Rental evictions build after Covid ban lifted

- Published

What can you do about rent increases? Watch the BBC's Lora Jones tell you, in a minute.

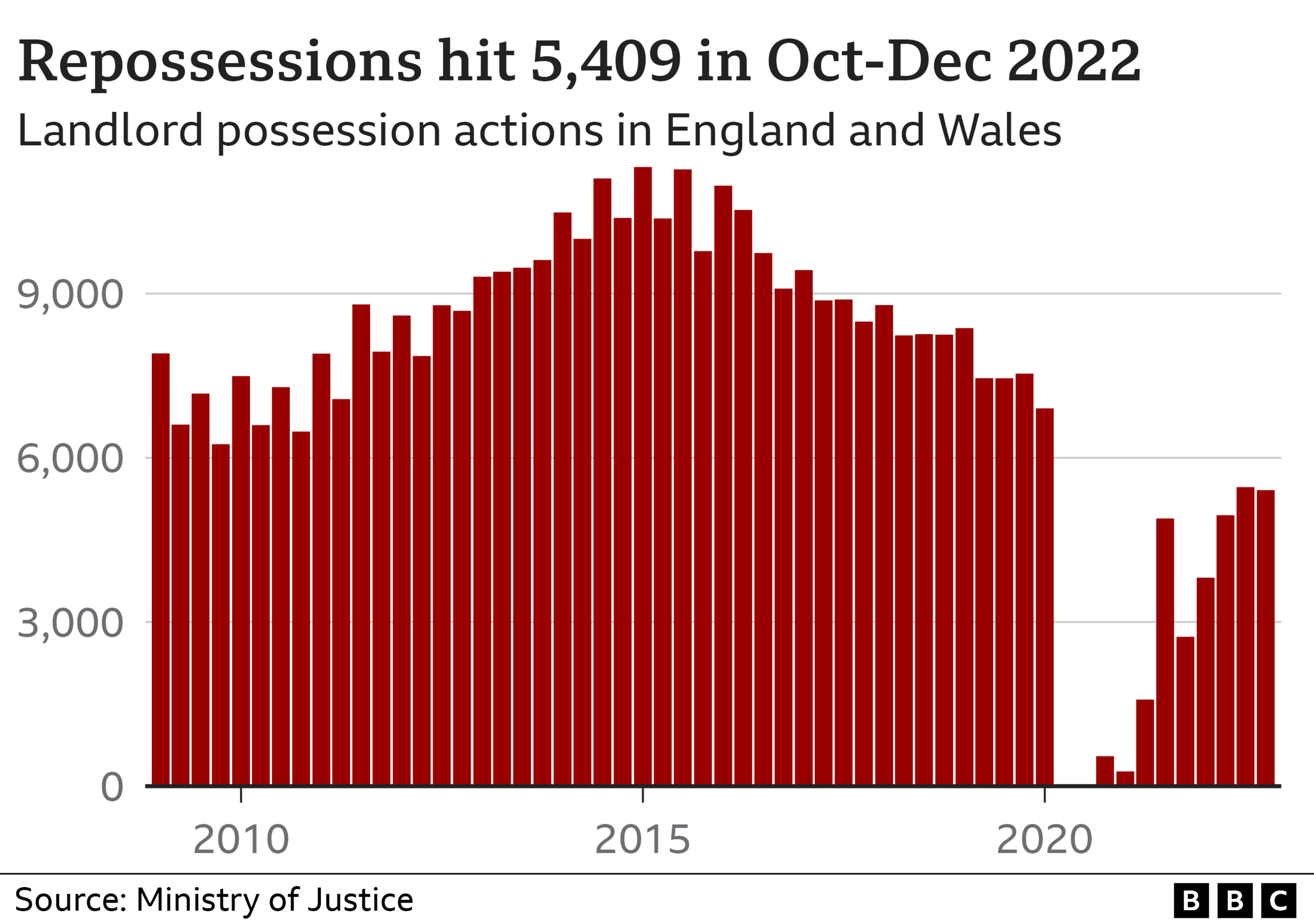

The number of people forced out of rented homes in England and Wales hit 5,409 in the last three months of 2022 as rental evictions continue to build up following a ban during Covid.

When the country went into lockdown in March 2020, the government halted landlord possession actions.

They have built back up since then, but are still below pre-pandemic levels.

Lucie, a single mother of four, spoke of her despair at being forced out of the home she has lived in for 14 years.

"Anybody who is in the same situation as me, I feel you - because you just feel like you're on your own and you are dying, you're drowning," she told the BBC.

The 41-year-old, who lives in Bristol with her children, has a job selling new build homes. "The irony," she says.

Lucie has been forced to leave because her landlord is selling the property.

Lucie, a single mother of four, has been forced to leave her home of 14 years

"If I went and rented somewhere else, somewhere exactly the same as this, it would be £1,650," she said, which is something she just can't afford.

Although the council found emergency accommodation for Lucie and her family in the end, it is only temporary and they could soon be forced to move again.

"There is a lack of understanding from many landlords [about] the impact that it has on a family," said Harriet Goodland, head of the advice service at the charity Housing Matters.

Figures from the Ministry of Justice showed the number of landlord possession actions actually fell slightly in the last quarter, compared with the previous three months.

At its peak back in 2014 and 2015, there were around 10,000 to 11,000 every quarter.

Pressure on landlords

The current cost-of-living crisis has not just had an impact on renters.

"I think a lot of landlords are under pressure as well financially," Ms Goodland said.

Interest rates have been rising since December 2021 as the Bank of England attempts to cool rising prices, or inflation.

It has meant higher costs for some homeowners. Some mortgage costs also rose after the ill-fated mini-budget last year, when they peaked at 6.65%.

Last year, the Bank warned that buy-to-let investors were particularly vulnerable to rising interest rates. Many landlords take out interest-only mortgages which are particularly vulnerable to changes in borrowing costs.

The Bank said: "Were landlords to seek to offset the projected rise in buy-to-let mortgage costs, it was estimated they would need to increase their rental income by around 20%.

"This would increase the cost of housing for renters."

The Ministry of Justice said that while the eviction figures remain below pre-Covid levels, "numbers have risen steadily since restrictions ended".

Ms Goodland said: "I've spoken to several people who have been suicidal on the phone. Just last week, we had to call an ambulance for somebody.

"It gets to that urgent, crisis point far too often."

Matt Downie, chief executive of Crisis, the homelessness charity, said: "The devastating impact of the cost-of-living crisis, rising rents and low wages has once again been laid bare as thousands more renters are faced with eviction and the very real threat of being left with nowhere to go."

- Published19 January 2023