Adani: India watchdog probing Hindenburg fraud allegations

- Published

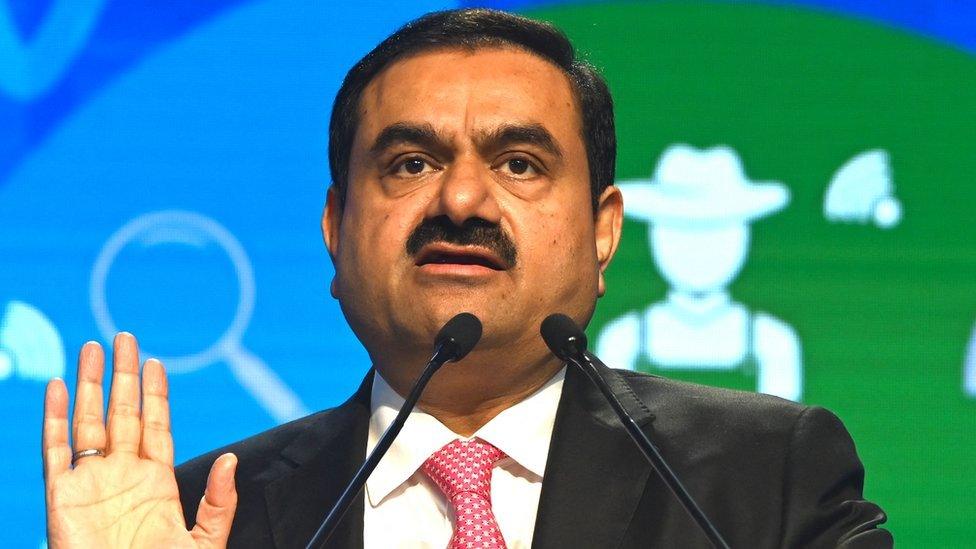

India's markets regulator has confirmed that it is investigating allegations made by Hindenburg Research against companies owned by multi-billionaire Gautam Adani.

The Securities and Exchange Board of India (SEBI) also says it is examining market activity around the report.

Mr Adani's business empire had over $100bn (£82.3bn) wiped off its stock market value after the claims of market manipulation and financial fraud.

Adani Group has denied the claims.

On Monday, SEBI said in a Supreme Court filing that it was studying the allegations and "the market activity immediately preceding and post the publication of the report".

"SEBI is strongly and adequately empowered to put in place regulatory frameworks for effecting stable operations and development of the securities markets," it added in a filing to the Supreme Court.

Adani Group did not immediately respond to a BBC request for comment.

But the group did tell the Reuters news agency that it had strong cashflows and its business plans were fully funded.

"We are confident in the continued ability of our portfolio to deliver superior returns to shareholders," it said.

Meanwhile, the conglomerate's flagship company, Adani Enterprises, reported a net profit of nearly $100m for the October to December quarter, against a loss of $1.5m in the same period a year earlier.

Its total revenue jumped by 42% to $3.3bn, owing to a strong performance in its airports, coal trading and new energy businesses.

"Our fundamental strength lies in mega-scale infrastructure project execution capabilities… the current market volatility is temporary," said Mr Adani in the results statement.

The company did not announce any cutback in growth projections or investment plans, or comment on the decision by France's TotalEnergies to put its partnership with Adani for a green hydrogen project on hold following the Hindenburg report.

Shares in Adani Enterprises were up 5% on Mumbai's stock exchange after plunging nearly 50% over the past month.

Mr Adani's group has seven publicly-traded companies which operate across a wide range of sectors, including commodities trading, airports, utilities, ports and renewable energy.

Last month, a report by US-based short-seller Hindenburg Research alleged that Adani Group companies had engaged in decades of "brazen" stock manipulation and accounting fraud.

It also claimed its companies had "substantial debt" which put the entire group on a "precarious financial footing".

Short-selling is betting that the value of an asset will fall.

Adani Group has categorically denied the allegations. It has said previously that the Hindenburg report was intended to enable the US-based short seller to book gains, without citing evidence.

You may also be interested in:

From January: Students arrested before screening of BBC Modi documentary

- Published7 February 2023

- Published3 February 2023

- Published2 February 2023

- Published1 February 2023

- Published30 January 2023

- Published26 January 2023