Bumper BP profits of £4bn in three months spark criticism

- Published

- comments

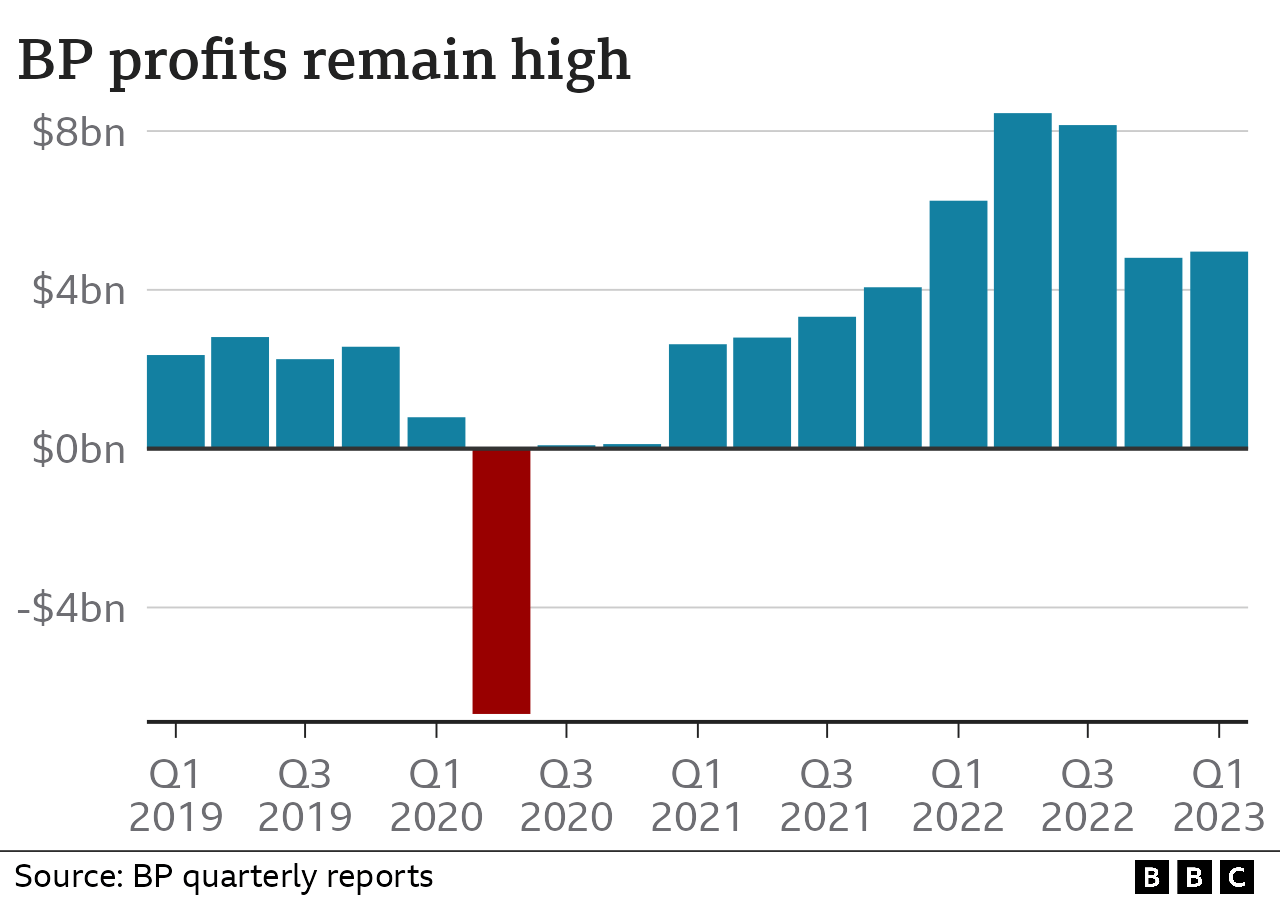

Oil and gas giant BP has reported strong profits for the beginning of the year as energy prices remain high.

