Rising numbers seek help for energy bill debts, warns Citizens Advice

- Published

- comments

Thousands more people will start the winter behind on their energy bills with some borrowing to pay them, Citizens Advice has warned.

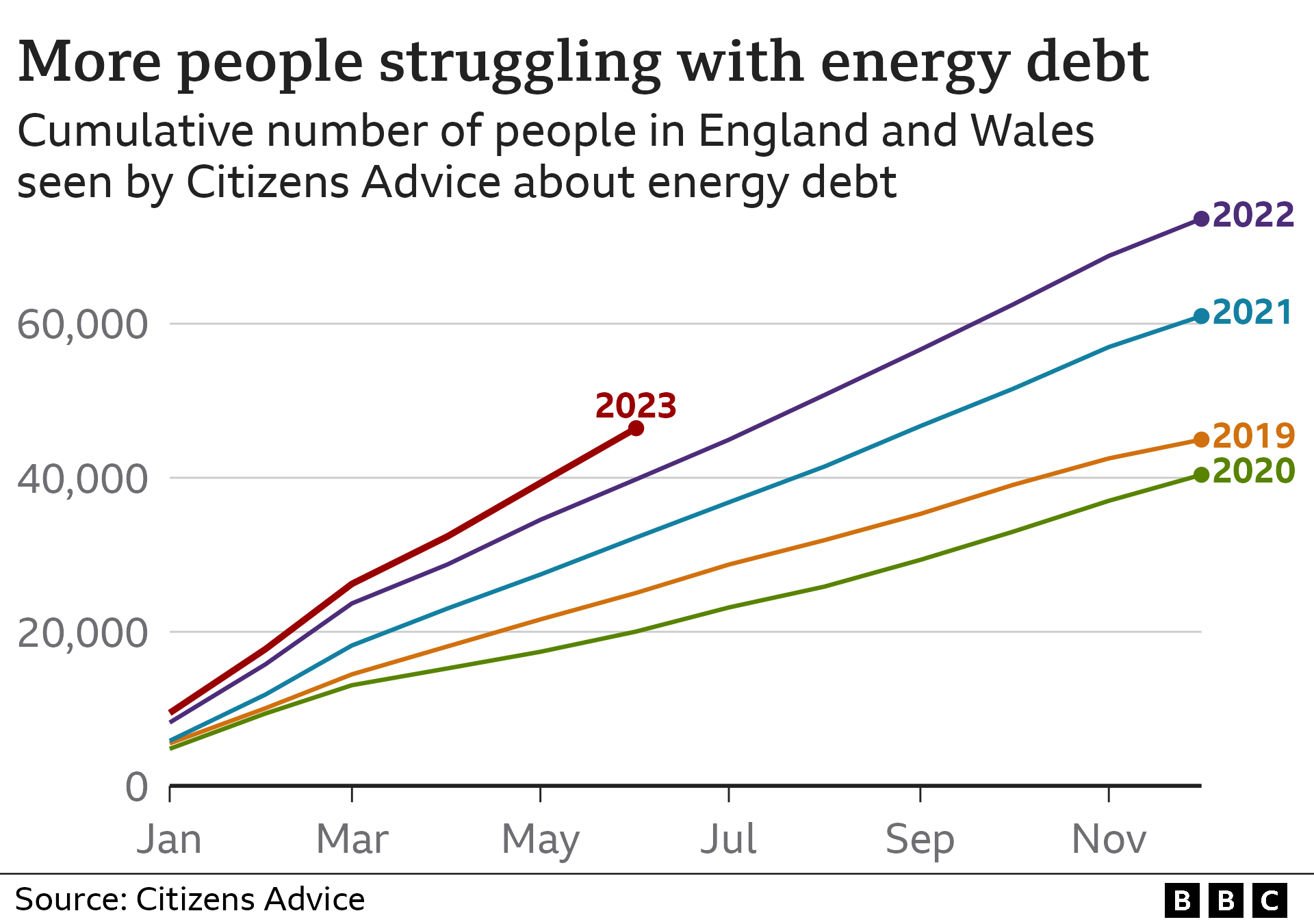

A total of 46,431 people with energy debts contacted the charity for advice in the first six months of 2023, a 17% increase on the same period last year.

