Apple sales in biggest fall since 2019

- Published

- comments

Apple warned of delayed shipments of its new iPhone 14 as Covid restrictions hit its manufacturer

Apple sales dropped at the end of 2022 as shoppers squeezed by the rising cost of living cut back their purchases.

Sales at the iPhone giant fell 5% in the three months to December compared with the same period in 2021.

It was the biggest decline since 2019 and worse than expected.

The update came as many firms warn about a sharp economic slowdown, especially in the tech sector which boomed during the pandemic.

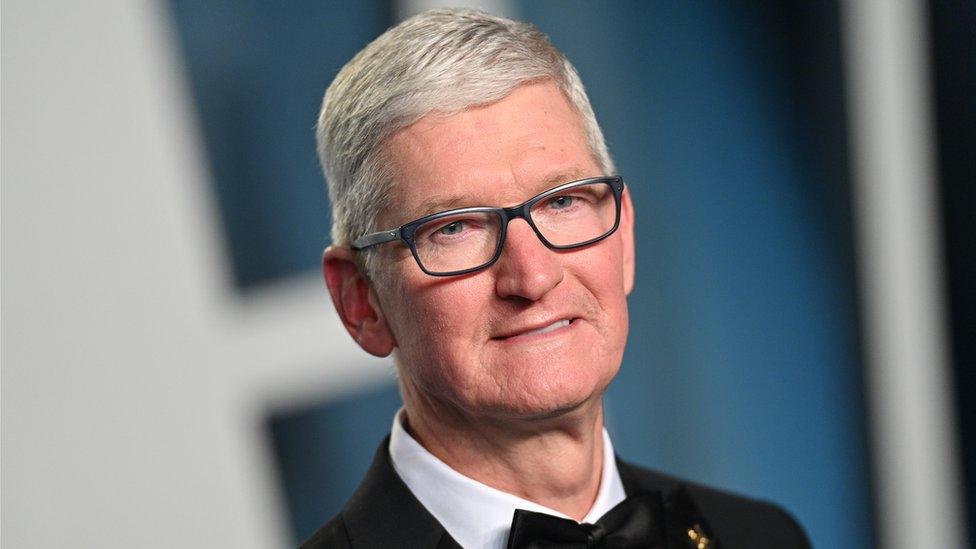

Apple boss Tim Cook said the firm was navigating a "challenging environment".

He blamed the sales decline on supply shortages due to Covid-19 disruption in China - where its phones are manufactured - and a strong dollar, as well as wider economic weakness stemming from rising prices, the war in Ukraine and lingering effects from the pandemic.

"As the world continues to face unprecedented circumstances ... we know Apple is not immune to it," he said on a conference call with investors.

Apple said the decline in sales occurred throughout the world and hit most of its products.

Sales of its popular iPhones were down more than 8%, and sales of Mac computers dropped 29%.

The declines hit the firm's profits, which fell 13% to $30bn (£24bn).

Roger McNamee, founding partner of Elevation Partners, told the BBC's Today programme that the biggest issue facing Apple was its supply chain in China.

"China has taken a more combative approach with Western economies over the past year and a half, partly due to their zero tolerance on Covid but I think there are other geopolitical issues factoring in as well and Apple, which has historically done the vast majority of its manufacturing in China, has had supply chain issues," he said.

"It is unclear to what degree Apple may have demand problems. It is super-clear they can't get all the supply that they want to get."

Paolo Pescatore, analyst at PP Foresight, said Apple, like many electronics makers, was also struggling to make the case that users should upgrade given "what is perceived to be incremental improvements on previous models".

"More so when everyone is tightening their belts," he added.

Globally the number of smartphones shipped sank 12% last year, according to market analysis firm Canalys.

Apple executives said they expected their services business, which includes Apple Pay and Apple News, to continue to drive growth, noting that there are now more than 2 billion active Apple devices around the world.

"When we look at the behaviour of our installed base, we think it's very promising," said chief financial officer Luca Maestri, while warning investors that the firm was expecting sales to continue to decline in the months ahead.

Other big tech companies also said they were feeling pressure in updates to investors.

Amazon, which has been struggling to reignite its e-commerce business, said sales at its online stores dropped 2% in the final three months of 2022, compared with a year earlier.

Overall, Amazon's sales in the three-month period rose 9% to $149.2bn, lifted by stronger growth in its cloud computing business.

But its profits dropped sharply, falling to near zero from $14.3bn a year ago, a change that chief financial officer Brian Olsavsky warned investors was likely to continue in the coming months.

At Alphabet, parent company of Google and YouTube, sales were up just 1% in the three months to December, compared with 2021, as firms cut back on advertising - the company's main source of revenue - in the face of economic uncertainty.

"The issues for Google and Amazon are remarkably similar," said Mr McNamee.

"Both companies prospered during the pandemic as people stayed home both for work and for entertainment, and that was just incredibly good for both those companies, as well as other web companies like Meta. But now we are going back to work things have settled down."

- Published13 January 2023

- Published5 January 2023