More 16-24-year-olds get jobs as living costs bite

- Published

- comments

More people are entering or returning to work as the cost of living continues to bite into household finances.

The Office for National Statistics said a record number of people moved out of "economic inactivity", which is defined as people not looking for work, between July and December, as more got jobs.

It was driven by people in the 16-24 age group, as well as 50-64-year-olds.

One analyst suggested a "great unretirement" trend had emerged, with older people returning to work.

The UK's economic inactivity rate, the proportion of people aged between 16 and 64 who are not in work or seeking to be, had been falling in general since records started in 1971, but then it increased during the Covid pandemic.

This increase was partly due to those aged 50 to 64 taking early retirement and illness, as well as inactivity among students.

But the trend has started to reverse in recent months. The ONS said the fall in economic inactivity during the latest three-month period was helped by more of those aged 16 to 24 either getting jobs or looking for work.

An increase in employment was also driven by part-time workers.

Darren Morgan of the ONS said that in the last three months of 2022 fewer people remained outside the labour market altogether, with some moving straight into jobs and others starting to seek work again.

"This meant that although employment rose again, unemployment also edged up," he added.

The trend is partly down to the rising cost of living, according to Helen Morrissey, head of pension analysis at Hargreaves Lansdown.

"The great unretirement helped drive a record number of people back to work in the year to October-December," she said.

"People are realising their pensions may not go as far as they had expected. However, we also know some of these people stopped work because of long-term sickness, so better health may have encouraged them to reconsider a return to work."

However, she added that young people entering the workplace, many for the first time from education, also played a "major role" in the rate falling.

UK economic growth has flatlined in recent months and the Bank of England expects the UK to enter a recession this year. Many industries have struggled to recruit workers, though job vacancies are falling.

The government has been considering plans to coax retired middle-aged workers back into jobs to try to boost the economy, with reports older workers could be offered a "midlife MoT" to assess finances and opportunities for work.

Kate Shoesmith of the Recruitment and Employment Confederation said the Spring Budget was an opportunity for the government to provide extra support.

"Improving childcare support and provision to enable more parents to work and older workers such as grandparents to stay in work is vital, as is reinvigorating welfare to work schemes," she said.

Mark Hassan-Ali says his business offers the over-50s flexibility

Mark Hassan-Ali from the N Family Club nursery in Balham, London said the over-50s workforce was "definitely an untapped area" in his sector.

He said the nursery had partnered with an organisation called Restless who specifically target recruiting the over-50s.

"Flexibility is what we are offering over-50s because we know that people have outside responsibilities, we know that working isn't the biggest thing in their diaries day to day," he said.

The jobs market is very closely watched by the Bank of England. Their concern is that rising rates of pay puts more money into the economy and that can keep inflation higher for longer, prompting further calls for yet higher wages, causing an inflationary spiral.

That means the the Bank may have to combat that with further interest rate rises to suck some of that money back out.

