UK government borrowed less than expected last year

- Published

- comments

The government borrowed less than expected last year, despite spending heavily on helping with energy bills and facing higher borrowing costs.

Borrowing, the difference between spending and tax income, was estimated at £139.2bn in the year to 31 March, external.

That was less than had been predicted and gives ministers "wiggle room" for possible tax cuts ahead of the next election, one analyst said.

The chancellor said the government was still borrowing "eye-watering sums".

The amount borrowed last year was equivalent to 5.5% of the value of the UK economy - the highest percentage since 2014, excluding the pandemic.

However, the borrowing figure was lower than the £152bn predicted by the government's forecaster, the Office for Budget Responsibility, at the time of the Budget last month.

The Office for National Statistics (ONS) said the government borrowed £21.5bn in March alone, the second-highest March figure since monthly records began in 1993.

Chancellor Jeremy Hunt said: "These numbers reflect the inevitable consequences of borrowing eye-watering sums to help families and businesses through a pandemic and [Vladimir] Putin's energy crisis.

"We were right to do so because we have managed to keep unemployment at a near-record low and provided the average family more than £3,000 in cost-of-living support this year and last."

However, he said the government had a "clear plan to get debt falling".

The lower-than-expected borrowing for 2022-23 will give the chancellor "more wiggle room to cut taxes or raise spending ahead of the next general election", said Ruth Gregory at Capital Economics.

Mr Hunt faces pressure from Conservative MPs to cut taxes before the next election, which is expected in 2024, while public sector workers' unions are pushing for pay increases to offset the soaring cost of living.

Ms Gregory said that with the next election fast approaching, she "wouldn't be at all surprised" to see giveaways in the Autumn Statement, following similar moves this spring.

But she added: "With both parties likely to stick to current plans to bring down public debt as a share of GDP, a sizeable fiscal tightening will still be required after the election, whoever is in charge."

What could you do with an unexpected £13bn?

Thanks to the better-than-expected public finances, that's the amount the chancellor could have at his disposal and still meet his (self-imposed) rules on financial housekeeping.

He has three broad choices:

He could boost spending. £13bn would be roughly enough for a 5% pay rise for public sector workers. But the chancellor has shied away from matching pay awards to current elevated rates of inflation - arguing that, by possibly provoking bigger pay rises elsewhere, that could prolong high inflation and be more damaging to the economy. Some economists dispute his reasoning.

Or, with an election looming within the next couple of years, he may cut taxes, throw a couple of sweeteners to voters - £13bn would pay for a penny or two off the standard rate of income tax, it would stretch to taking more than 1p off the standard rate of VAT, soften the blow of the cost of living crisis. After all, much of this sum came about because more money went to the tax man.

Or he may opt to save the cash - after all the outstanding pile of debt remains high. And the outlook for the economy - and so public finances - remains very uncertain. It would help raise his credentials for prudent housekeeping, and is the most likely option - for now .

But if the economy avoids any severe shocks, the temptation of a pre-election giveaway will be high.

The government's borrowing costs jumped last year as interest rates rose around the world and spiked after former chancellor Kwasi Kwarteng proposed a swathe of tax cuts without explaining how he would fund them.

Mr Hunt reversed most of the plans easing concerns on financial markets. However, borrowing costs remain relatively high and the UK is set to be one of the worst performing major economies in the world this year, according to the International Monetary Fund.

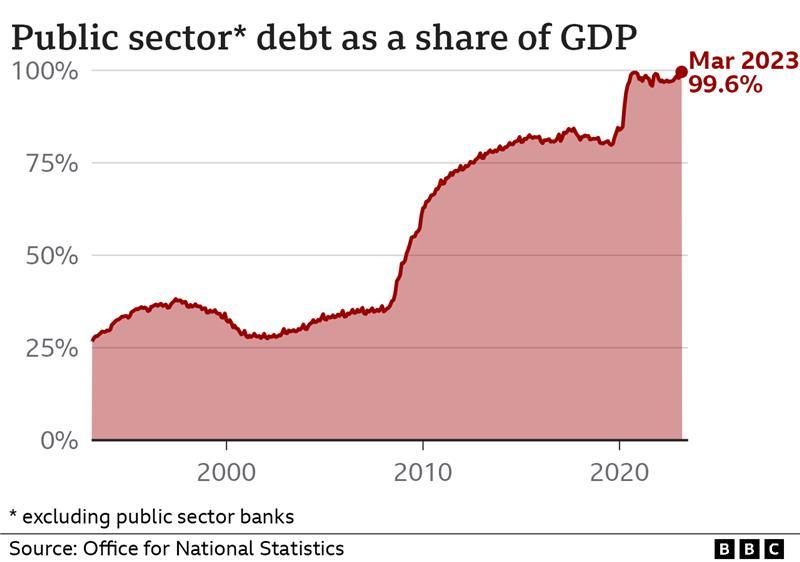

All in all, the ONS said public sector net debt at the end of March 2023 was £2.53 trillion - equivalent to around 99.6% of the value of the whole UK economy and a level not seen since the early 1960s.

Mr Hunt has said he plans to get debt falling as a share of output - or GDP - in five years' time.

Yael Selfin, chief economist at KPMG, told the BBC's Today programme: "The way things are at the moment it doesn't look like he will meet that target but it wouldn't be the first time a chancellor doesn't meet a target.

"The important thing is that he still has the confidence of the markets so in the longer term, debt will go down and we won't have similar episodes like we had from last year."

Related topics

- Published11 April 2023