energy Price Guarantee was originally put in place for two years - to limit the price that suppliers could charge for each unit of energy.

Now that will only be in place for six months, just to cover this winter. The Treasury will review support given from April, but Mr Hunt said there would be "a new approach" targeting those in the most need.

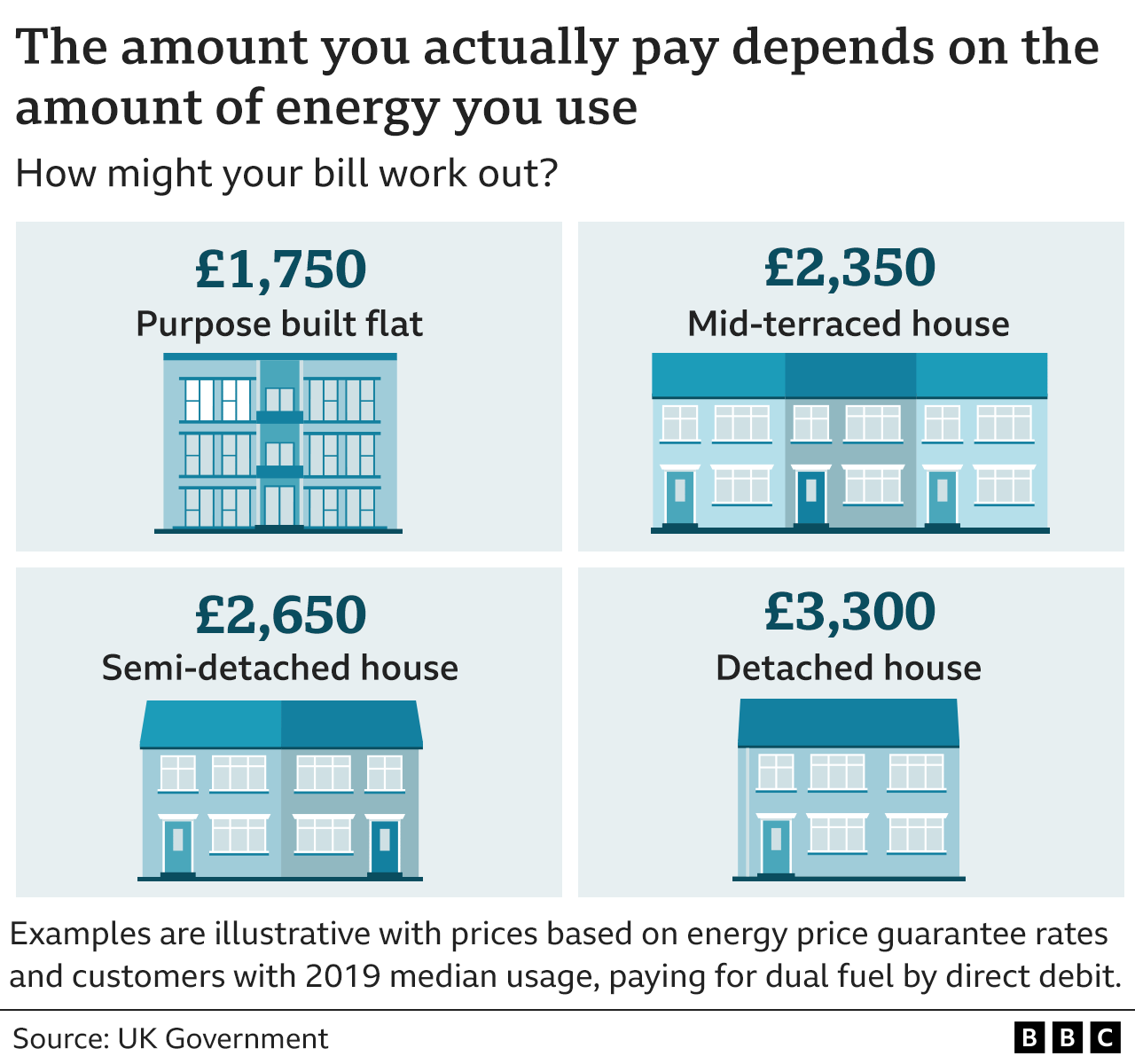

You will still pay for the gas and electricity you use. For a typical household - one that uses 12,000 kWh (kilowatt hours) of gas a year, and 2,900 kWh of electricity a year - it means the annual bill will be £2,500 until next spring. Last winter it was £1,277 a year.

