Warm weather in June boosts UK economy

- Published

- comments

Warm weather in June helped lift UK economic growth by more than expected, according to official figures.

Higher temperatures boosted pubs, restaurants and the construction industry, lifting the economy by 0.5%.

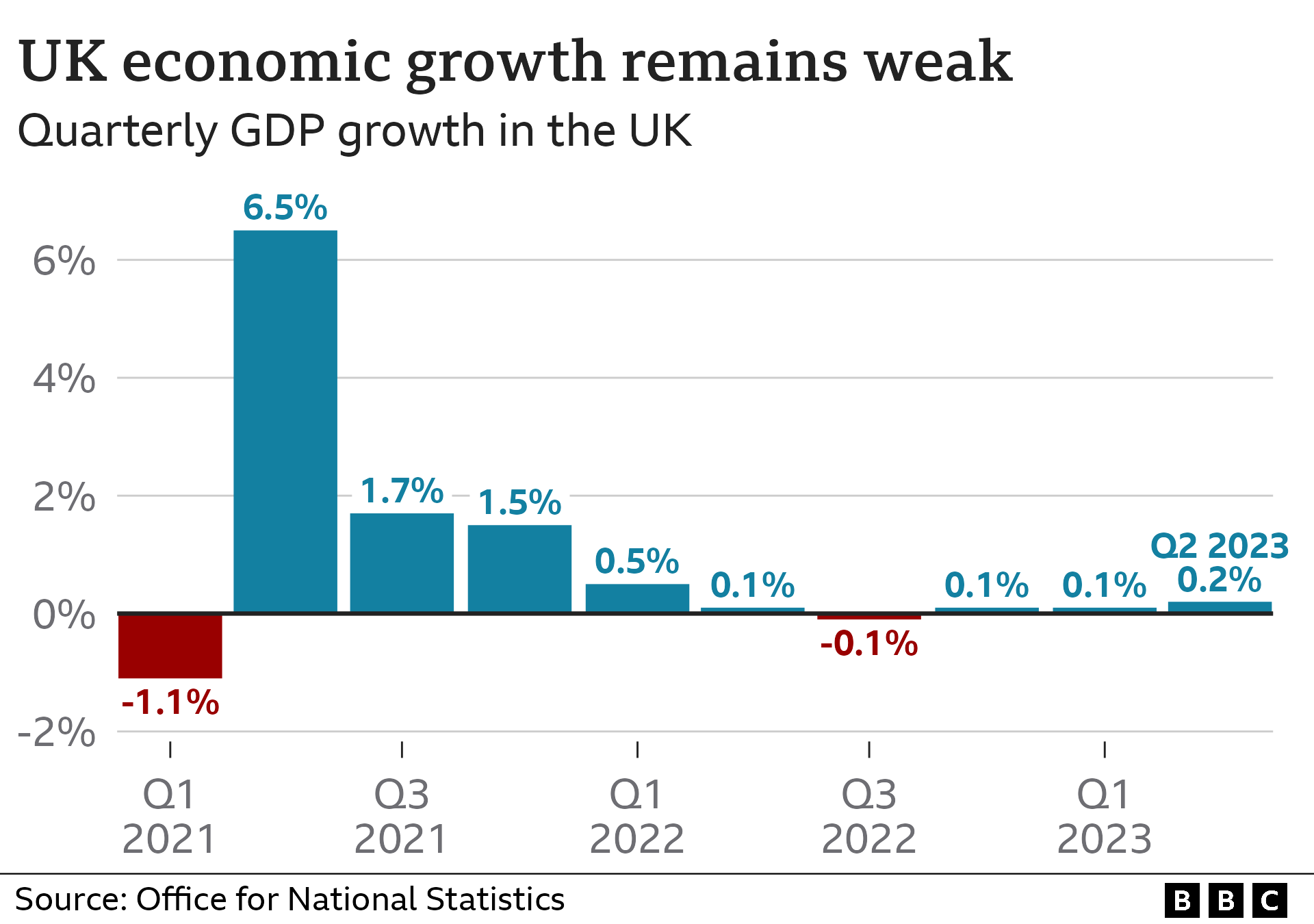

The stronger data meant that the economy expanded by 0.2% between April and June.

