Soaring food prices push inflation to 40-year high

- Published

UK food prices are rising at their fastest rate in 42 years as the cost of living crisis continues to squeeze household budgets.

Food costs jumped 14.6% in the year to September - the biggest rise since 1980 - with bread, cereal, meat and dairy prices all climbing.

It comes as people also struggle with higher energy and transport costs.

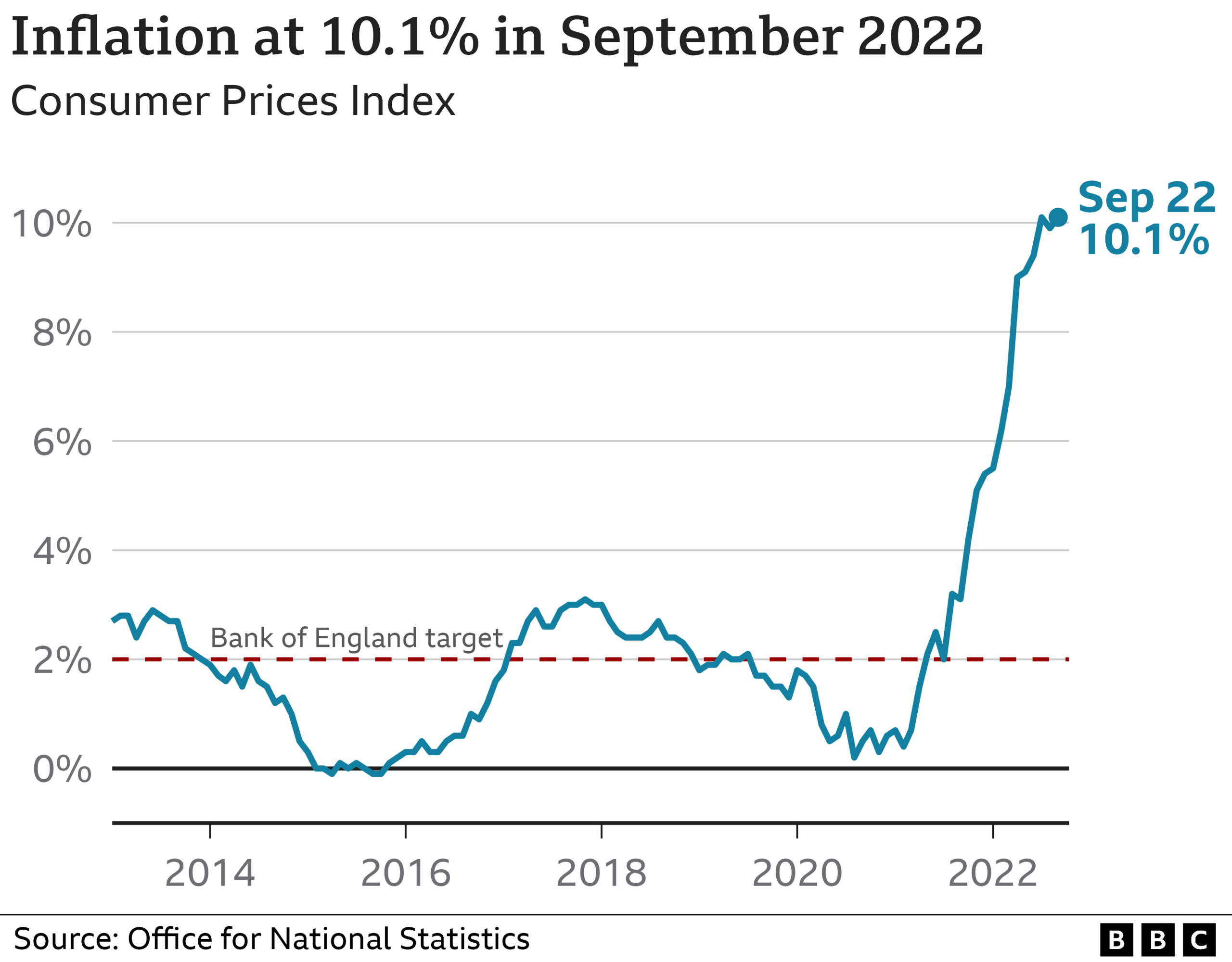

Overall inflation - the rate at which UK prices rise - surged to 10.1% last month and is expected to climb further.

The prices of most key items in the average household's food shopping basket went up last month, including fish, sugar, fruit and rice, the Office for National Statistics (ONS), external said.

Experts say the rise in the cost of groceries has been accelerated by the war in Ukraine, which has disrupted grain, oil and fertiliser supplies from the region.

Food and drink prices have also been affected by the recent weakness in the pound, which has made imported products and ingredients more expensive.

Your device may not support this visualisation

Karen Betts, chief executive of the Food and Drink Federation, said: "Food and drink manufacturers continue to do everything they can to keep product prices down, but huge rises in ingredient, raw material, energy and other costs mean they have no choice but to pass some price rises on."

According to the ONS, overall inflation is back at the 40-year high seen in July after dipping to 9.9% in August.

It said the cost of furniture and hotel stays had also risen - although these were partially offset by the falling price of petrol and airline tickets.

It comes as a BBC survey uncovers growing concern about the squeeze on finances, external. Some 85% of those asked are now worried about the rising cost of living, up from 69% in a similar poll in January.

As a result, nine in 10 people are trying to save money by delaying putting the heating on.

The Bank of England says inflation could peak at 11% in October, after inflation figures have factored in the big rise in energy bills that came in at the start of this month.

Jen Welch, who runs artisan bakery Bread&, says the situation is "scary" as her costs rise rapidly.

She set up the bakery in Sunderland during the pandemic and thought that would be the toughest experience she would face.

Jen Welch, who runs an artisan bakery, said costs for all key ingredients have gone up

But the cost of her key ingredients such as flour, butter and oils have "spiralled out of control" and they face energy bills of more than £1,000 a month.

"You think to yourself, if we can [get through the pandemic], we can weather most storms," she told the BBC. "But maybe that's not the case."

The latest official figures come as new Chancellor Jeremy Hunt attempts to tackle the rising cost of living, as well as the recent turmoil on financial markets sparked by his predecessor's mini-budget.

As a result of the volatility, mortgage prices have hit a 14-year high, driving up costs for millions at a time when energy and food bills are also rising.

Mr Hunt said the government said he understood people were struggling and would "prioritise help for the most vulnerable while delivering wider economic stability".

But shadow chancellor Rachel Reeves said: "Inflation figures this morning will bring more anxiety to families worried about the Tories' lack of grip on an economic crisis of their own making."

Rising interest rates?

Experts said the latest inflation figures would put extra pressure on the Bank of England to hike interest rates at its next meeting in November.

By raising rates the Bank aims to encourage people to save more and spend less, in the hope this will stop prices rising as fast. It has increased rates seven times in a row since December as it tries to bring inflation back down to its 2% target.

But higher rates also drive up borrowing costs for mortgage holders and businesses, with experts warning this could put a brake on economic growth.

The rise in the cost of living is expected to peak this October, when government support to freeze energy bills at £2,500 for an average household comes into play.

But that help is expected to be reduced from April as the government looks to plug a hole in the public finances, leading to warnings that bills could go above £4,000.

Mr Hunt has promised to protect the most vulnerable but not said what help they will get, or whether those on higher incomes will be supported.

In addition, while the prime minister confirmed she would increase pensions in line with inflation, she has not committed to do the same for benefits.

Related topics

- Published17 July 2024