Global recession warning as World Bank cuts economic forecast

- Published

- comments

The World Bank, led by President David Malpass, says the economies of the US, Eurozone and China are all struggling

The global economy is "perilously close to falling into recession", according to the latest forecast from the World Bank.

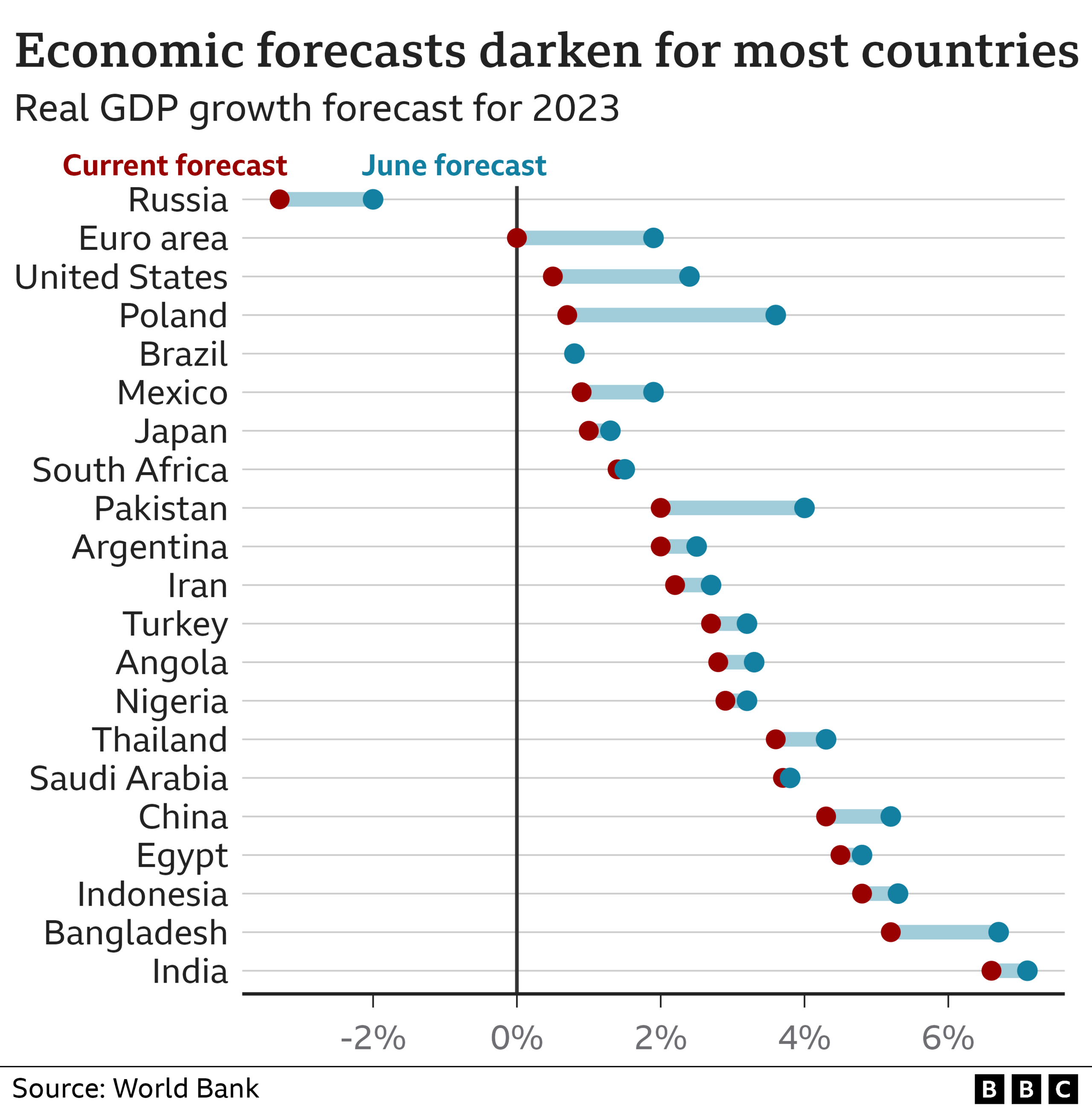

It expects the world economy to grow by just 1.7% this year - a sharp decrease from the 3% it predicted in June.

The report blames a number of factors stemming from Russia's invasion of Ukraine and the impact of the pandemic.

The effects of higher interest rates are picked out as the key challenge for policy makers to overcome.

World Bank president David Malpass said the downturn would be "broad-based" and growth in people's earnings in almost every part of the world was likely to "be slower than it was during the decade before Covid-19".

The 1.7% growth figure would be the lowest since 1991, with the exceptions of the recessions of 2009 and 2020, which were caused by the global financial crisis and the Covid pandemic.

The World Bank said the US, the Eurozone and China - the three most influential parts of the world for economic growth - were "all undergoing a period of pronounced weakness", a downturn that was worsening the problems faced by poorer countries.

After surging 5.3% in post-pandemic 2021, growth in the world's richest economies is likely to slow sharply from 2.5% in 2022 to just 0.5% this year.

"Over the past two decades, slowdowns of this scale have foreshadowed a global recession," the bank warned, adding that it anticipated "a sharp, long-lasting slowdown".

If a global recession were to occur, it would be the first time since the 1930s that there have been two global recessions within the same decade.

