Cineworld drops sale of UK and US businesses after failing to find buyer

- Published

- comments

A new tribe, the Metkayina Clan, is introduced in The Way of Water

Cineworld has said it will raise new funding as it dropped plans to sell its businesses in the US, UK and Ireland after failing to find a buyer.

The troubled cinema chain saw its share price fall by nearly 30% after announcing it would terminate the move.

At the same time, Cineworld said it had struck a deal with its lenders to restructure its substantial debt and exit bankruptcy.

Like other cinemas, Cineworld was hit hard by the pandemic.

Many theatres were forced to close for extended periods during lockdowns, or had to operate at a reduced capacity due to social distancing rules.

They also continue to face tough competition from streaming services.

Cineworld, which is the world's second-largest cinema chain, filed for bankruptcy in the US in August last year as it struggled under the weight of $5bn (£4bn) in debt.

The firm, which employs more than 28,000 people across 740 sites globally, said it now plans to raise $2.26bn of new funding.

Cineworld's chief executive Mooky Greidinger said the deal represented a "vote-of-confidence" in the business and propelled the company "towards achieving its long-term strategy in a changing entertainment environment".

The company said it would continue to consider proposals for the sale of its business outside the US, UK and Ireland.

In 2020, a row broke out when Cineworld and rival AMC, which owns the Odeon Cinemas chain, criticised Universal Pictures for releasing Trolls: World Tour online at a time when cinemas were forced to close because of coronavirus.

Cineworld subsequently signed a deal with Warner Bros to show films in theatres before they are streamed.

After lockdown restrictions eased, cinema chains have seen large audiences return to view the latest Hollywood blockbusters.

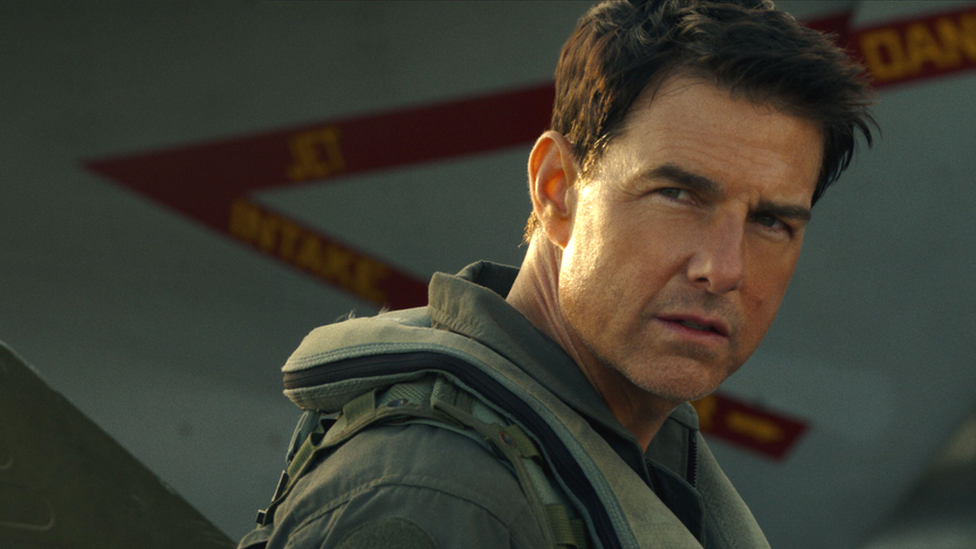

Big box office hits in recent months include Top Gun: Maverick, Avatar: The Way of Water and Dungeons & Dragons: Honour among Thieves.

- Published22 August 2022

- Published19 August 2022

- Published24 February 2023