US throws out charges against interest rate ‘rigger’

- Published

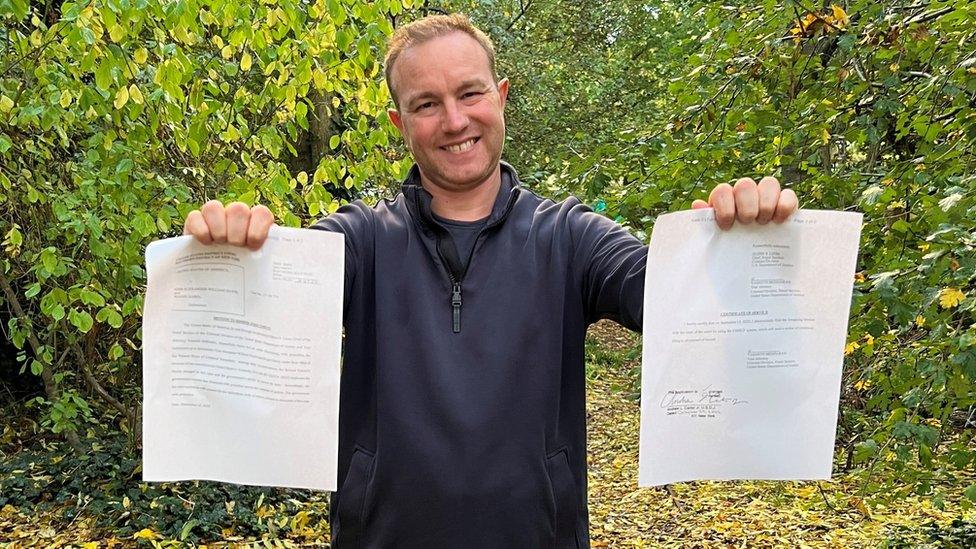

Tom Hayes holding the US court document dismissing charges against him

The United States has thrown out criminal charges it brought against the first trader to be jailed for "rigging" interest rates.

Former UBS trader Tom Hayes was the first of 38 people to be prosecuted.

He was charged in both the US and the UK, tried in London in 2015 and sentenced to 14 years, reduced on appeal to 11.

But earlier this year, US courts ruled that the prosecutions were misconceived.

Tom Hayes told the BBC: "I'm ecstatic to get this decision. It feels almost like I'm in a dream."

For Mr Hayes, who has Asperger's syndrome, it brings to an end a decade-long ordeal facing criminal charges brought by the US Department of Justice.

However, he is still struggling to overturn his conviction in the UK on the same evidence.

"After years of tireless work by my solicitor Karen Todner, the Department of Justice in the US have now dismissed my charges in their entirety, acknowledging the flawed legal theory pursued in the cases of so called Libor 'rigging'," Mr Hayes said in an exclusive interview with the BBC.

"I am pleased to end the 10-year international pursuit of my legal activity. It is now time for the UK to examine the convictions of all traders. It is now the sole jurisdiction that deems the conduct criminal."

Tom Hayes served his full jail tariff in the UK of five and a half years and was released in 2021.

What traders were accused of, the US court decided, did not in fact break any rules or laws, raising serious questions about the safety of convictions for traders found guilty in nine trials for "rigging" interest rates on both sides of the Atlantic.

The interest rate traders were accused of manipulating was Libor, the benchmark interest rate that tracks the cost of borrowing cash.

What is Libor?

What the FTSE or Dow Jones are to share prices, Libor is to interest rates - an index that tracked the cost of borrowing cash between the banks.

For the past 35 years, it has been used to set interest rates on millions of residential and commercial loans around the world.

To work out Libor each day, 16 banks answer a question - at what interest rate could they borrow money? They submit their answers and an average is taken.

The evidence against Tom Hayes and other traders consisted of messages and emails asking for those interest rates to be submitted "high" or "low" to suit their bank's trades, which could make or lose money if the Libor average rose or fell.

In 2012, the US Department of Justice claimed this was corrupt. Defendants said it was normal commercial practice to ask for high or low estimates, within a range of interest rates on offer from lenders in the market.

There were no laws or written regulations about Libor at the time the traders made the requests.

In late 2014, lawyers for Tom Hayes argued that because there was no rule against the traders' requests, the case should be dismissed.

