Thames Water: nationalisation is not the way forward says new chairman

- Published

Thames Water's new chair has said nationalisation is not the right way forward despite the regulator warning the company has "deep-rooted" problems.

Sir Adrian Montague said he understood customer "frustration" over the UK's largest water firm's poor performance.

But he said the best way to resolve it was keeping the company under private ownership.

Thames Water has faced criticism over sewage discharges and leaks and is struggling under £14bn debts.

In June, there had been fears that the company could collapse and the government said it was ready to take it over. But since then, Thames Water has secured a £750m cash injection from its shareholders.

Appearing before MPs on Wednesday, Sir Adrian said "public ownership seems to be the answer to many questions, I think when you conduct a real evaluation, I think private ownership is still the way forward".

"I can understand frustration of customers who want to see improvements, we would love to be able to deliver all those improvements overnight but it will take time," Sir Adrian added, who is the former chairman of Aviva and outgoing boss of Manchester Airports Group.

There has been speculation that if Thames Water failed to secure fresh funds it could be temporarily taken over by the government until a new buyer is found, in what is called a special administration regime (SAR).

This route was most recently taken with energy supplier Bulb after it ran into financial difficulties.

Iain Coucher, chairman of water industry regulator Ofwat, told the committee of MPs that "at this point" he was "confident the shareholders will inject some cash".

But he warned that problems at Thames Water were "deep-rooted" and its current situation was a consequence of its underperformance.

"They need to fix that as quickly as possible otherwise they will have the same problems in the future," he said.

Mr Coucher also said he "would worry" about the level of investment required for the industry if it was nationalised, adding that up to £6bn a year had been invested into the water sector since it had been privatised in 1989.

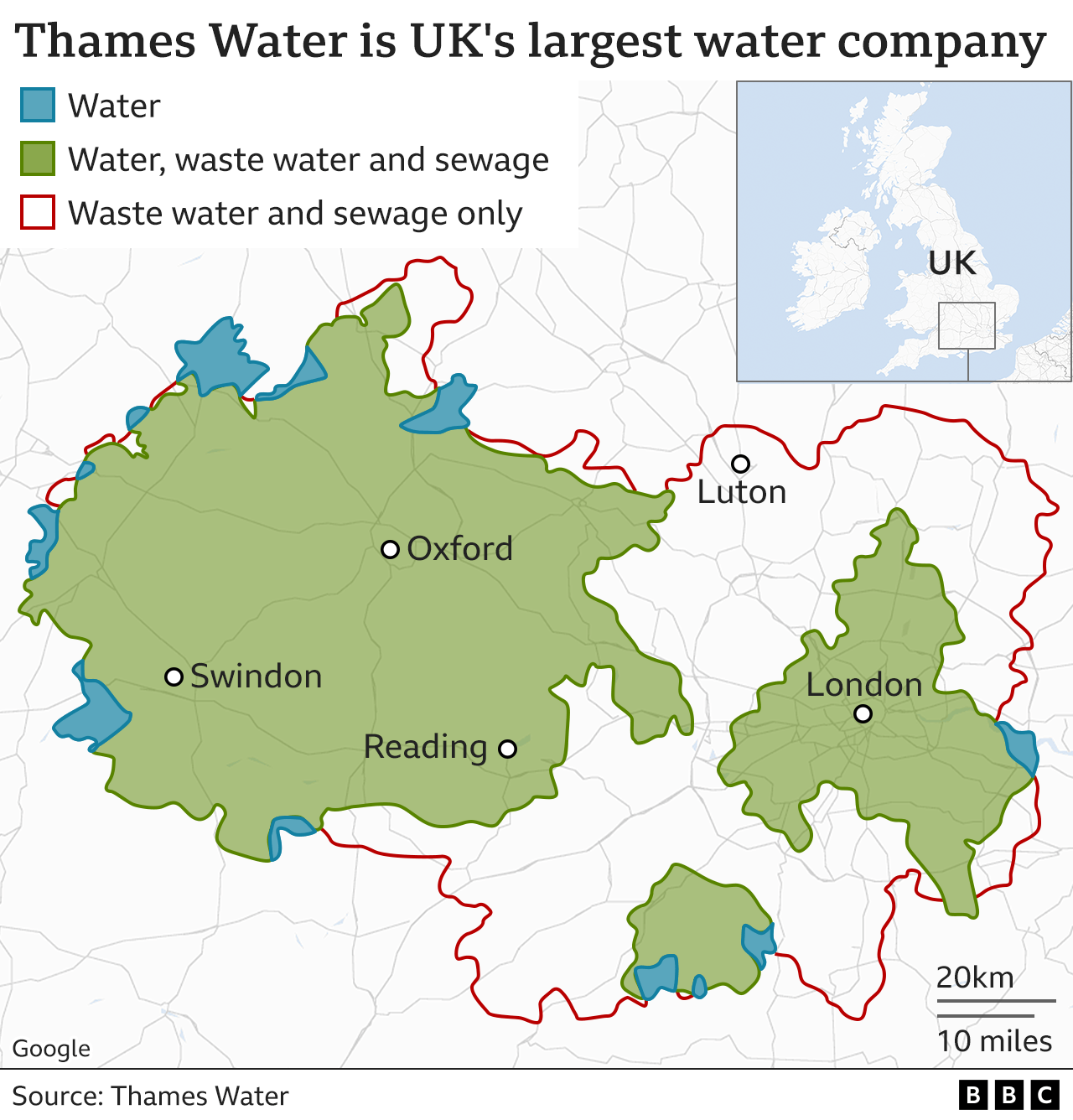

Thames Water serves a quarter of the UK population across London and parts of southern England.

It leaks more water than any other water company in UK, losing the equivalent of up to 250 Olympic size swimming pools every day from its pipes.

The company's future came under the spotlight last month when it emerged it was in talks to secure extra funding, and the firm's chief executive Sarah Bentley stepped down after just two years.

Sir Adrian told MPs Ms Bentley's departure was a "surprise", adding he believed she had "got to the point perhaps of feeling that the burdens of office were considerable and it was an entirely personal decision, with which I think we had no involvement".

Thames Water's new joint chief executives Alastair Cochran and Cathryn Ross both faced questions from the Environment, Food and Rural Affairs Committee

Ms Ross, who was previously chief executive of Ofwat, was asked by Labour MP Darren Jones if she would like to apologise to taxpayers for "potentially putting them in this position where yet again another regulated market could potentially collapse and expose taxpayers to billions of pounds".

Ms Ross said: "I won't apologise for my role as chief executive of Ofwat, no."

Last week, Thames Water was fined £3.3m after it discharged millions of litres of untreated sewage into two rivers near Gatwick in 2017, killing more than 1,400 fish.

A judge said she believed there had been a "deliberate attempt" by the firm to mislead the Environment Agency, but Ms Ross said the company was changing its culture.

"I think historically, we were a company in which bad news travelled upwards to slowly, I think people were afraid to say how things really were on the ground," she told MPs.

The current leadership of Ofwat is also under pressure over its performance in regulating water firms, but denied its chair, Mr Coucher, had been "asleep at the wheel".

David Black, the chief executive of Ofwat, told MPs that customers would not foot the bill for Thames Water's troubles through higher bills, saying "shareholders are up for the additional costs associated with their poor performance".

But Mr Black has already admitted water companies generally are likely to seek higher bills from 2025 to cover the cost of improving services.

Related topics

- Published29 June 2023

- Published2 July 2023