Mortgages: New squeeze on landlords will hit renters too

- Published

- comments

Landlords are making their lowest profits for 16 years as interest rates rise, leading some to look to leave the sector, estate agency Savills has said.

Twelve consecutive increases in the Bank of England's base rate, matched by rising mortgage costs, were putting the squeeze on landlords' income, it said.

Many smaller buy-to-let investors were also near, or at, retirement age.

If they decide to sell up, fewer homes could be available and renting would get more expensive.

"Following a boom period for buy-to-let landlords, 2023 marks a turning point for Britain's private rented sector," said Lucian Cook, head of residential research at Savills.

"There is a very real risk that landlords will exit the sector, particularly those with high levels of borrowing, putting increased pressure on a sector where demand significantly outweighs supply in many locations."

Recent events

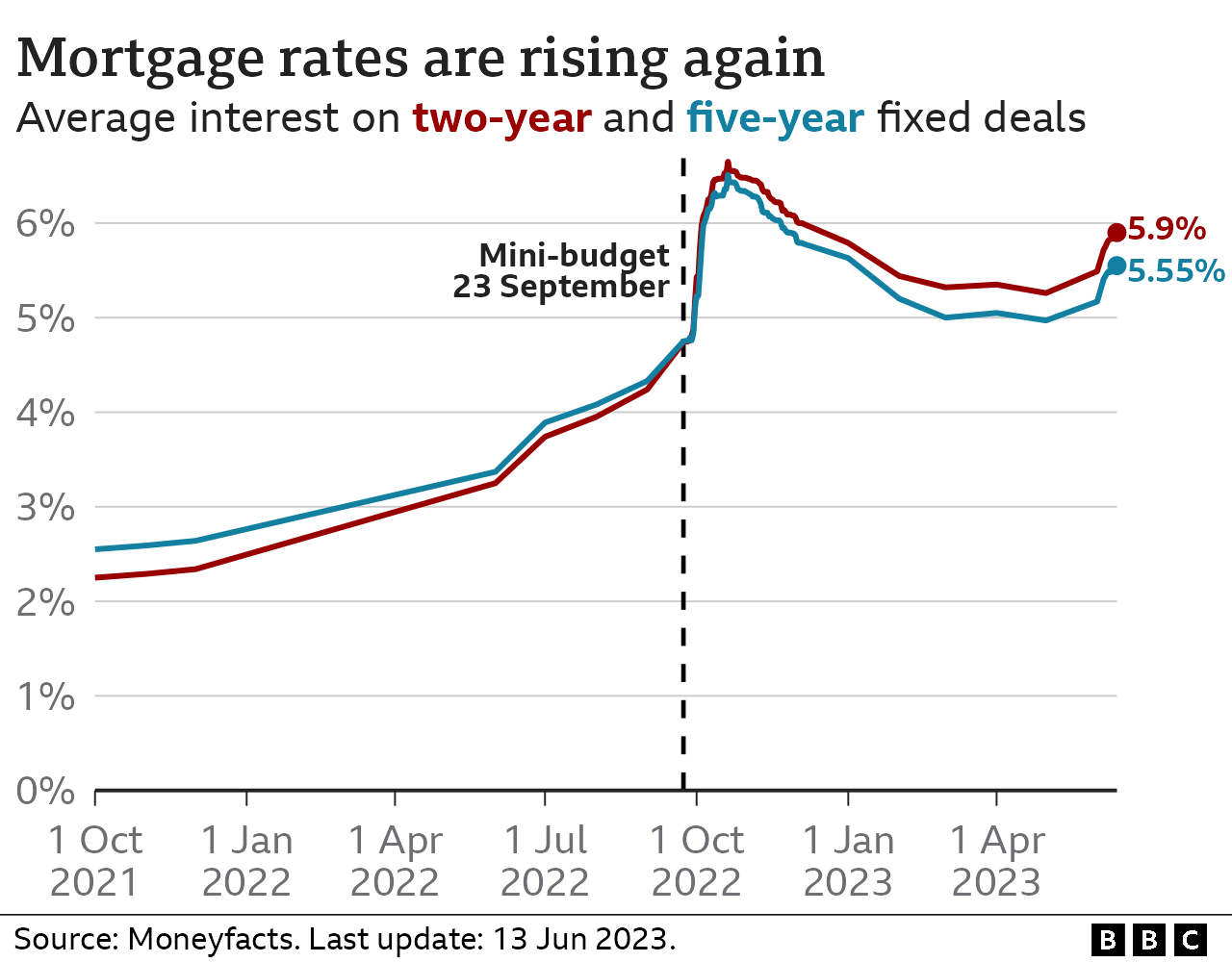

Interest rates have been rising since December 2021, and in recent days expectations of further increases have been heightened.

Data on wages and rising prices mean markets anticipate inflation and interest rates to stay higher for longer than previously expected.

This has led to government borrowing costs - which directly impact mortgage rates - rising to their highest rate since last year's mini-budget.

Mortgage rates are expected to continue rising - leaving landlords particularly exposed.

Are you a landlord? Get in touch and share your experiences.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Savills said data from the first three months of the year showed buy-to-let investors had already been squeezed, with net profits falling below 4% - the lowest since 2007. That compares with profits of as much as 23% when rates were at ultra-low levels during the last decade.

It said that larger landlords could be the most likely to stay in the sector.

Savills research suggests 1.9 million properties are owned by 620,000 landlords aged over 65, with a further 1.9 million owned by landlords aged between 55 and 64.

They could choose to leave, meaning tenants would have less choice, Mr Cook said. Better-paid renters in more secure employment could go to the front of the queue for those remaining properties, he added.

What are your renting rights?

How much can my landlord increase the rent? It depends on your agreement but rises must be fair, realistic and in line with local properties and there's usually a month's notice.

Can my landlord evict me? Landlords need to follow strict rules such as giving written notice. Once the notice period ends, the landlord can start eviction proceedings through court.

Can a landlord refuse people on benefits? No. DSS policies are unlawful discrimination, says charity Shelter., external Some councils have lists of private landlords who rent to tenants claiming benefits.

There's more on your renting rights and where to go for help here.

Newly-published figures from the Bank of England, external show that the proportion of mortgages advanced to buy-to-let investors is at its lowest level since 2011.

The data also showed how total mortgage lending dived during the first three months of the year.

Total mortgage borrowing stood at £58.8bn, down 23.6% in a year. The Bank also recorded a rise in people falling behind on mortgage repayments.

Since then, mortgage rates have climbed for borrowers looking for a new deal, with a typical two-year fixed-rate deal now at a rate of 5.9%, according to the financial information service Moneyfacts. The average rate on a five-year fixed-rate mortgage is 5.55%.

Related topics

- Published11 June 2023

- Published12 June 2023

- Published8 June 2023

- Published25 May 2023