Banks face fines if they breach rules on access to cash

- Published

- comments

Banks face fines if they fail to provide free access to cash withdrawals for consumers and businesses, the Treasury has confirmed.

A new policy will state that free cash withdrawals and deposits must be available within one mile for people living in urban areas.

In rural areas, where there are concerns over "cash deserts", the maximum distance is three miles.

The move is unlikely to halt branch closures and the decline in cash use.

The Treasury said the distances were chosen to maintain the current level of coverage of free access to cash, through ATMs or face-to-face services. Those limits could be extended if cash use declines in the future.

Under the new guidance, if a service such as an ATM or branch is withdrawn and a replacement service is needed in the area, then this should be done before the closure takes place.

A voluntary arrangement is currently in place which means every High Street should have free access to cash within 1km. The detail of the new policy will come under the microscope, including the starting point and practicalities of the distances that have been stipulated.

Worries for vulnerable

An average of more than 50 UK bank branches have closed each month since 2015. Campaigners fear some retailers could stop accepting cash if it becomes too burdensome to process.

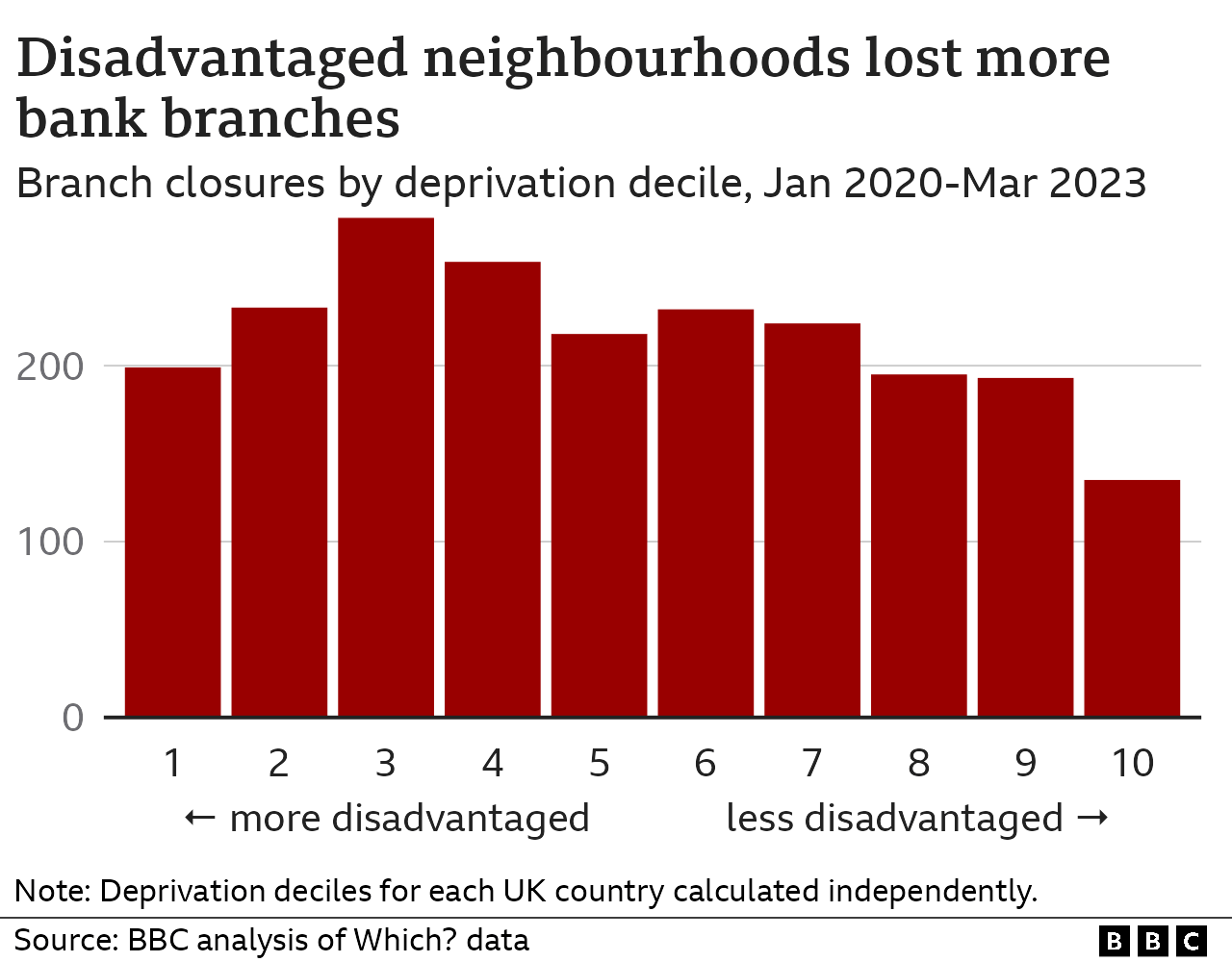

Cash remains a necessity for millions of people, research has found, with the elderly and those with disabilities among those likely to struggle. Branches have been more likely to close in disadvantaged areas.

Banks have pointed to the large reduction in branch use - a trend accelerated by the Covid pandemic - and the popularity of managing money via smartphones, as good reason for diluting their branch network.

But a recent survey by Age UK suggested that, among those who were uncomfortable about digital banking, the key concerns were fraud and scams, a lack of trust in online banking services, and a lack of computer skills.

Share your experiences. Get in touch.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Meanwhile, some small businesses are concerned about the declining use of cash, which accelerated during the Covid pandemic.

Nina Narramore, who runs the Norfolk Cheese Company in Downham Market, said that when customers pay by card it creates additional costs for her business.

Nina Narramore says card payments add to her costs

"I think post-Covid people have got used to using and paying with cards," she said. "I would say about 10% of our shop sales are only cash payments now. We're just about to see the closure of our last bank in the town so that is only going to get worse.