However, strikes by NHS workers weighed on output in June and fears of a recession remain over the UK's longer-term growth.

Darren Morgan, director of economic statistics at the Office for National Statistics (ONS), which published the data, said there were three factors that affected the UK in June - the number of working days, weather and industrial action.

He said while the economy bounced back from May's extra Bank Holiday for the King's Coronation, the manufacturing industry - and cars in particular - had performed robustly.

"Services also had a strong month with publishing and car sales and legal services all doing well," he said. "Though this was partially offset by falls in health, which was hit by further strike action."

While June's growth was better than expected, the UK remains only country out of the G7 nations not to see its gross domestic product (GDP) return to pre-Covid levels, based on the latest quarterly figures.

James Smith, research director at the Resolution Foundation think tank, said that growth of 0.2% between April and June showed the UK's "relative resilience".

The UK has avoided a recession after the economy expanded by 0.1% in the first three months of this year. A recession is usually defined as when the economy shrinks for two three-month periods - or quarters - in a row.

Mr Smith said that while the UK has swerved a slowdown, it "will feel like a recession to many as families struggle with the ever-rising cost of essentials and higher mortgage repayments".

'It's tough'

Phil Simpson, managing director of Lancaster Brewery which has venues in south Cumbria and north Lancashire, said that he has never experienced an environment like the current one during his 20 years in business.

"It's tough," he told the BBC. "We came out of Covid, that was obviously appalling, we've come into a world that's just horrendous. It's better than Covid, but only just."

While the company's sales are up by about 9% on last year, its running costs are higher because of inflation which is squeezing its profits.

Phil Simpson, managing director of Lancaster Brewery

He said that the hospitality industry is experiencing a "dual battering" from internal pressures such as wages, energy bills, food and drink costs and the external pressures like higher interest rates and inflation.

"People haven't got the cash they used to have...everyone's just clinging on," Mr Simpson said. "There really is no good news in our industry."

Capital Economics predicted the country will enter a "mild recession" later this year once a succession of interest rate rises by the Bank of England take effect.

Its deputy chief UK economist Ruth Gregory, said while June's growth looked encouraging: "The Bank Holiday, unusually warm weather and strikes make it hard to judge the true health of the economy."

She said underlying activity is still growing, "albeit at a snail's pace".

"We still think that with most of the drag from higher interest rates still to come, gross domestic product will fall [between July and September] and a mild recession will begin."

Strikes by health workers could continue to drag on the UK economy. Industrial action took place in July.

And on Friday, junior doctors started a four-day walkout as health bosses warned that NHS services were at tipping point, with costs to cover the previous four strikes estimated totalling about £1bn, as well thousands of postponed treatments.

Prime Minister Rishi Sunak has made growing the economy one of his key pledges.

In response to the latest figures, Chancellor Jeremy Hunt said the "actions" the government were taking to fight higher prices were "starting to take effect, which means we're laying the strong foundations needed to grow the economy".

But Labour's Shadow Chancellor Rachel Reeves said growth in the economy was "still on the floor" due to "13 years of economic mismanagement under the Conservatives".

The rising cost of living and higher interest rates have been squeezing the finances of households and businesses.

Inflation which is the rate prices rise at, is 7.9% which is almost four times the Bank of England's 2% target.

The Bank has been raising interest rates in an effort to bring inflation down, with the theory being that by making borrowing more expensive, people will spend less, leading to demand slowing and prices to rise as fast.

GDP is a measure - or an attempt to measure - all the activity of companies, governments and individuals in a country. It is one of the most important tools for looking at the health of the economy, and is watched closely by the government and businesses.

If the figure is increasing, that means the economy is growing and people are doing more work and getting a little bit richer, on average.

But if GDP is falling, then the economy is shrinking which can be bad news for businesses. If GDP falls for two quarters in a row, it is typically defined as a recession.

Sign up for our morning newsletter and get BBC News in your inbox.