Tackling rising prices

Higher inflation is one of the main reasons that the global economy is struggling. Global food and energy prices jumped last year as the war in Ukraine led to reduced crop supplies and pushed the West to move away from Russian fossil fuels.

Why are things so expensive? The BBC's Faisal Islam answers your inflation questions in 90 seconds

The World Bank said it expected the global pace of price rises to slow from 7.6% in 2022 to 5.2% this year, as those pressures ease.

While some "prices spikes are possible". the bank said it expected energy prices to fall in general. It pointed to an increase in global production and lower demand in Europe, where an energy crisis has led businesses and households to reduce their use of gas.

Crop prices are also forecast to fall by 5% this year although they will still be significantly higher than they were a few years ago, having risen by 13% in 2022.

Despite those developments, inflation is expected to remain well above the 2% rate typically considered healthy.

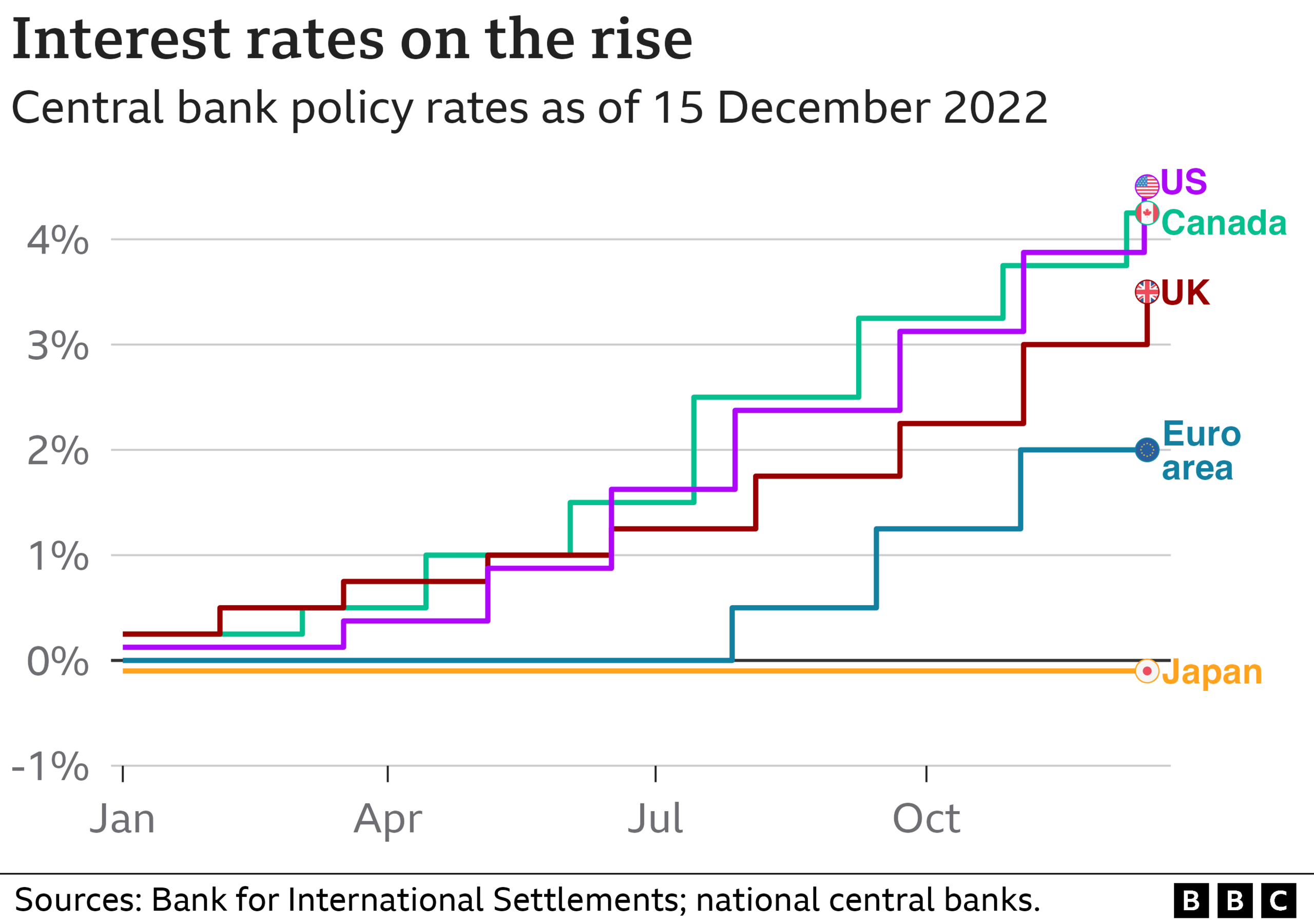

Central banks in dozens of countries, including the US and the UK, have been raising interest rates in response to the problem, aiming to cool their economies and ease the pressures pushing up prices.

But they are navigating a delicate path as they try to address the cost-of-living crisis while not tipping their economies into recession.

The World Bank said higher borrowing costs have stifled business investments and warned that more companies were struggling with their debts. Developing economies are also being squeezed hard by US interest rates, which are expected to rise further. Many of them borrow money in US dollars.

The Bank said that even with the global economy "under pressure" the right government policies could offer hope. It recommended measures to boost investments and create jobs, tackle climate change, address the debts of poorer countries and facilitate international trade.

- Published10 May 2024

- Published11 November 2022

- Published24 January 2021

- Published6 October 2022