How worrying is debt ceiling for Americans on Social Security?

- Published

The idea of a default is nearly inconceivable

The US faces dire warnings that a political stand-off over the debt ceiling could unleash unprecedented economic chaos. But few in the country, where nearly half the population relies on money from the government to help make ends meet, are making any backup plans.

In the base of a tower near the Brooklyn Bridge, half a dozen white-haired men and women assembled for their monthly book club.

The members are among the nearly 70 million Americans who receive monthly payments from Social Security, the government's assistance for pensioners and the disabled.

The programme pays out more than $115m (£92m) each month - about $1,700 on average per person - support that is at risk if President Joe Biden and Republican leader Kevin McCarthy cannot reach a deal before the US runs out of money to pay its bills.

Authorities have warned that moment could arrive in less than two weeks.

The seniors at Southbridge Towers said they were following the talks - and feel worried. But asked if they had taken any precautions in case the US defaults and their Social Security benefits do not arrive, the seniors seated around the plastic table responded with a sea of blank looks.

"That will never happen," declared 82-year-old Norman Manning. "It would be disastrous."

Mr Manning is hardly alone in betting that a deal allowing the US to borrow money will get done.

Financial markets also appear largely confident, despite some signs of anxiety among investors, including a drop in demand for some kinds of US debt.

Even after the lead Republican negotiator last week walked out of a closed-door meeting with White House representatives during talks aimed at avoiding a default, shares only flinched.

But Ian Bremmer, president of political consultancy the Eurasia Group, warned that even if both sides can agree to a deal, it will probably take significant wrangling before Republicans in Congress will vote for it - which could push the US into risky territory.

"This is going to get worse before it gets fixed," he said.

Without a deal, the White House has warned that if the government defaults, there would be severe disruption to government functions as well as pay for pensioners, government employees and members of the military. Financial markets are expected to go haywire.

Analysts say a prolonged stand-off could spark an economic downturn on the scale of the 2008 financial crisis, when millions of people lost their jobs and trillions of dollars in wealth was wiped out in financial markets.

A recent poll by Ipsos/Reuters found that three in four Americans fear personal financial fallout from such an event.

But dire predictions aside, no-one is exactly sure what would happen in a default - nor are government agencies providing many clues about if or how they are preparing.

When asked if it had alerted Social Security recipients about the risks, the Social Security Administration referred questions to the Treasury Department. The Treasury Department did not respond to a request for comment. Neither did the Department of Health and Human Services, which administers food benefits for the poor and other programmes.

Unions representing government workers said their members had received no guidance about what staff should expect.

"I don't think the government itself knows quite what would happen," said Daniel Horowitz, deputy legislative director for the American Federation of Government Employees, which represents 750,000 federal and DC government workers. "It is the Titanic heading for the iceberg right now."

Max Richtman, president and chief executive of the National Committee to Preserve Social Security and Medicare, said he was not surprised that the government would not want to unnecessarily alarm seniors if some kind of agreement to raise the debt ceiling is a foregone conclusion.

Arzu Deiker says she is worried about what could happen to her if the government defaults

But his organisation has still been trying to raise awareness among its millions of members and supporters about the potential risks.

"What we're telling our members is save some money, have a cushion in case things don't work out in the next couple of weeks," he said, noting that those on fixed incomes tend to have limited financial flexibility.

Robin Warshay, one of the book club members, said without her Social Security payment arriving on time, she would have to dip into savings.

She was also concerned about the ripple impact on businesses and the economy, should people's ability to spend suddenly freeze. But she said she remained "hopefully optimistic" talks in Washington would yield an agreement.

"If they want to get re-elected, they better make up," she said.

Even a deal could bring economic pain, depending on what it includes, analysts warn.

Republicans are seeking steep spending restrictions and changes to some benefits programmes.

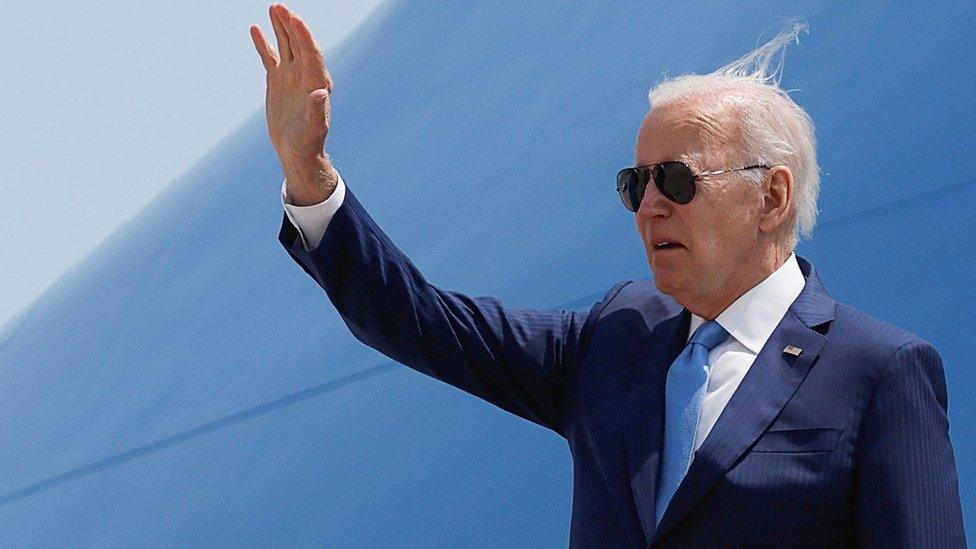

While Mr Biden has rejected many of their proposals, he has also laid the ground for compromise, saying: "We're going to come together, because there's no alternative."

Arzu Deiker, a home health aide in New York who receives assistance from the government to buy groceries for herself and her three children, said she was worried about the threat to that support - whether it comes in the form of default or a deal.

"I'm scared," said the 29-year-old. "It would affect me a lot."

Related topics

- Published2 June 2023

- Published22 May 2023