Inflation slows to 6.8% but flights and hotels keep prices high

- Published

- comments

Inflation slowed last month due to lower energy costs but pressure remains on households with food, restaurant and hotel costs staying high.

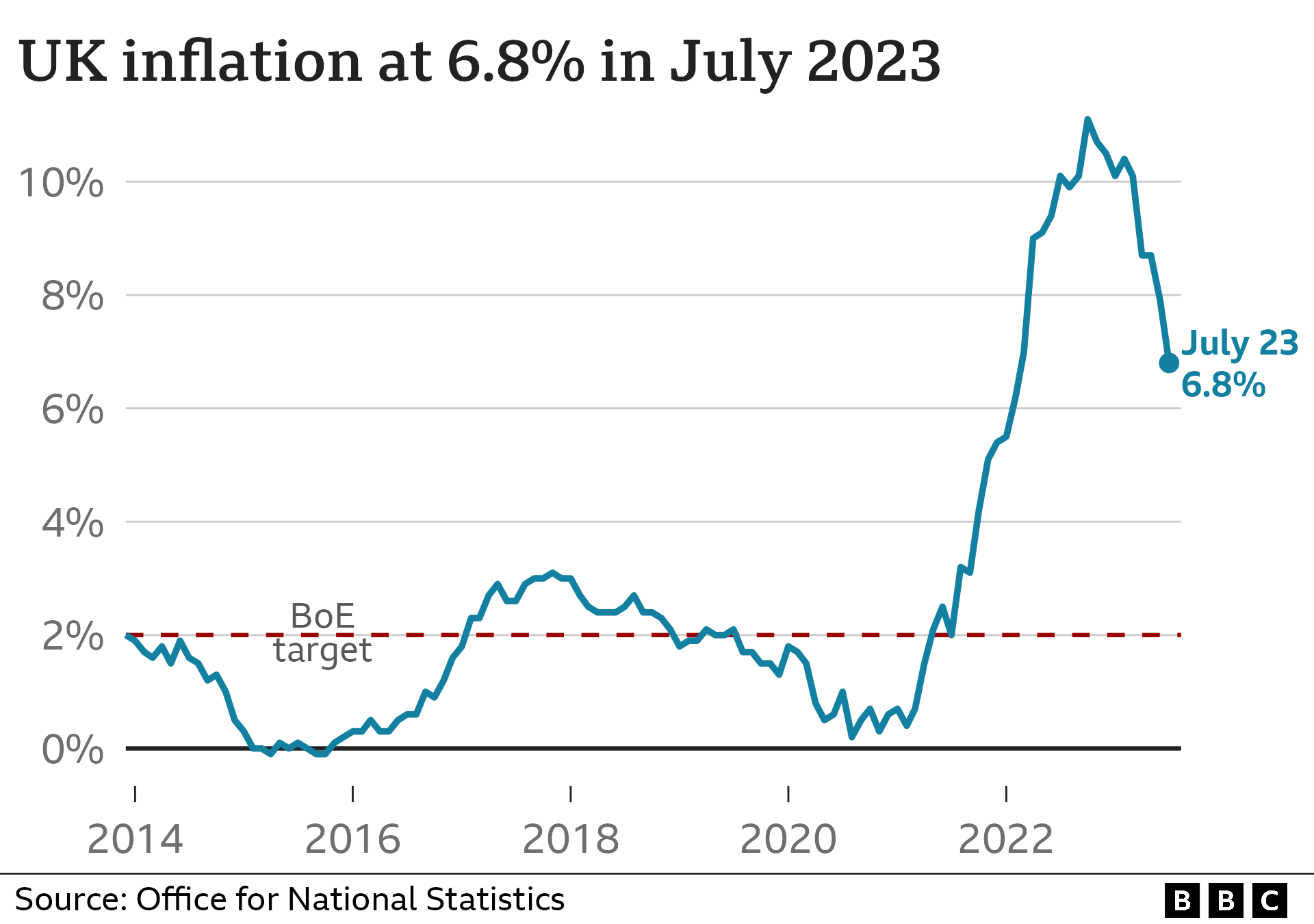

The inflation rate, measuring price changes over time, fell to 6.8% in the year to July, down from 7.9% in June.

Lower electricity and gas prices drove the drop, but price rises in other areas have led to expectations that interest rates will be raised further.

The cost of eating out has risen, along with alcohol and tobacco prices.

Flight prices continued to rise, jumping almost 30% compared to July last year, according to the official figures, released by the Office for National Statistics (ONS).

Inflation is much lower than it was at its peak of 11.1% in October, but it still remains high compared to historical rates and much higher than the Bank of England's 2% target.