In January 2015, Lord Justice Davies ruled that it was "self-evident" that the requests were against the rules.

Banks were not allowed to take into account commercial interests, such as trading positions linked to the Libor rate, when making their estimates.

That ruling was used to prosecute 24 traders in the UK. However, US judges decided in January 2022 that far from being "self-evidently" corrupt, the requests did not break any rules or laws in either the US or the UK.

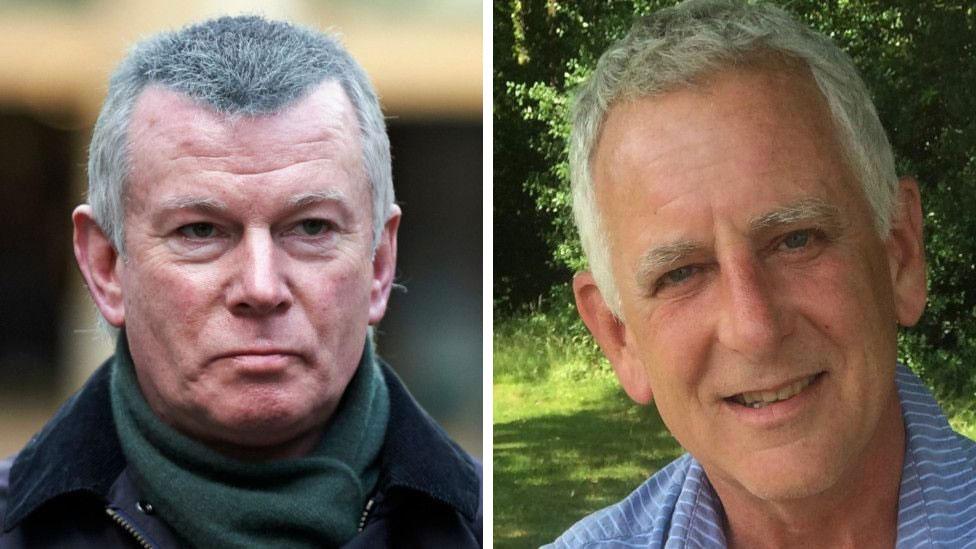

US judges have now reversed four convictions of American and British former traders for "rigging" Libor, including former Deutsche Bank traders Gavin Black from Twickenham and and Matt Connolly from New Jersey.

This year they also reversed the convictions of two former colleagues of Mr Black and Mr Connolly who had pleaded guilty to "manipulating" interest rates, former US swaps trader Tim Parietti and British former cash trader Mike Curtler.

Now, after the top fraud prosecutor at the US Department of Justice, Glen Leon, asked the courts to throw out the charges against Mr Hayes to serve the interests of justice, the courts have dismissed his indictment.

The dismissal motion, signed by a judge and published on Monday, says the US government "submits that dismissal with prejudice serves the interests of justice".

But Mr Hayes continues to seek an appeal against his UK conviction, which is still under consideration by the Criminal Cases Review Commission, the body that investigates miscarriages of justice.

Eight further defendants have been jailed for the same offence in the UK, including two whistle-blowers who tried to alert authorities to evidence that the Bank of England, UK government and other central banks were involved in Libor "rigging" on a much larger scale.

In February, BBC Radio 4 series The Lowball Tapes, exposed confidential audio and documentary evidence, kept secret by the UK authorities, that support those allegations.

The UK is now the only jurisdiction in the world where the Libor "rigging" alleged against the traders is regarded as an offence.

In 2017, the BBC also revealed evidence that implicated the Bank of England in Libor "rigging". Later that year, the financial regulator, then led by former Bank of England official Andrew Bailey, initiated reforms to phase out Libor by 2023, in spite of earlier recommendations from an official review that it should be kept in place.

Mr Bailey was appointed governor of the Bank of England in March 2020.

Tom Hayes added: "The US Department of Justice themselves saw fit to dismiss charges based on the same facts, evidence and case in law that the UK used to incarcerate me for five and a half years.

"That alone should be grounds enough for these cases to referred back to the court of appeal here and if need be the Supreme Court which is yet to hear the case," he said.

"Justice for all those incorrectly prosecuted is paramount."

Related topics

- Published6 September 2022

- Published1 March 2022

- Published28 January 2022