House prices are falling, so why can't I afford a home?

- Published

This week has been a game of two halves, economically speaking, for prospective housebuyers.

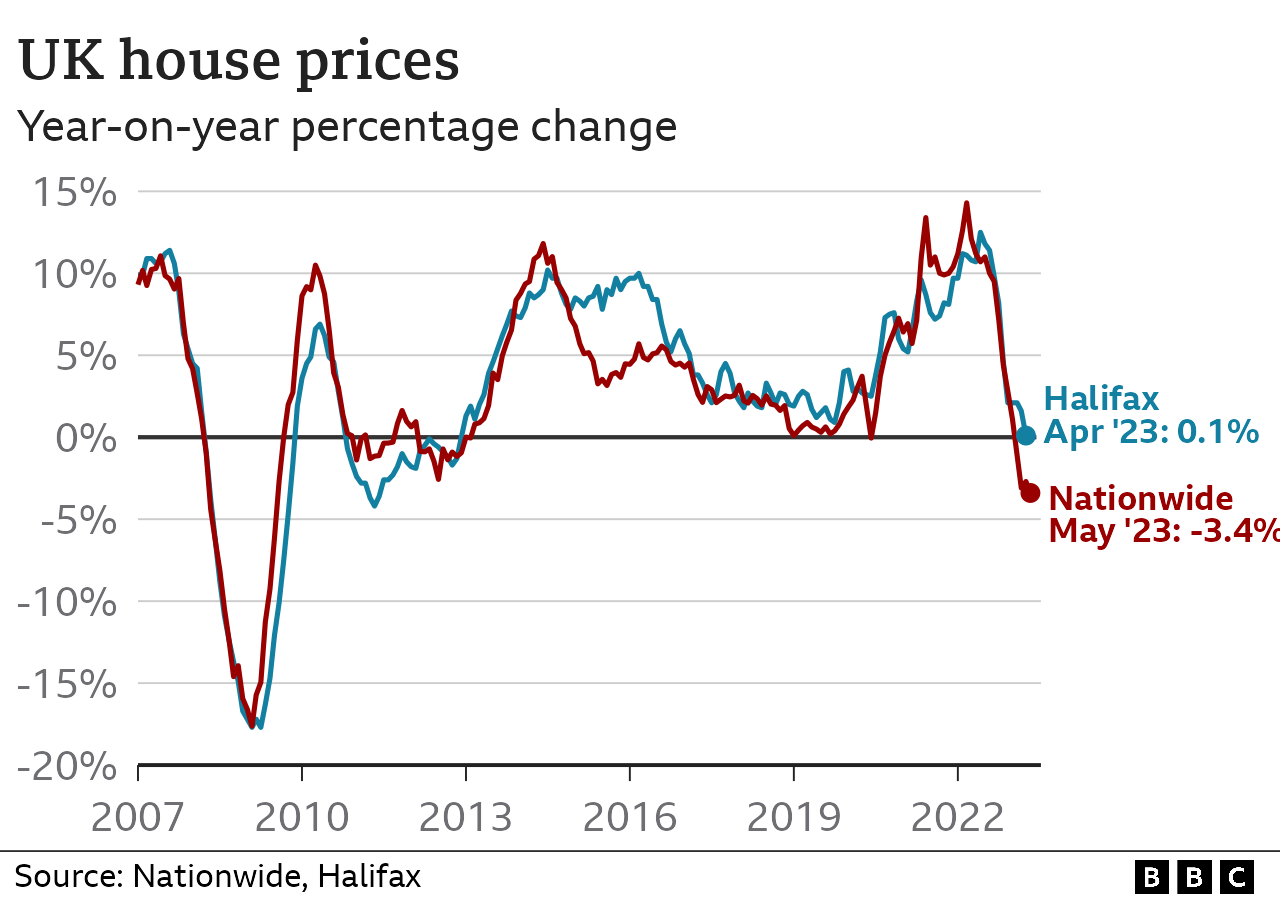

On Tuesday, the Nationwide building society said that house prices had recorded the biggest annual fall for 14 years.

Then on Thursday, the Bank of England hiked interest rates yet again.

Falling house prices should be good news for first-time buyers.

But with mortgage rates remaining high, things aren't quite as simple as they seem.

Are house prices actually falling?

It depends on how you look at it.

