Nearly 800 mortgage deals pulled amid uncertainty over rates

- Published

- comments

Nearly 10% of UK mortgage deals have been taken off the market since last week amid concerns about how high interest rates will go, figures show.

Financial data firm Moneyfacts said, external nearly 800 residential and buy-to-let deals had been pulled as lenders were reassessing their offers.

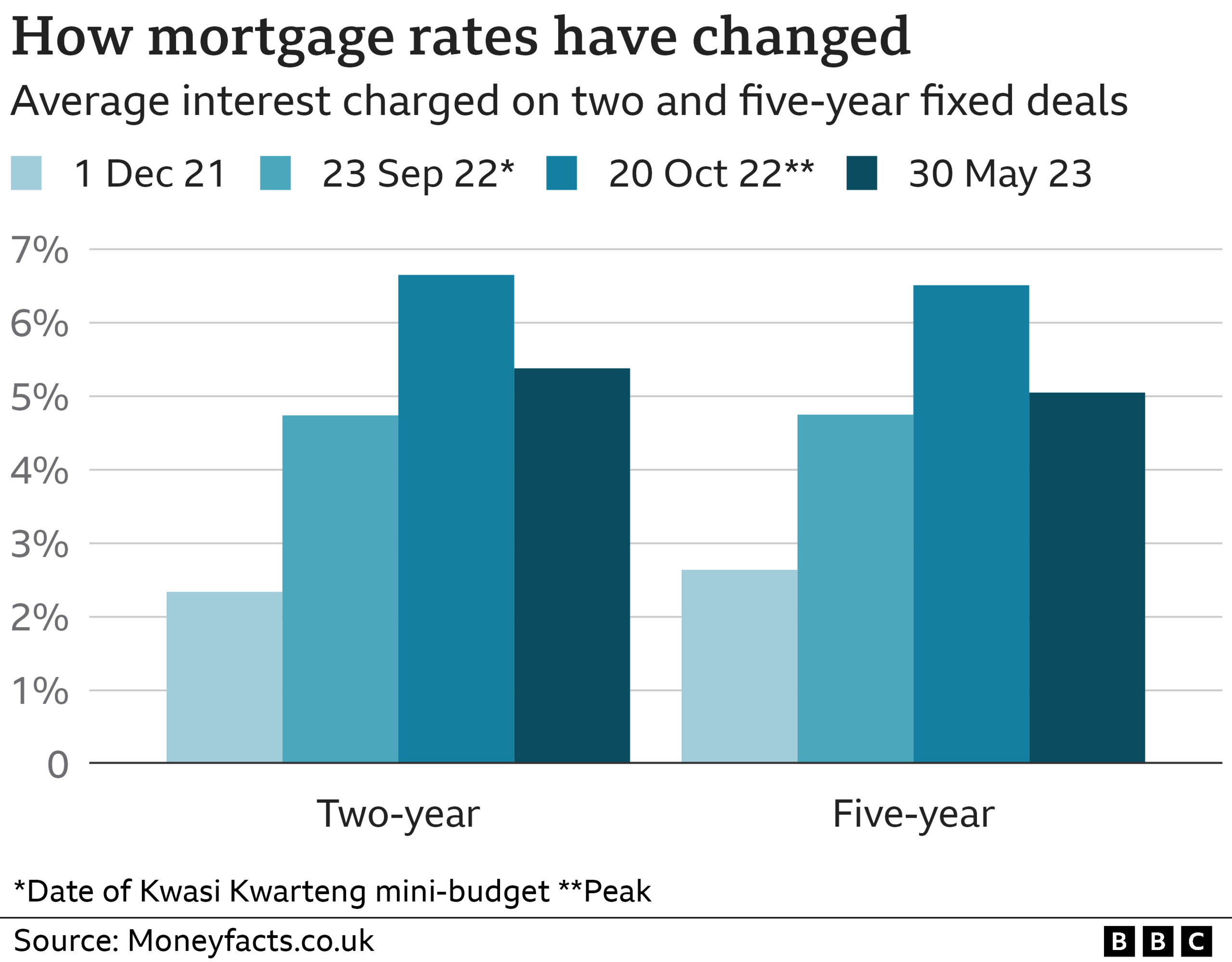

Meanwhile, average rates on two- and five-year fixed deals have also risen.

It comes after higher-than-expected inflation figures raised forecasts of how much UK interest rates will go up.

Official figures last week showed the UK inflation rate - which charts rising prices - slowed in April by less than expected to 8.7%.

That led to a strong reaction in the markets, with investors now predicting the Bank of England will have to raise interest rates above their current level of 4.5% to as high as 5.5% to try to slow price rises.

The change in expectations has led to big movements in prices and interest rates in the bond markets, and this has a knock-on effect on mortgages. So-called swap rates, which lenders use to price home loans, have increased.

According to Moneyfacts, since the start of last week, the number of residential mortgages on the UK market has fallen by 373 - from 5,385 deals to 5,012.

The number of buy-to-let mortgages has fallen by 405 to 2,343.

Are you affected by issues covered in this story? Get in touch.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Mortgage rates have also gone up, with the average rate on a two-year fixed deal rising to 5.38%, and the average rate on a five-year fixed now standing at 5.05%.

They are far higher than they were last May, when two- and five-year fixed rates stood at 3.03% and 3.17% respectively, although they are still some way off the levels seen last October, just after the mini-budget spooked markets and drove up borrowing costs.

"Borrowers searching for a new deal may well be concerned about the latest developments in the mortgage market," said Rachel Springall, a finance expert at Moneyfacts.

"Over the past few days, we have seen a few lenders withdraw selected fixed products, with some pulling out of the market, at least temporarily. Product choice has started to fall, and as may be expected, average fixed mortgage rates are on the rise."

Property prices have been falling over the last six months as borrowing costs creep up, squeezing people's buying power.

But earlier on Tuesday the property website Zoopla said buyer confidence appeared to be improving, with sales agreed reaching their highest point of the year so far in April.

However, boss Charlie Bryant told the BBC's Today programme last week's inflation figures had caused some uncertainty,

"What we've seen over the course of the last few months is that if rates settle around the 4-4.5% level, that is affordable for most buyers. If you look at the rates that came in shortly after the mini-budget at the back end of last year, we saw those rates going up to 5-5.5%, which brought in those faster house price falls."

He added: "We do need to see what happens following the inflation data at the beginning of last week, which saw swap rates increase, which may lead mortgage lenders to push rates up a little bit and that may have more of an impact again."

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future

Related topics

- Published26 May 2023

- Published24 May 2023