After that, the details will be decided by the review, and it is likely that only those with lower incomes would be supported.

Predictions from consultants Cornwall Insight suggest that, for households that do not receive any support, a typical annual energy bill could be £4,347 in the spring, dropping to £3,722 next winter. That prediction will be affected by any change in wholesale prices.

There will also be incentives to be more energy efficient.

Income tax cut is cancelled

A cut in the basic rate of income tax - which had been promised by two chancellors this year - has been cancelled.

In the spring, Rishi Sunak, when chancellor, pledged to reduce the basic rate of income tax by 1p in the pound before the end of the Parliament in 2024.

Kwasi Kwarteng, when chancellor, said this would be brought forward to April 2023.

Now Jeremy Hunt has said the basic rate of income tax will stay at 20% indefinitely. This means your income tax rates will remain unchanged.

People are already facing higher bills and a higher cost of borrowing, and more people have been drawn into paying higher income tax bands, because the thresholds have been frozen - and this will continue.

The proposed abolition of the 45% additional rate of tax, which is paid by people who earn more than £150,000 a year, had already been ruled out.

Income tax bands are different in Scotland, where there are five different rates, external.

Some people are taxed on the share dividends they receive. This tax was increased in April, but was supposed to be reversed in April next year. That reversal will now be cancelled.

