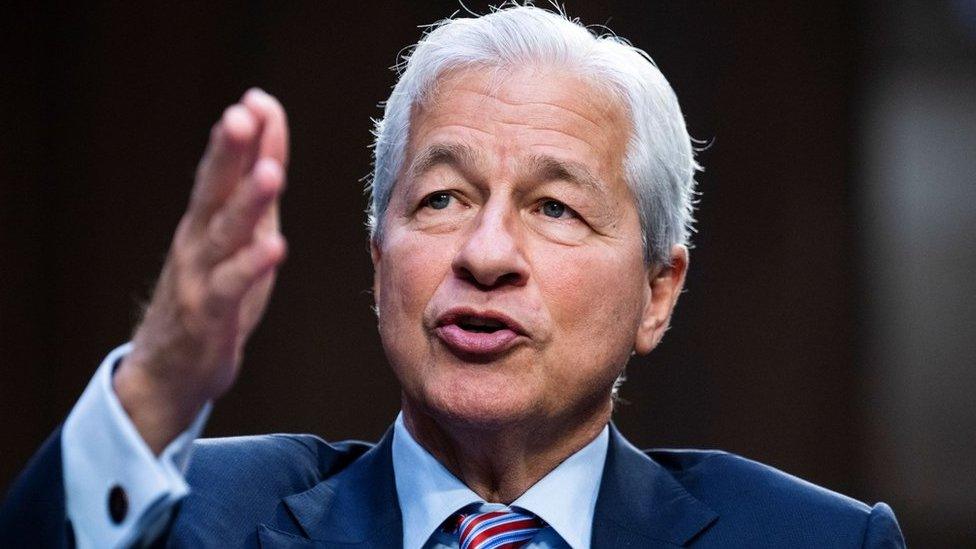

JPMorgan chief Jamie Dimon warns banking crisis 'not yet over'

- Published

The crisis facing the US banking system "is not yet over," the head of America's biggest bank has warned.

Jamie Dimon, chief executive of JPMorgan Chase, made the comments in an annual letter to shareholders, external just weeks after the dramatic collapse of two major US banks.

He said he did not expect the turmoil to lead to a global crisis akin to 2008, noting that it involved "involved fewer players and fewer issues".

But he warned the impact would linger.

"While this is nothing like 2008, it is not clear when this current crisis will end," he said. "Even when it is behind us, there will be repercussions from it for years to come."

Mr Dimon is a veteran of Wall Street, who steered JPMorgan through the 2008 financial crisis, when exposure to bad home loans in the US caused problems throughout the global financial system.

In recent weeks, he worked with government officials to coordinate a rescue plan for the California-based bank First Republic, which many feared was also on the verge of collapse.

In the near term, he said the failures of Silicon Valley Bank and Signature Bank, and the rushed takeover of Credit Suisse in Europe, had provoked "lots of jitters in the market" and were likely to prompt lenders to pull back in the months ahead, increasing the odds of an economic recession.

But he said it was not clear if the crisis would affect regular consumers in the US, who are the main drivers of the world's largest economy.

"While the current crisis has exposed some weaknesses in the system, it should not be considered... anything like what we experienced in 2008," he wrote.

SVB failed last month after fears about its financial position prompted customers to withdraw nearly a quarter of the firm's deposits in a few days, overwhelming its ability to supply the funds. Regulators shut down Signature amid signs of a similar bank run.

As the failures led to scrutiny of other potentially troubled firms, Credit Suisse saw shares plunge, leading to its rushed takeover by rival UBS in a deal brokered by the Swiss government.

Mr Dimon said the recent turmoil should push regulators to scrutinise risks to banks that arise from having a high proportion of uninsured deposits, or many customers with similar profiles, as SVB, which was known for catering to the tech industry, did.

But he added that many of the risks - including a sharp rise in interest rates last year that have hurt the value of some kinds of assets typically held by banks - had been "hiding in plain sight". He criticised regulators for not considering the increase in rates in tests designed to test bank stability.

"This is not to absolve bank management - it's just to make clear that this wasn't the finest hour for many players," he said.

As US President Joe Biden and others call for stronger rules for banks, he warned against "knee-jerk, whack-a-mole or politically motivated responses".

"We should carefully study why this particular situation happened but not overreact," he said.

"Erratic stress test capital requirements and constant uncertainty around future regulations damage the banking system without making it safer," he added.

Related topics

- Published2 May 2023

- Published4 April 2023