House prices see biggest fall for two years, says Nationwide

- Published

- comments

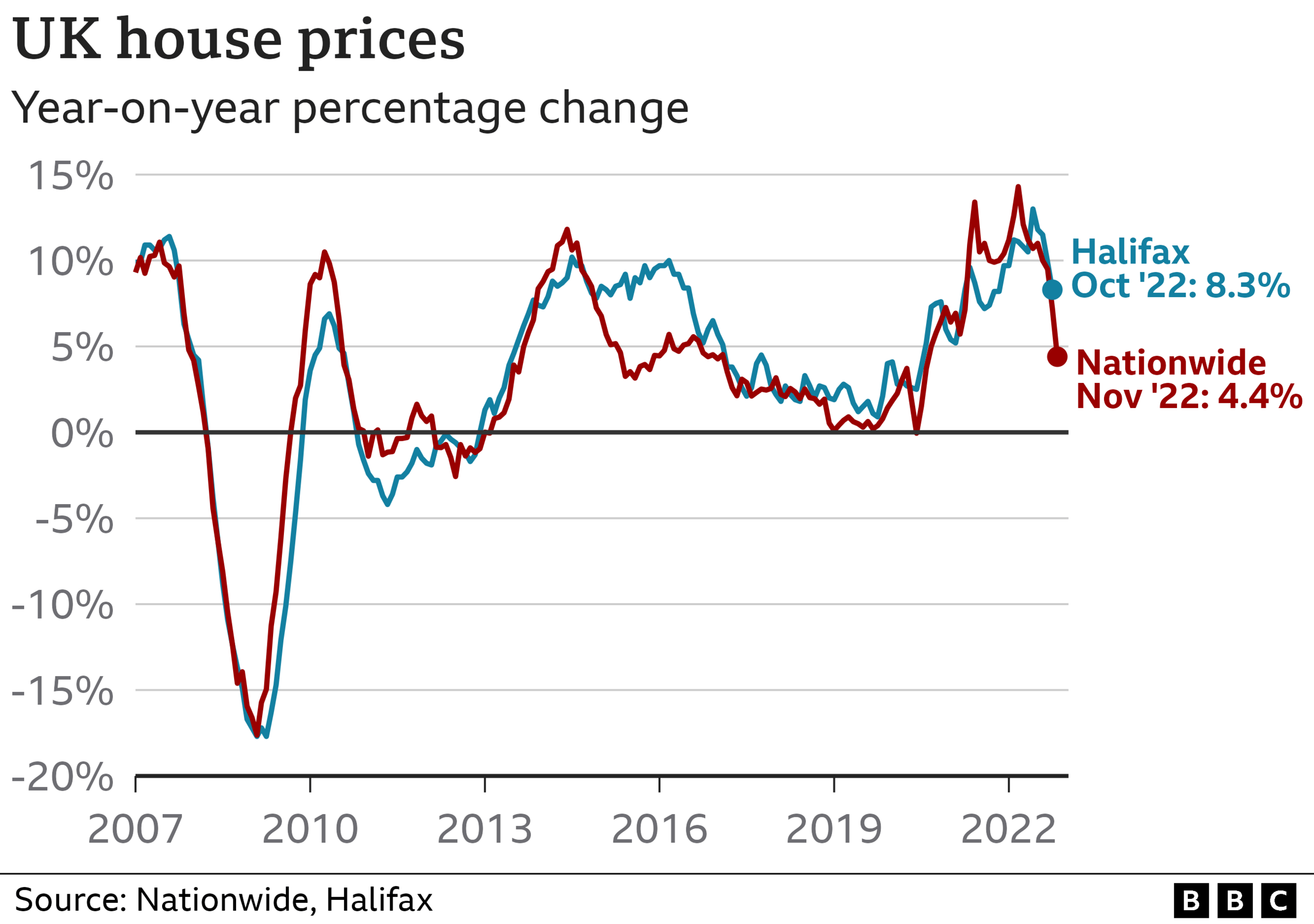

UK house prices saw their biggest monthly fall for more than two years in November as rising interest rates put off buyers, the Nationwide has said.

Prices fell 1.4% from October, which was the largest month-on-month fall since June 2020.

Annual house price growth saw a "sharp slowdown", the building society said, falling to 4.4% from 7.2% in October.

The lender added the housing market looked set to "remain subdued" in the coming months.

Earlier this month, the government's official forecaster predicted that house prices will fall by 9% over the next two years as affordability issues weigh on demand.

The average property price fell to £263,788 last month from £268,282 in October, the Nationwide said.

It said the housing sector was still being affected by the fallout from September's mini-budget, which triggered a rise in mortgage rates and also led lenders to suspend hundreds of mortgage products amid turmoil on the financial markets.

Speaking to the BBC's Today programme, Nationwide's chief economist, Robert Gardner, said: "A lot of this reflects the fallout of the mini-budget and the big rise that we saw in mortgage rates, because that really did change the affordability calculations for prospective buyers and really made things a lot less affordable."

Are you affected by issues covered in this story? Get in touch.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

He added: "If you look at the typical mortgage payment as a share of someone's take-home pay, for the typical first-time buyer that was running at close to long-run averages of 30%. But as a result of the mini-budget it's moved up to around 45% of take-home pay, which is clearly a massive difference."

Mr Gardner said the market was likely to remain under pressure for some time, with inflation - the rate at which prices rise - set to remain high and the Bank of England likely to raise interest rates further.

But he added that while the outlook was uncertain, a "relatively soft landing" for the market was still possible, given that employment rates remain high and there is a lack of properties coming up for sale.

He also noted that the cost of borrowing had started to fall in recent weeks.

Last week, figures from financial information service Moneyfacts showed that the average five-year fixed mortgage rate had fallen below 6% for the first time in nearly two months.

Recent data has been pointing to a sharp slowdown in the housing market. Earlier this week, the Bank of England said the number of mortgages approved in October fell to its lowest level since June 2020.

These figures are evidence of a shift in the housing market - a predictable shift, but a significant one all the same.

Official forecasters say this will be the start of two years of house price falls - but, remember, that follows a period of big rises.

Falling property prices may be a relief to some first-time buyers, but the big increase in the general cost of living may limit their ability to save for a deposit.

Other buyers may feel that now is the time to negotiate hard on price, and sellers will have to give some extra thought to pricing and how quickly they want to move.

All these are general points, but there is not one single UK housing market to navigate. Instead, there are a series of local markets where price, demand and supply are affected by a host of variables from local schools and housing developments to job opportunities and transport.

The next few months could be "something of a nightmare" for the housing market, according to Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

She said that we were "not seeing anything like the full impact" of the mini-budget in Nationwide's figures, as on average it takes about three months to complete a sale.

As a result, the latest data is likely "to include only around a week of sales agreed after mortgage chaos was unleashed. Even at that point, sales being settled were highly likely to have been funded by mortgages agreed well before everything kicked off, so all we're seeing is the effect of a sudden and possibly catastrophic loss of confidence."

She added that while mortgage rates have since dipped, and are expected to fall further, "the damage may well have been done".

Are you affected by issues covered in this story? Email: haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Or fill out the form below

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

- Published23 November 2022

- Published18 November 2022

- Published1 August 2023