Little chance of mortgage rates dropping immediately

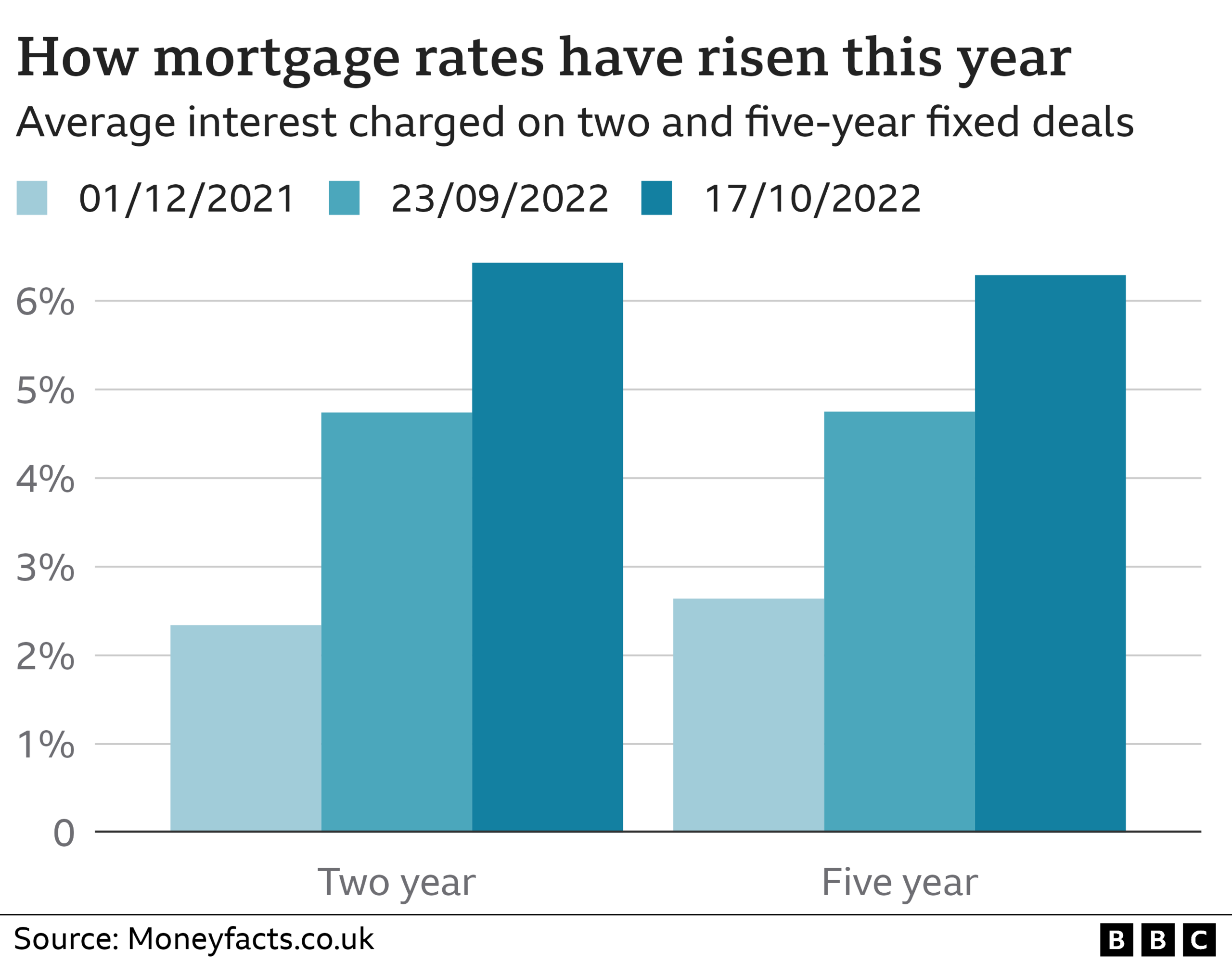

Mortgage rates have been rising - a trend that was accelerated after the mini-budget.

But brokers say borrowers should not expect the dismantling of that economic statement to feed through to an immediate reversal in mortgage rates.

Lenders are likely to "play safe", waiting to see how the markets react to the changes, and - critically - what the Bank of England is likely to do with interest rates. Any lender dropping their rates now could also be inundated with demand.

The backdrop is unchanged. Inflation is still high, and the Bank is still expected to tackle that with higher interest rates. Average rates have been unchanged in recent days.

Some of that will already be priced in by lenders, so it may be the case that mortgage rates stop rising significantly, but do not drop much in the short-term, if at all. It is difficult to make too many predictions at this stage.

One broker said we are returning to a position of facing the same challenges as the rest of the world.

What about the so-called sin taxes?

Planned increases in the duty rates for beer, cider, wine and spirits will now go ahead, rather than being cancelled.

The duty paid on alcohol is re-valued each year to keep pace with inflation - though it has been either cut or frozen in every budget since 2013.

Alcoholic drinks are classed in to tax categories - beer, cider, wine, sparkling wine and spirits. There are 15 different tax rates based on type of alcohol, strength and production method.

The increase in this tax from February 2023 will be worth around £600m a year.

Potential for spending cuts

Anyone on the major benefits - such as universal credit - should expect a rise in what they receive. However, that will not come until April.

There is no clarity yet about whether this rise will be in line with rising prices, or the lower increase in average wages.

Mr Hunt said that would be "difficult decisions" to come on tax and spending - but support for the most vulnerable would be prioritised.

IR35 reforms to stay

The government had been planning to repeal the changes to the rules on off-payroll working, known as IR35, which were introduced in 2017 and 2021.

But these regulations, which have been controversial and criticised by some businesses, will now continue.

The point of them is to make businesses responsible for making sure that contractors they are employing, via another company, are actually entitled to that status and should not be paid directly via payrolls. Previously, there was concern that tax was not being paid in the way it ought to have been done.

What remains from the mini-budget including stamp duty

The change in the threshold of how much a property has to cost in England and Northern Ireland before stamp duty is paid from £125,000 to £250,000 will stay.

First-time buyers will pay the tax on properties costing more than £425,000. Discounted stamp duty for first-time buyers will apply up to £625,000.

Homebuyers in London and the South East of England will benefit the most from this. They pay 65% of all stamp duty as prices are higher and the tax is particularly focused on homes of more than £500,000, according to research by Zoopla. Three-quarters (76%) of stamp duty came from homes priced at more than £500,000.

National Insurance changes will also go ahead as the 1.25% rise in National Insurance will still be cancelled on 6 November.

The Treasury has said the change will save nearly 28 million people an average of £330 per year.

However, the impact varies considerably depending on what you earn.

Overall, analysis by the Resolution Foundation suggests that, for a typical household, all these policies - taken together - will mean tax cuts of £290, rather than £500, driven by the scrapping of the rise in National Insurance.

For the richest 10% of households, tax cuts have been reduced from £5,380 to £1,650, the analysis suggests.

What are your questions about the policy changes and cost of living?

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Or fill out the form below:

Please include a contact number if you are willing to speak to a BBC journalist.

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published17 October 2022

- Published16 October 2022