Energy bill help drives UK borrowing to February record

- Published

- comments

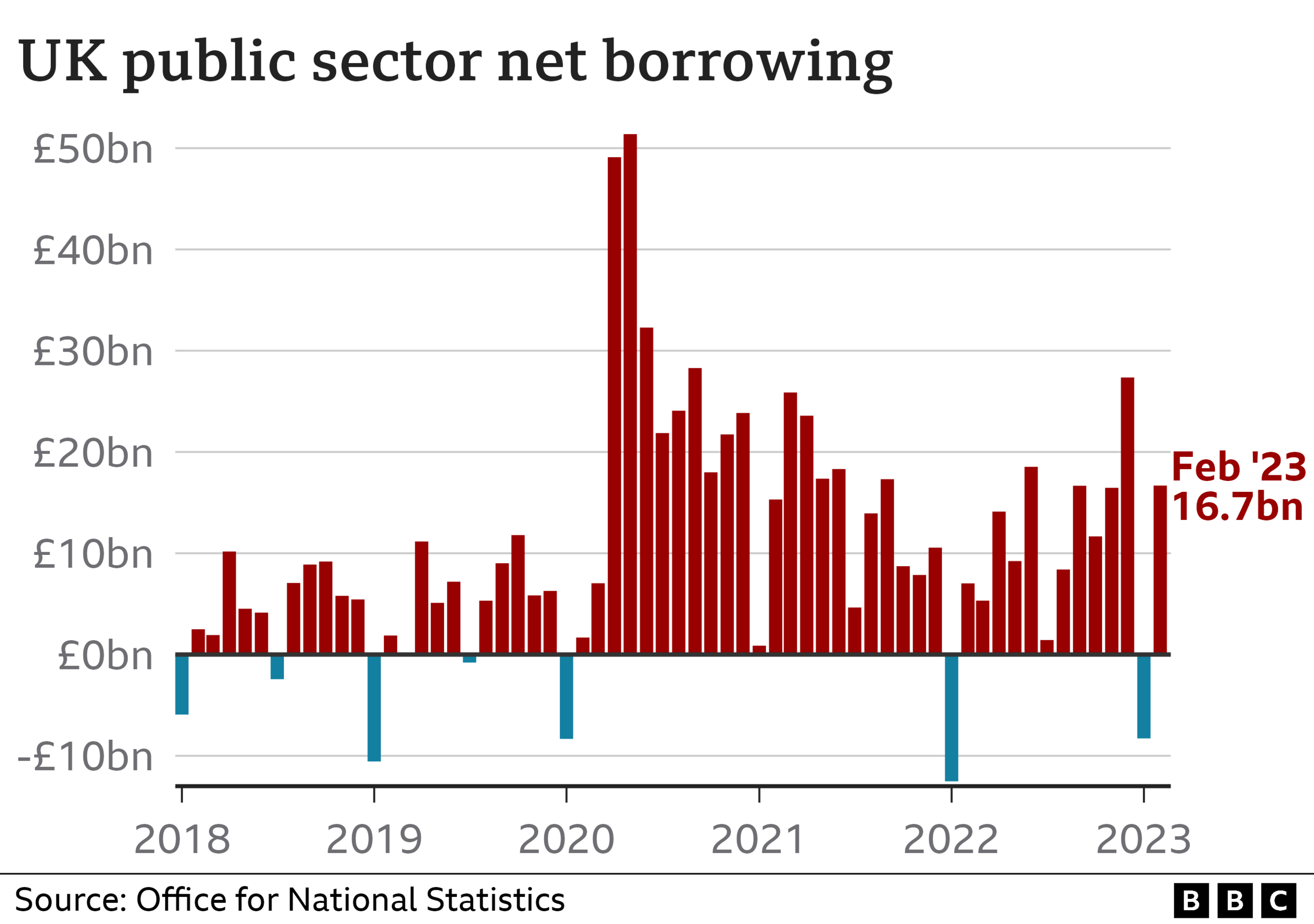

Energy support schemes for households pushed government borrowing in February to its highest level for the month since records began in 1993.

Borrowing, the difference between spending and tax income, was £16.7bn, last month, the Office for National Statistics (ONS) said.

The ONS said this was largely due to spending on energy schemes this year.

However, the interest paid on government debt was £6.9bn in February - £1.3bn less than a year earlier.

Interest payments fell because of changes in the inflation rate that sets how much interest the government has to pay on its debts.

But the amount borrowed exceeded economists' expectations and followed a surprise surplus in the public finances in January.

Chancellor Jeremy Hunt said borrowing was "still high" because the government was supporting households with the rising cost of living.

The government announced last week that it would extend support for energy bills at current levels until the end of June.

The move came as typical household energy bills in Britain had been due to rise to £3,000 a year from April.

Now average bills will be kept at £2,500 until the end of June, when they are expected to drop to around £2,200 a year due to falling wholesale gas prices.

However, the government's £400 winter fuel payment will not be renewed, meaning households' costs will still rise in the short term.

Mr Hunt said the government was "spending about £1,500 per household to pay just under half of people's energy bills this winter".

The ONS said the extra spending on energy subsidies in February 2023 compared with a year earlier was estimated to be about £9.3bn.

However, despite the record borrowing in February, the ONS said £1bn was raised through the new windfall tax on UK energy company profits. Tax income overall was also £5bn higher than a year ago at £77.8bn.

With self-assessed tax receipts in January and February at their highest level for those months since 1999, Capital Economics said the UK economy was perhaps becoming "a bit more tax-rich".

Ruth Gregory, its deputy chief UK economist, added the chancellor might have "a bit of money to play with" come the autumn, but warned there was a "big risk" that the recent turmoil in the banking sector deepens and "the recent improvement in the public finances is blown away".

Global financial markets were spooked on Monday but appeared to recover losses after news of a rescue deal for Swiss banking giant Credit Suisse over the weekend.

Related topics

- Published21 February 2023

- Published15 March 2023

- Published21 March 2023