US firms 'more negative' about doing business in China

- Published

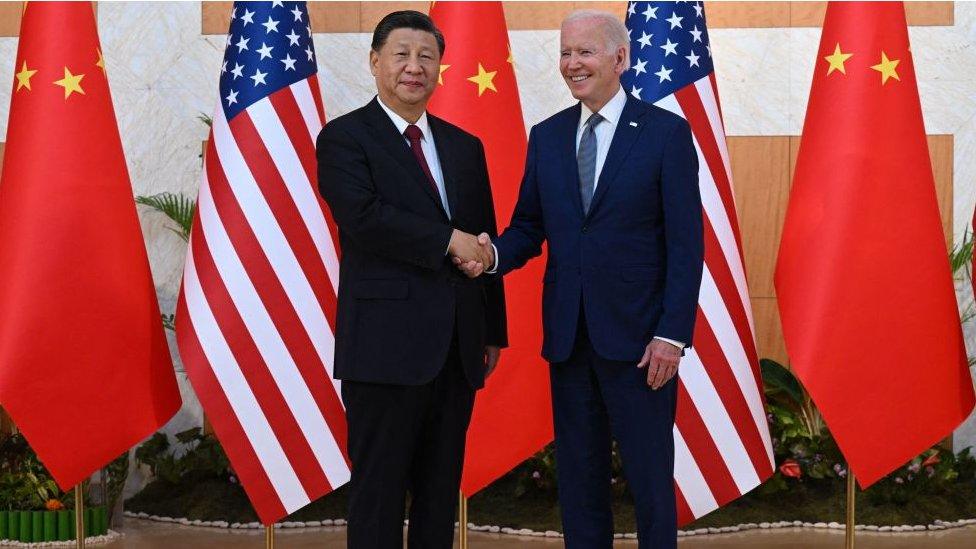

President Biden and President Xi met at the G20 in Indonesia in November but have numerous differences

US companies are "more negative than they've been in a long time" about doing business in China, according to the president of the American Chamber of Commerce in China (AmCham China).

As tensions continue to grow between the world's two biggest economies, Michael Hart says that the rivalry has "made business very challenging".

The governments of President Xi and President Biden have been disagreeing on what seems like an ever-increasing number of issues; ranging from Ukraine, to coronavirus, and Taiwan, to Tiktok, and semiconductors.

That is reflected in AmCham China's latest annual survey, external of its more than 900 members. For the first time it shows that a majority, 55%, no longer regard China as a top-three investment priority - a place where they should spend money to grow their business.

The number who see the "uncertainty of bilateral relations" as their leading challenge in China has risen 10% in the last year to 66%. At the same time, the number who think China has become less welcoming to foreign companies has grown to 49%.

US firms are "more negative than they've been in a long time" about doing business in China, says Michael Hart

It's now five years since then US President Donald Trump imposed tariffs on $60bn (£49bn) of Chinese goods, as he stepped up his trade war over "unfair trade practices", external including intellectual property theft and the trade deficit.

China followed through on its promise to retaliate with tariffs of its own.

Relations built on trade

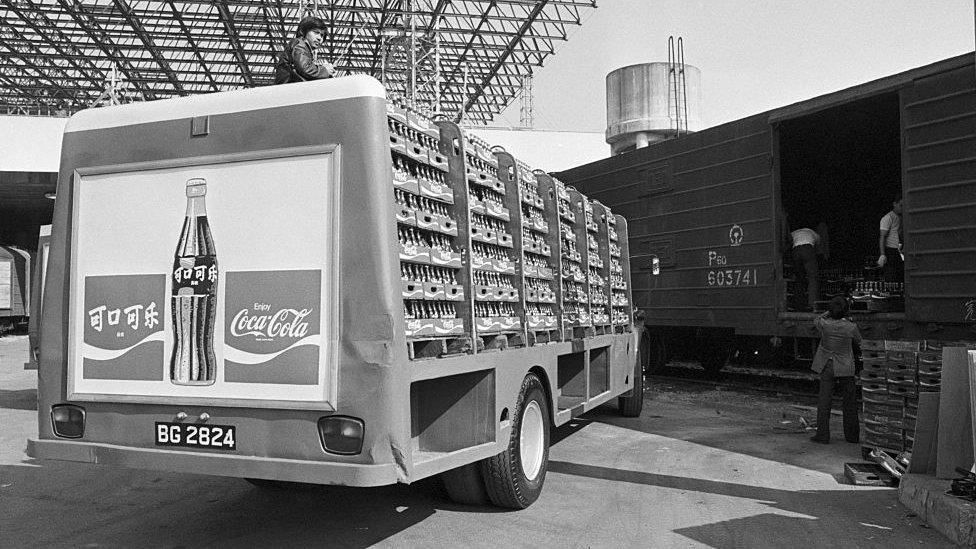

AmCham China members include some of the US's most successful companies such as Nike, Intel, Pfizer and Coca-Cola.