Friday's energy price cap is expected to set a typical annual household bill at about £1,926 from October.

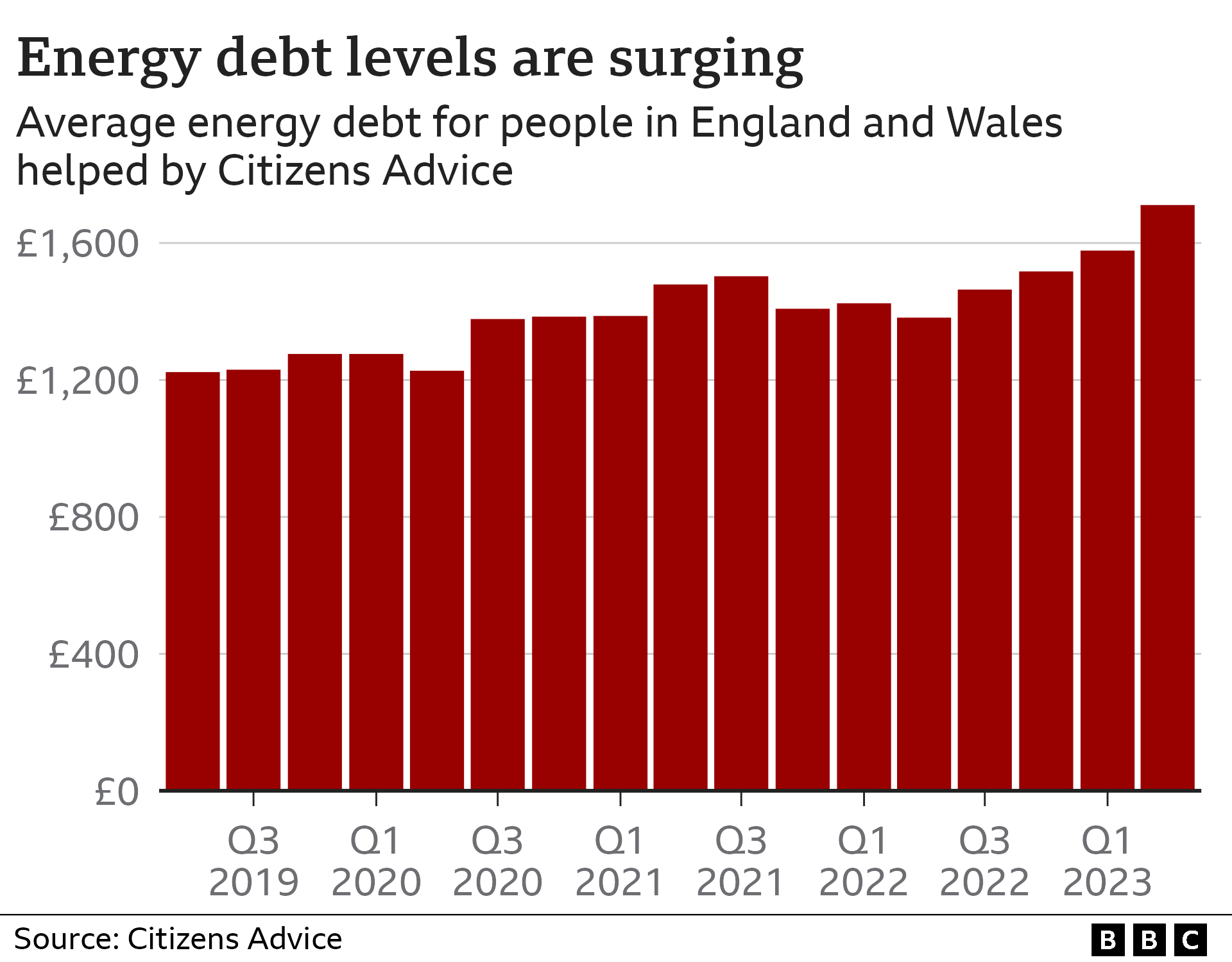

But those who contacted Citizens Advice for help had debts averaging £1,711.

