British Gas: Anger as energy bill change leads to record profits

- Published

- comments

There has been an angry reaction to British Gas reporting record half-year profits as millions of households continue to struggle to pay their energy bills.

British Gas's profits rose to £969m after price cap rises allowed it to make more money from household bills.

Regulator Ofgem said the bumper results were a "one-off" due to the changes.

But campaigners said the profits were "a further sign of Britain's broken energy system".

"The profits posted will be greeted with disbelief by those struggling through the crisis," said Simon Francis, co-ordinator of the End Fuel Poverty Coalition, adding that "energy firms are operating on a playing field set by the government".

British gas owner Centrica said it was important to understand that the changes were "simply a recovery of costs that we incurred in the past".

About half of British Gas's profit - £500m - was due to changes to the price cap made by the energy regulator. By comparison, the business reported a profit of £98m in the same period last year.

Two other major energy suppliers also announced large increases in profits, helped by the changes to the price cap.

Scottish Power went from a large loss last year to profits of £576m in its retail division, while France's EDF said its British operations - including nuclear and wind power generation - saw earnings jump to £1.95bn from £740m last year.

Profits have risen after the energy regulator raised how much suppliers can claim from household bills to make up for costs incurred during the pandemic.

But Ofgem said bumper profits in the first half of the year would be a "one-off" as energy firms recoup "significant costs" from the impact of the Covid pandemic and Russia's invasion of Ukraine, and that profits would then "fall back significantly".

On average, in 2022 suppliers made a shortfall for each dual-fuel customer due to the cap, but in the first half of 2023, the higher cap gave them a benefit of about £100 a customer.

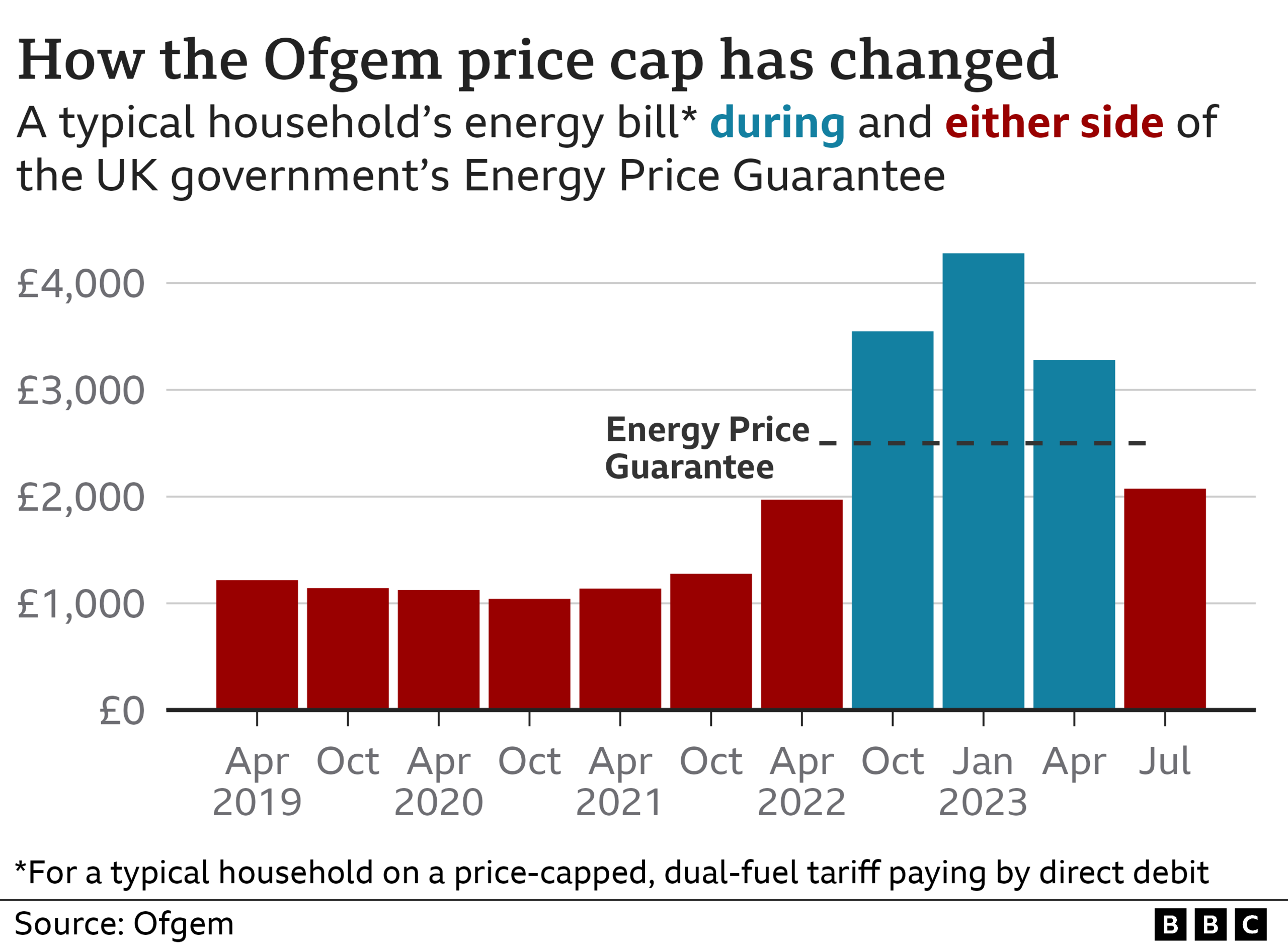

Households were protected from the full rise in the cap by the government's energy price guarantee, which ran from October to June and limited typical annual bills to £2,500.

Ofgem said that billpayers, and taxpayers via government subsidies, had "supported the sector and its customers as prices rose and costs spiralled", adding that firms should not pay dividends to shareholders unless they are "financially robust".

Centrica reported underlying operating profits of £2.1bn for the first six months of the year, up from £1.3bn a year earlier. It has proposed a 33% hike in dividends and a £450m extension of share buybacks.

What can I do if I can't afford my energy bill?

Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

Pay what you can: If you can't meet your direct debit or quarterly payments, ask your supplier for an "able to pay plan" based on what you can afford.

Claim what you are entitled to: Check you are claiming all the benefits you can. The independent Moneyhelper, external website has a useful guide.

Prime Minister Rishi Sunak said that the windfall tax on energy firms had helped to pay "around half of a typical family's energy bill".

"That support has been worth £1,500 to a typical family," he said.

However, Labour's shadow climate and net zero secretary, Ed Miliband, said the profits "demonstrate the continuing scandal of the Tory failure to act on the windfalls of war being pocketed by the oil and gas companies".

Liberal Democrat leader Ed Davey said the government was "still allowing energy firms to rake in extraordinary profits while millions of families struggle".

Analysts at Cornwall Insight predict the energy price cap is expected to remain "significantly above pre-pandemic levels for the foreseeable future".

Advisory organisation the Energy and Climate Intelligence Unit said the government had been "prioritising oil and gas over cheaper renewables", whereas recent polls suggest that people wanted "more action on climate change".

Energy firms have continued to make big profits from oil and gas, even though energy prices are not as high as they were last year.

Russia's invasion of Ukraine in 2022 pushed up oil and gas prices and led to energy firms making record profits.

Oil and gas giant Shell said profits fell to $5bn (£3.9bn) in the April-to-June period, partly due to the fall in prices.

Shell said it had also been selling less oil and gas and making lower profits on refining.

Related topics

- Published30 June 2023