In the year to July, house prices dropped by 3.8% - that was the biggest annual fall since 2009, according to Nationwide.

However, the average price of a home in the UK remains high. It hit £260,828 in July, which is only marginally lower than the all-time record reached last August.

The housing market heated up because of the Covid pandemic, helped by a stamp duty holiday.

After being forced to work from home, cooped-up people decided they wanted more space inside and out, prompting a rush of buying, selling and moving.

The average house price is now £45,000 higher than it was in February 2020, the last full month before the pandemic struck, according to Nationwide.

Andrew Bailey, the governor of the Bank of England, has said house prices are falling.

But don't expect a bargain just yet.

Mr Bailey pointed to the fact that the number of mortgages that were approved in June rose to 54,700 - the highest since last October - while total borrowing for mortgages rose from £19bn in May to £20bn in June.

Higher approvals and borrowing will support house prices in the coming months, said Mr Bailey.

"Yes, there is an adjustment," he told the BBC. "But I think we should avoid preaching crisis at this point, it's not that."

In fact, in its most recent Monetary Policy Report, the Bank said that house prices are expected to fall only "modestly" in the coming months.

Why are mortgages so expensive?

The interest that a bank charges you to borrow money for a house is heavily influenced by the rate set by the Bank of England.

Since late 2021, when the Bank of England's main interest rate stood at just 0.1%, it has been putting up rates to try to stop prices rising so quickly.

Inflation, which measures the rate at which prices are rising, is easing but at 7.9% in June, is still nearly four times higher than the Bank's 2% target.

On Thursday, the Bank increased rates for the 14th time in a row, taking them from 5% to 5.25%.

Recent rate rises have had a big knock-on impact of the cost of mortgages.

The average interest payment on a two-year fixed deal is currently 6.85%, according to financial data company Moneyfacts. For a five-year fixed mortgage, it is 6.37%.

By comparison, between July and September 2021, the average two-year rate was around 2.5%.

But there has been suggestions that the current interest rate level could be the peak for consumers, with banks and building societies starting to actually cut mortgage rates.

Mortgage rates are determined by what financial markets think the average UK interest rate will be over the next two or five years.

The five-year rate is sometimes lower that the two-year rate is because investors might forecast that interest rates will come down at a later date.

But that is not a certainty and on Thursday, the Bank of England warned that it may have to keep interest rates higher for longer to control inflation.

I'm a first-time buyer - what now?

It's a bit of a rock and a hard place situation.

A couple of years ago, the biggest problem facing first-time buyers was the deposit they needed to get on the property ladder, according to Nationwide.

Roughly speaking, between July and September 2021, the average house price was £208,757, and the average annual earnings for a full-time worker was just over £38,000, according to the Office for National Statistics.

A 10% deposit would be £20,875, which would be equal to 55% of average annual pay at that time - "an all-time high", said Robert Gardner, Nationwide's chief economist.

"If you fast-forward to now, the deposit requirement is still high by historic standards," he said.

"It is not quite as high as it was relative to earnings because house prices have come down and people's incomes on average have gone up."

While average wages have risen - up 7.3% according to the latest data from the ONS - they continue to lag behind the cost of living.

Mr Gardner said: "The thing that has really changed is the typical monthly payment is now significantly higher than the long-run average because mortgage costs are significantly higher."

Even if a first-time buyer managed to put down a higher deposit of around 20%, Nationwide estimated that a first-time buyer earning an average annual wage with a mortgage rate of 6% "would see monthly mortgage payments account for 43% of their take home pay".

The building society said that a year ago, monthly mortgage payments accounted for around 32% of take home pay.

So is there any good news?

Mr Gardner said that even though the unemployment rate is expected to rise - from 4% to nearly 5% in 2026 according to the Bank of England - it will hopefully remain low by historic standards.

Added to that, if wage growth remains solid "our expectation is that house prices will fall a little bit further and are likely to lag behind earnings growth for a good while".

"Over time what that will do is improve affordability, especially if mortgage rates start to moderate as well, which they may well do once the Bank rate passes its peak," Mr Gardner said.

What happens if I miss a mortgage payment?

If you miss two or more months' repayments you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, such as lower repayments for a short time

They might also allow you to extend the term of the mortgage or let you pay just the interest for a certain period

However, any arrangement will be reflected on your credit file, which could affect your ability to borrow money in the future

- Published1 August 2023

- Published1 August 2023