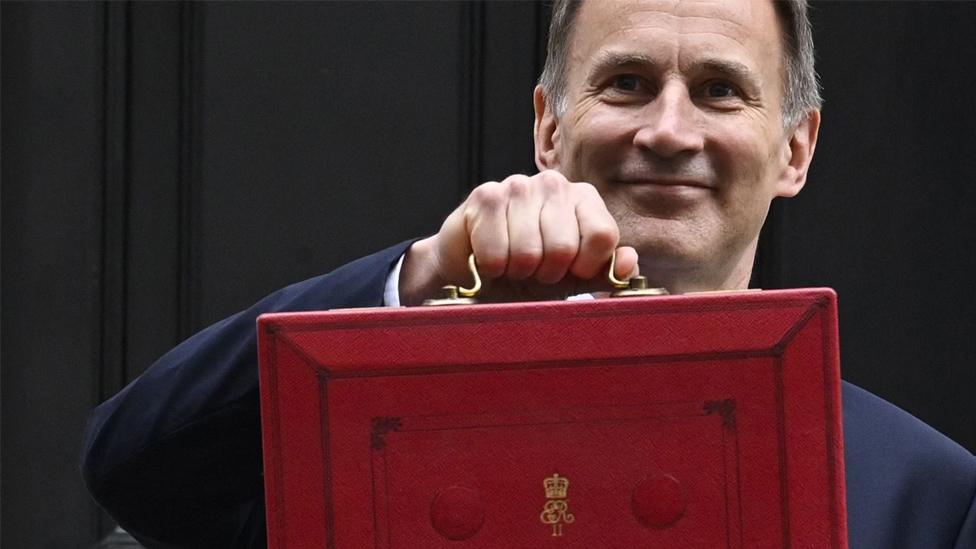

Jeremy Hunt's Budget is focused on the next election

- Published

The big claim from Chancellor Jeremy Hunt is a modest one - we are no longer going into recession, and inflation will fall faster.

That is better news, relatively speaking, given the size of the shock to the economy from higher energy prices. But the big picture on living standards is that we are still in the middle of an historic fall. It is little wonder that Mr Hunt felt compelled to extend the largest part of the energy bill support that was due to run out.

But the big broad strategic decision the chancellor has made is to spend the windfall from better upfront growth in the economy to try to get the UK out of a slow growth mire.

The government has spent nearly all the extra revenue from better economic news, which means it has borrowed about £20bn a year to spend on trying to boost business investment, getting people back to work and extra defence.

The plans to boost growth look like microsurgery: several dozen measures, designed to unlock two key self-admitted problems - poor business investment, and getting the workforce back up to full strength. And that surgery has a notable timing - all frontloaded to provide as big a boost possible now, before the next general election.

There are some eye-catching thrusts into a high-tech future of a dozen Canary Wharfs situated near our biggest universities. Post-Brexit changes to trading rules are focused on five key sectors. Pharmaceuticals will get the fastest regulator in the world and automatically accept medicines approved in the US, EU and Japan, building on the Covid vaccine success.

But some of the biggest measures run out just after the election, and that's why the forecasts from the government's independent forecaster, the Office for Budget Responsibility (OBR), show growth declining afterwards.

So it's maximising the bang for the buck early, trying to get a deliverable, visible, noticeable impact for voters by the time of the election, which we're expecting by late 2024.

In fact in the small print of the OBR report it says that because the changes to corporation tax are a temporary measures "we have assumed that the Budget measure has no long run impact on the capital stock" and "all the additional investment is ultimately displaced from future years".

So you get a pre-election boom in business investment and then it falls below the level that it would have done without the policy, with "no overall impact" on total investment.

Related topics

- Published15 March 2023

- Published16 March 2023

- Published15 March 2023