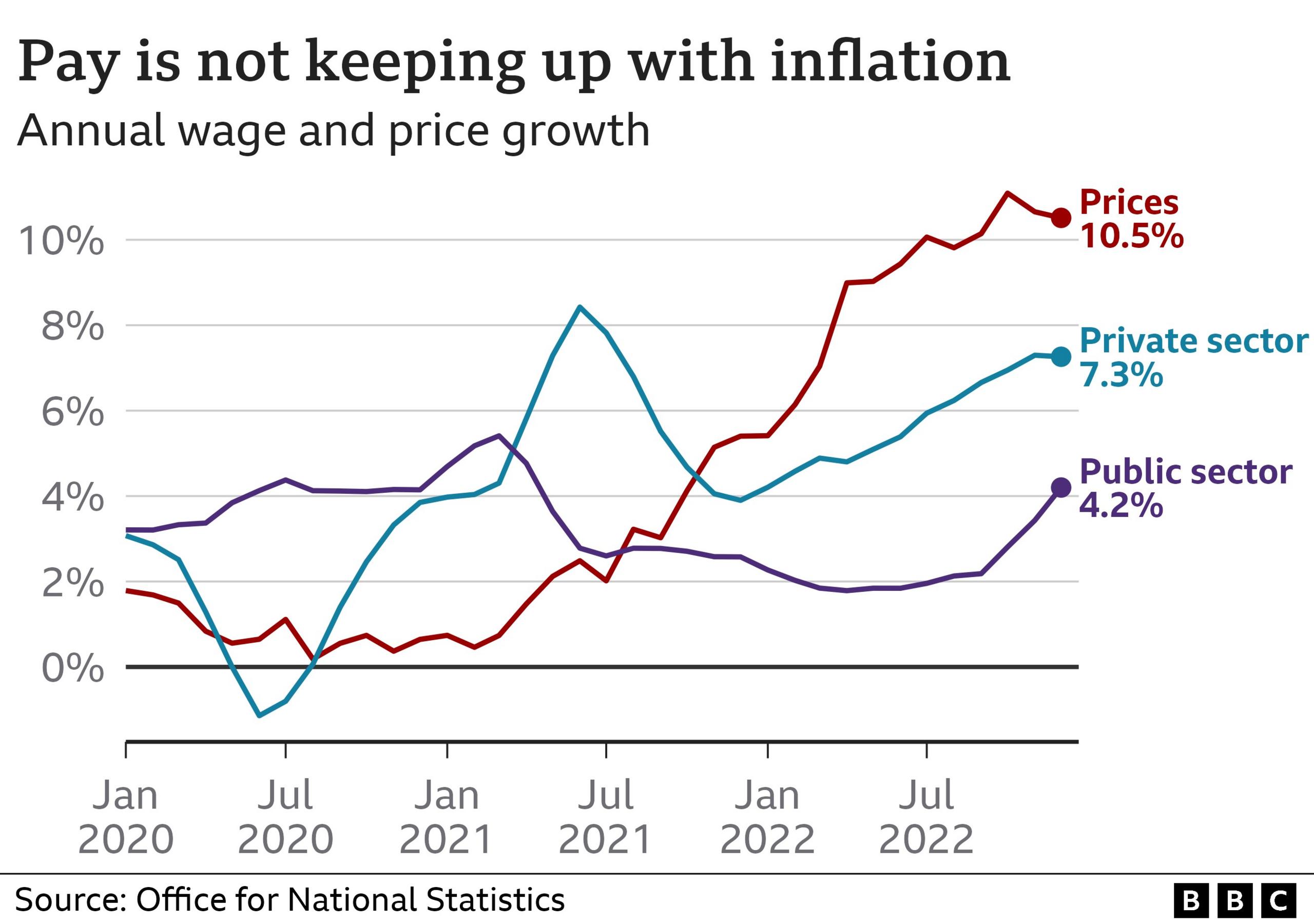

These figures are a mixed bag. Although wage rises in the private and public sector increased to 7.3% and 4.2% respectively, with an average of 6.7%, an increasing number of people of working age are returning to the workforce.

That is good news for the Bank of England as it increases the supply of labour at the same time as we see that demand - the number of vacancies - is falling.

While that may encourage the Bank that supply and demand for labour is becoming more balanced, it also means that employers are scaling back their hiring intentions - a sign they think the economic outlook is getting worse. Taken together these numbers seem to confirm the view that the economy will remain stagnant at best or slip into recession this year.

Pay outstripped by rising prices

With rising energy and food prices squeezing household finances, many worker have asked for pay rises in recent months.

Pay, excluding bonuses, increased at an annual pace of 6.7% between October and December 2022, which was the strongest growth seen outside of the Covid pandemic.

However, when adjusted for inflation which is at 10.5%, regular pay fell by 2.5%.

The ONS also said that 843,000 working days were lost to strike action in December, which was the highest number since November 2011.

The total number of strike days from June to December 2022 was more than 2.4 million, the highest total for a calendar year since 1989. There is no ONS data on the number of strike days from February 2020 to May 2022.

Thousands of workers have gone on strike in recent months over pay and working conditions.

Chancellor Jeremy Hunt, who has warned the UK is "not out of the woods" despite it narrowly avoiding a recession last year, said: "The best thing we can do to make people's wages go further is stick to our plan to halve inflation this year."

But Rachel Reeves, Labour's shadow chancellor, said the UK's economy was "stuck in the slow lane" and called for more government measures to "prevent yet more harm from the cost of living crisis".

Related topics

- Published12 February 2024

- Published30 January 2023

- Published24 December 2022

- Published9 August 2022