When the rate of inflation falls, it does not mean that prices are coming down, but that they are rising less quickly.

Wages have been failing to keep up with rising prices for some time, but there are potential signs of change after figures on Tuesday revealed wages rose 7.8% annually between April and June.

Alongside reductions in energy bills, price rises for staple food items like milk, butter, bread, eggs, cereal and fish eased. But overall, food still costs almost 15% more than one year ago.

Matthew Corder, deputy director of prices at the ONS, said falling gas and electricity prices drove down inflation last month when a change to the energy price cap, which limits how much suppliers can charge households for what they use, came into force.

While easing energy bills and food costs will be welcome for households, there "will be little cause for celebration" at the Bank of England, according to Danni Hewson, head of financial analysis at AJ Bell.

"Inflation is still significantly above that 2% target and even if it is cooling off faster than a sunburnt Brit diving into a hotel pool, prices are not falling, they're just not rising as fast as they have been," she said.

"Wage increases and price pressures have forced up service costs and that's weaving its own nasty spell on core inflation," she added.

Core inflation, which strips out the price of energy, food, alcohol and tobacco, remained unchanged in July at 6.9%. The rate is higher than in Germany, France, and the US and it is a figure that is closely watched by the Bank of England, which sets interest rates.

With inflation still more than three times the Bank's 2% target, many experts expect it will raise interest rates again in September in an attempt to slow price rises.

The Bank has steadily increased interest rates to 5.25%, the highest level in 15 years, meaning mortgage costs have jumped, but savings rates have also increased. Higher rates can also lead to high credit card and loan repayments.

It hopes that if it makes borrowing more expensive, people will spend less, demand will slow, and prices will not rise as quickly.

Ruth Gregory, deputy chief UK economist at Capital Economics, said with wage growth and services inflation both stronger than the Bank had expected, its decision makers would look to raise rates from 5.25% to 5.5% in September.

In the year to July, services inflation, which includes data on prices for services in venues like bars, hairdressers and restaurants was back up to 7.4%, the joint highest level since 1992.

The ONS said price increases for hotels drove services inflation higher.

At first glance, this sharp fall in the rate of inflation to below 7% puts the UK on a path to a more "normal" economic situation. However, the underlying measures of inflationary pressures across the economy, are no longer going in the right direction.

Services inflation was back up to 7.4% - the joint highest level since 1992. Core inflation, which strips out volatile food and energy costs, remained at 6.9%.

The significance of these measures is that they show how much inflation is left in the economy, after the direct impacts of the energy shock have passed through. This set of figures increase the likelihood of further interest rate rises in September and perhaps October too.

While the prime minister has said there is "light at the end of the tunnel", Wednesday's figures confirm that we can see a tunnel out of this, but it may still be some time before the light is reached.

The owner of Naija High Street, a Nigerian food store in south London, told the BBC he has been limiting its price hikes despite some running costs doubling.

Feyisara, who runs the business with his wife, said a box of plantain costs between £35 and £40 compared to £16 five years ago, while prices for meat and beans and other imported ingredients have risen.

Feyisara says he might have to increase his prices

He said he is fortunate to be on a busy street market with steady footfall, but fears if wholesale costs do not ease soon, the shop will have to put up its prices.

"Everything's gone up but somehow we've been able to absorb it," he said. "If they don't fall, we'll have to unfortunately increase our prices. So that the business can cope."

Prime Minister Rishi Sunak defended his record on tackling the cost of living, saying the plan to ease rising prices was working.

He said it was difficult for people to understand the scale of government support with energy bills.

Shadow Chancellor Rachel Reeves said inflation in Britain remained "higher than many other major economies".

"After 13 years of economic chaos and incompetence under the Conservatives, working people are worse off - with higher energy bills and prices in the shops," she said.

Heidi Karjalainen, a research economist at the Institute for Fiscal Studies suggested the government's pledge to halve inflation by the end of this year was "always a little odd as there is only so much the Treasury can do to influence the pace of price increases".

"When the target was set, the prime minister may have hoped he could rely on falling in energy prices to do most of the work to hit it," she said.

"However, the stubbornly high rate of price inflation for goods and services other than food and energy has put the target in jeopardy. With only four months to go, it no longer seems at all clear that inflation at the end of the year will have fallen by enough to achieve it."

How can I save money on my food shop?

Look at your cupboards so you know what you have already

Head to the reduced section first to see if it has anything you need

Buy things close to their sell-by-date which will be cheaper and use your freezer

Correction: The graphic on this story was amended on 17 August to correct the price of white sliced bread to £1.35 and the price of milk to £1.25

Related topics

- Published3 April 2024