Jack Dorsey business target of Hindenburg report

- Published

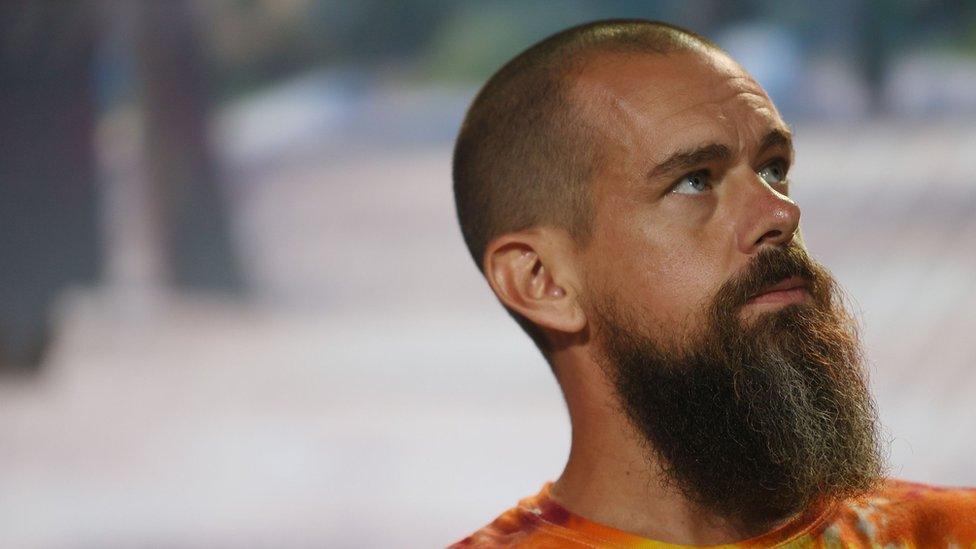

Jack Dorsey co-founded Twitter and Block

Tech billionaire Jack Dorsey is facing scrutiny, after a report accuses the payments company he leads of inflating user numbers and catering to criminals.

The firm, Block, rejected the claims, which sent its shares tumbling 15%.

The report, external came from short-seller Hindenburg Research, which is known for taking on high-profile targets such as Indian tycoon Gautam Adani.

The company makes money by betting shares will fall and is poised to benefit from the slide.

Block, which former Twitter boss Mr Dorsey co-founded in 2009 and leads as chief executive, said it was exploring legal action against Hindenburg for the "factually inaccurate and misleading report".

"We are a highly regulated public company with regular disclosures, and are confident in our products, reporting, compliance programs, and controls. We will not be distracted by typical short seller tactics."

Formerly known as Square, Block made its name with a sleek, small white credit card reader that became popular among vendors at farmer's markets, and other small businesses, allowing the firm to fetch a nearly $3bn (£2.4bn) valuation when it listed on the stock exchange in 2015.

Now worth more than $30bn (£24.4bn), it was renamed Block in 2021, to reflect another, fast growing side of its business: Cash App, a payments app that was the focus of Hindenburg's report.

Hindenburg alleged Block provided misleading statistics on its users which it claimed had been linked to criminal activity such as sex trafficking.

While conducting its research, Hindenburg claimed it had easily created obviously fake Cash App accounts in the names of Donald Trump and Elon Musk and made public records requests, which allegedly showed that Cash App was used to facilitate millions in fraudulent pandemic relief payments from the government.

It said that reflected "key lapses" in compliance processes.

"Former employees described how Cash App suppressed internal concerns and ignored user pleas for help as criminal activity and fraud ran rampant on its platform," Hindenburg said. "This appeared to be an effort to grow Cash App's user base by strategically disregarding Anti Money Laundering (AML) rules."

Shares in Block had already been hit by worries of a slowdown in economic activity and consumer spending. Cash App also has ties to the world of crypto currencies, which have seen their values tumble.

Mr Dorsey, who had split his time between Twitter and Square, stepped down as chief executive of the social media company in 2021. Twitter was later sold to billionaire Elon Musk for $44bn (£35.8bn).

.

Related topics

- Published7 February 2023

- Published2 December 2021

- Published30 November 2021