Profits hit $5bn (£4bn) in the first three months of the year, although this was down from $6.2bn last year with oil prices having fallen from the peak seen after Russia's invasion of Ukraine.

Bumper profits from energy firms have led to calls for them to pay more tax with households facing high bills.

Labour and the Liberal Democrats called for changes to the windfall tax.

Labour leader Sir Keir Starmer called for a "proper" windfall tax on energy profits.

"Of course we want BP and others to make profits so they can invest but these are profits that they didn't expect to make, these are profits that are over and above because the world price of energy is so high," he told BBC Breakfast.

Liberal Democrat leader Ed Davey said: "These eye-watering profits are a kick in the teeth for all those struggling to pay their energy bills."

He added that the government had "let oil and gas giants off the hook for billions of pounds while people and businesses struggle to pay for their gas and electricity".'

A Treasury spokesperson said: "Through the Energy Profits Levy we are ensuring excess energy profits... are being used to ease the pressure on families up and down the country.

"These funds are being used to hold down people's energy bills and fund one of the most generous cost of living packages in the world- worth £94bn which is around £3,300 per household this year and last."

BP reported record annual profits last year as the company - along with the rest of the energy sector - benefitted from the surge in oil and gas prices following Russia's invasion of Ukraine.

It has led to big profits for energy companies, but also fuelled a rise in energy bills for households and businesses.

BP chief executive Bernard Looney said the first quarter had been one of "strong performance".

The company said it had seen an "exceptional" performance from gas marketing and trading, and "very strong oil trading".

Nick Butler, a former BP executive and visiting professor at King's College London, said the strong results had come "from a good internal business performance but also from high prices around the world".

But he told the BBC's Today programme the firm's profits were likely to "come down quite a lot this year" as oil and gas prices were falling back.

Last year, the UK government introduced a windfall tax on profits made from extracting UK oil and gas - called the Energy Profits Levy (EPL) - to help fund its scheme to lower gas and electricity bills.

The EPL is set at 35%, and together with existing taxes on oil and gas companies takes the total UK tax rate to 75%. However, companies are able to reduce the amount of tax they pay by factoring in losses or investment in their UK oil and gas business.

The vast majority of BP's profits are earned outside the UK and are therefore not covered by the EPL.

In the first three months of 2023, the company paid $3.4bn in tax globally and $650m in the UK - with about $300m due to the EPL. BP says it has now paid an extra $1bn in tax since the EPL was introduced.

Wholesale gas prices have been falling, which has raised hopes that household bills will start to come down this summer.

The price of Brent crude oil has also fallen back to around $80 a barrel from highs of nearly $128 following the invasion of Ukraine.

But BP said oil and European gas prices would remain higher than usual in the three months to the end of June.

Under the government's Energy Price Guarantee, energy bills for a typical household have been limited to £2,500 a year, although this level of support is due to stop at the end of June.

However, experts think that bills will fall below this level in July due to falling wholesale costs. This would make the price guarantee redundant.

Emissions protest

BP has also come under fire after it said earlier this year that it would cut back its target to reduce emissions by the end of the decade.

Last week, at the company's annual general meeting (AGM), some of the UK's biggest pension funds voted against reappointing BP's chairman, Helge Lund, in protest at the decision.

BP said that it valued "constructive challenge and engagement".

One of the pension funds also told the BBC that there were concerns over BP's actions on reducing gas flaring, after seeing the BBC documentary Under Poisoned Skies.

The BBC News Arabic investigation showed that BP was one of several major oil companies not declaring emissions from gas flaring at oil fields in Iraq, which produces cancer-linked pollutants.

Ali Hussein Julood, who documented his life in Rumaila, Iraq for the documentary, suspected his childhood leukaemia was due to the flaring. He passed away on 21 April after his cancer returned.

Ali's father told BP's board of his son's passing during the AGM.

Mr Looney gave his condolences at the meeting to Ali's family and said: "We are continuing to reduce flaring at Rumaila. We are making progress and it must continue to be made."

Related topics

- Published27 April 2023

- Published27 April 2023

- Published10 March 2023

- Published22 October 2024

- Published7 February 2023