"The impact that has on a small business is that we get charged per transaction rather than one deposit that we put in the bank per week."

'Here to stay'

Andrew Griffith, economic secretary to the Treasury, said that "cash is here to stay".

"People shouldn't have to trek for hours to withdraw a tenner to put in someone's birthday card - nor should businesses have to travel large distances to deposit cash takings," he said.

"These are measures which benefit everyone who uses cash but particularly those living in rural areas, the elderly and those with disabilities."

The City watchdog, the Financial Conduct Authority (FCA), will be given the power to police the provision of cash access, including the power to order fines. Legislation was voted through earlier in the summer.

"The government's new law has made it a legal requirement for the banking industry to protect the current levels of cash access and cash deposits, and to support the specific needs of different communities," said Natalie Ceeney, who authored a major report on the issue.

"That doesn't mean that nothing will change, but it does mean that where services plan to close, there need to be appropriate alternatives in place before they do so," Ms Ceeney added.

Among the alternatives are bank hubs, which are spaces shared by several different High Street banks and are meant to help communities that have seen all their bank branches close.

So far, only seven permanent hubs have opened in various areas across the UK. Another 10 leases have been signed, and organisers suggest more than 100 will be open over the next few years - a number dwarfed by the amount of branch closures.

Ms Ceeney told the BBC's Today programme that the advantage of hubs is that all banks are covered "which in many ways it actually a better service than relying on one brand in that town".

Jenny Ross, of Which? - the consumer group that has campaigned on the issue, said: "The Financial Conduct Authority must make use of its new powers to ensure banks meet their obligations and stand ready to direct them to address any gaps."

However, cash machine operators have criticised the Treasury for failing to address funding issues for the sector.

"The network remains under significant cost pressures due to successive cuts to the funding paid to ATM operators for every customer withdrawal, with rising interest rates making this picture even worse," said Charlie Evans, sales director at NoteMachine.

Related topics

- Published28 April 2021

- Published3 May 2023

- Published11 April 2023

- Published18 August 2022