The latter was the first US consumer business to sell its products in communist China after then President Deng Xiaoping opened the country up to foreign companies in December 1978. Ever since then trade has been at the heart of the relationship.

Coca-Cola has been a pioneer for US companies in China ever since this first shipment of its soft drink left Hong Kong for the mainland in January 1979

Corporate pessimism over the current state of the US-China relationship reflects a tumultuous few years, according to Mr Hart.

"Companies are just really tired after three years of Covid," he adds, also highlighting a number of other issues. These include travel becoming more difficult, rising labour costs, executives who are "just not willing" to take up assignments in China, political pressure, and China becoming a less predictable place in which to do business.

Despite all those difficulties, the numbers show trade between the two countries hit a record high of $690.6bn last year.

This reflection of their mutual dependence has implications for the health of the entire global economy. That is according to Eswar Prasad, who is a professor of global trade policy at Cornell University, and former head of the International Monetary Fund's China Division.

The US China trade relationship is critical to the wider global economy, says Cornell University's Prof Eswar Prasad

"The reality is that China does need a lot of products, especially technology products from the US, and the US does have a lot of companies that run their supply chains through China," he says.

"This is important for the global economy because it's not just supply chains that these two countries are critical for. The tenor for global trade is set by the relationship between these two countries."

The World Trade Organisation (WTO) is supposed to keep that tenor harmonious by upholding global trade rules.

However, in December, the Biden administration forcefully rejected two rulings that went in China's favour about the tariffs that were imposed by then US President Donald Trump as part of his trade war. The US said they were imposed over issues of national security that the WTO had no right to rule on.

Overall, 66.4% of US imports from China and 58.3% of Chinese imports from the US remain subject to tariffs, according to the Peterson Institute for International Economics,, external with little sign that either side will reduce them.

Global Trade

"The way the US is approaching its relationship with China could lead to a deterioration of the rules-based global trading system that the US and China have signed on to," says Prof Prasad.

He adds: "If the US starts withdrawing from engagement with multilateral institutions that does not bode well for global governance."

Supply chain difficulties

The souring US-China relationship also means a growing number of US companies are looking at moving their supply chains outside of China. Apple has become one of the world's most profitable companies by making huge numbers of iPhones in China, but is now increasingly making them in countries such as India.

However, that will only have a limited impact on getting round US-China tensions according to Dan Wang, who is the Shanghai-based chief economist at Hang Seng Bank China.

"Even if the US succeeds in building up an alternative supply chain, that alternative one will still largely depend on China," she says.

Dan Wang says that even if Western firm move supply chains away from China they will still be dependant upon it

Those other countries will still rely on China for components, especially in industries such as green energy, medical technology and electronics, explains Ms Wang.

Whilst companies aren't shunning China all together, Mr Hart does say that "they're trying to de-risk their supply chain". He adds: "So they're having more of a China plus one strategy, and they realise that can no longer rely on China."

China's economic growth has slowed to an annualised pace of 3% as coronavirus restrictions curtailed business activity. At the recent National People's Congress, the newly appointed Premier Li Qiang said that, now those measures had been lifted, the target was 5% growth, although it would "not be easy" to meet.

Ms Wang says: "Beijing still wants US companies to invest in China, and that attitude I do not believe will change anytime soon."

Mr Hart adds that the giant Chinese consumer market is probably the place where US firms remain "the most optimistic". Firms such as McDonald's, Starbucks and Ralph Lauren all have major Chinese expansion plans in the pipeline.

National security concerns

However, all this comes against a backdrop of national security concerns between the two nations, centred on technology.

These have led to a growing number of measures by the Biden administration to try to stop China accessing US technology. These include trying to limit new investments in China by US semiconductor manufacturers.

Why does China’s economy matter to you?

Both countries have been trying to increase government support for technologies they regard as critical to the future of the global economy.

In his State of the Union speech last month President Biden said: "I've made clear with President Xi that we seek competition, not conflict."

"I will make no apologies that we are investing to make America stronger. Investing in American innovation, in industries that will define the future, that China intends to be dominating."

However that approach has not gone down well in Beijing, where President Xi said recently that "Western countries - led by the US - have implemented all-round containment, encirclement and suppression against us, bringing unprecedentedly severe challenges to our country's development".

It is a rivalry which is increasingly affecting individual companies and spreading around the world.

Chinese telecoms giant Huawei has been restricted in many countries because of US pressure, with Germany the latest to consider taking action. Meanwhile, social media firm Tiktok has been threatened with a complete ban in the US, whilst also facing restrictions in the UK.

All these tensions between the US and China mean "the temperature is certainly very high", according to Prof Prasad and that could come at a cost that is felt well beyond the US and China.

"Rising hostilities between the world's two largest economies, which together account for roughly 40% of world GDP, are likely to create more volatility and uncertainty, which is the last thing an already fragile world economy now needs," he says.