This is up a third on 2019, the charity said.

The amount that some households are behind on their energy bills has been rising consistently since last spring, as billpayers have faced high prices for gas and electricity.

Prices for 29 million households in England, Wales and Scotland are governed by a cap set by the energy regulator Ofgem. In an announcement on Friday, it is expected to lower the cap, making the price of each unit of energy cheaper, for the three months from October.

Consultancy firm Cornwall Insight predicts typical bills could drop by £148 a year, compared with now, but still remain far higher than before Russia's invasion of Ukraine.

Those high prices, along with the rising cost of other essentials such as food, is why 12% of those surveyed by Citizens Advice said they had resorted to a loan or credit card in order to pay their energy bill.

The total number of people who have contacted the charity so far this year who are already behind on their bill is higher than during the same period of any of the previous four years. The same is true of those unable to top-up their prepayment meters.

It said there was a risk of debts growing because people would have to pay back arrears on top of the costs of increasing energy use in the colder months, and find the funds to cover other essential bills.

One of those clients was Natasha, who told the charity that her finances were overstretched.

"The bailiffs came to our home because of the gas and electric debt," she said. "They looked all around my home and said there was nothing of value to take, then left.

"I know the energy prices will go up again and that is worrying me a lot. Winter is going to be very hard for me and my family as we can't afford the bills now, so definitely won't be able to afford them when it gets colder."

Analysis by Citizens Advice suggested people with disabilities and families with young children, particularly single parents, were more likely to have very high levels of energy debt, as well as significant monthly shortfalls.

It called for greater support for struggling households through the current system of grants.

Matt Upton, executive director of policy at Citizens Advice, said the charity believed energy costs this winter would be "as bad, if not worse" than last year "unless government steps in with more support".

He pointed out that although the energy price cap was lower than in 2022, people would pay more gas and electricity on average because government support had been scaled back.

"We want at least to see a targeted offer of support to those struggling most," Mr Upton told the BBC's Today programme.

He suggested the government could extend help under the Warm Home Discount scheme - which is for some pensioners and people on a low income receiving certain benefits - from £150 to £600 and broaden it out to more people.

"Citizens Advice is an 84-year-old charity and we are busier than we have ever been at any time in our history. This is not getting better - it should be top of the priority list for government and we need action now," Mr Upton said.

The Resolution Foundation said its research predicted 7.2 million, or more than one in three homes would have higher energy bills this winter than last, with the poorest households hit hardest.

It said about one in eight households would see winter energy bills increasing by £100 or more.

Fuel poverty charity National Energy Action estimates there will still be 6.3 million UK households in fuel poverty - even after an upcoming fall in bills - up from 4.5 million in October 2021.

The government said it had spent nearly £40bn putting a limit on bills throughout last winter, since when wholesale energy prices - as well as the costs for consumers - had dropped. Additional help was being offered through schemes like the Warm Home Discount.

"Our consultation on how best to ensure people can access the full benefits of moving to a smarter, more flexible energy system is ongoing and we continue to keep options under review including for the most vulnerable households," said a spokesman for the Department for Energy Security and Net Zero.

What can I do if I can't afford my energy bill?

Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

Pay what you can: If you can't meet your direct debit or quarterly payments, ask your supplier for an "able to pay plan" based on what you can afford.

Claim what you are entitled to: Check you are claiming all the benefits you can. The independent MoneyHelper, external website has a useful guide.

Related topics

- Published9 July 2023

- Published15 February 2024

- Published3 April 2024