Pay matches price rises even as unemployment climbs

- Published

- comments

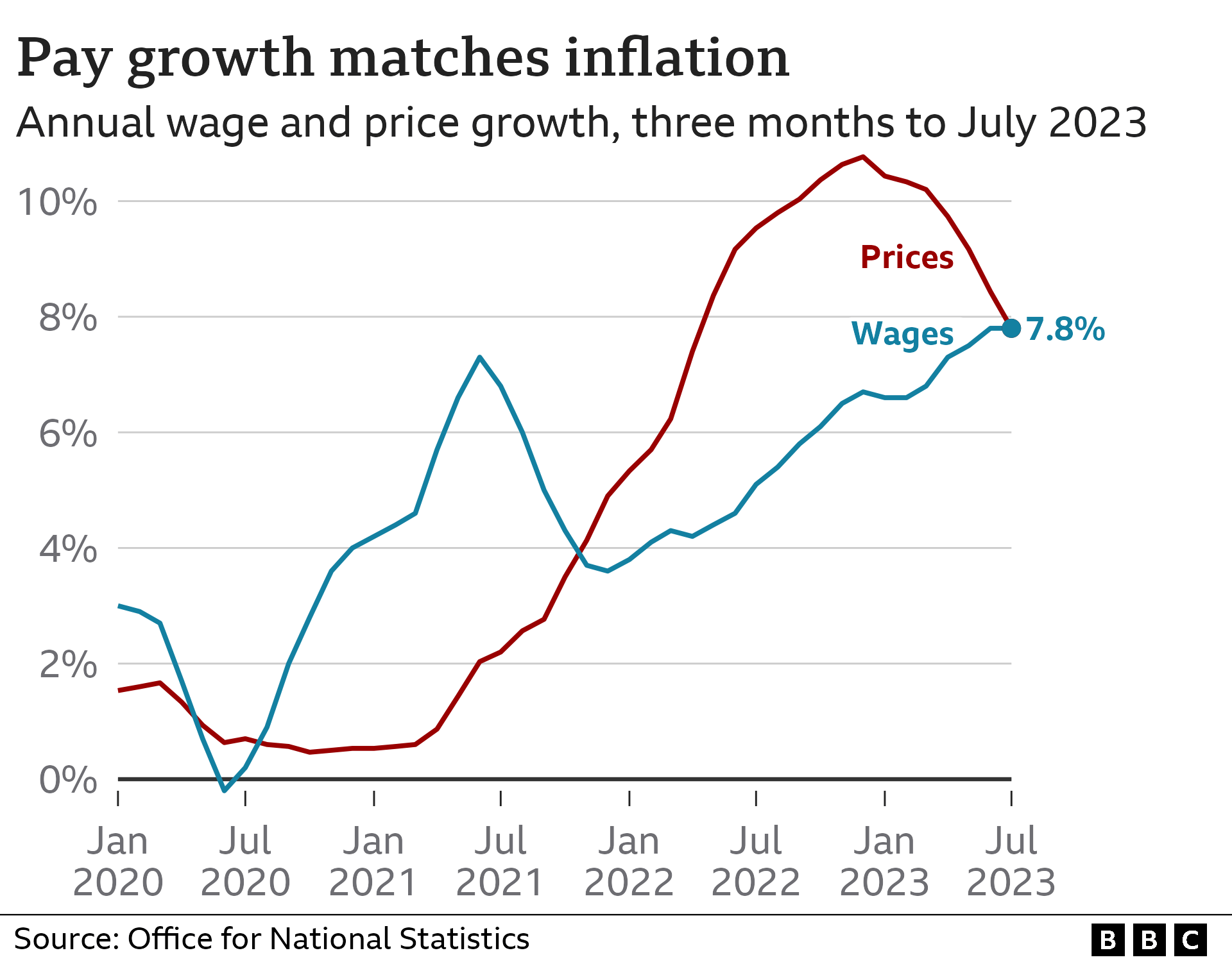

Wage growth has caught up with rising prices for the first time in nearly two years, even as unemployment goes up.

Regular pay, excluding bonuses, rose by 7.8% in May to July compared with a year earlier - matching the pace of inflation over the same period.

Not everyone's pay will be rising by that amount. The figure is an average across the economy.

There are also signs the jobs market is beginning to weaken, with fewer job vacancies and rising unemployment.

Overall, the latest figures from the Office for National Statistics (ONS) present a mixed picture with a lot of moving parts.

Darren Morgan, director of economic statistics at the ONS, said earnings continued to increase at record rates, while inflation - the measure of how fast prices of goods and services are rising - has come down from its highs.

"This means people's real pay is no longer falling," he said.

However, the headline unemployment rate in the May-to-July period was up to 4.3% for the first time in nearly two years, with the number out of work just below 1.5 million. The rate is low by historic standards, but has jumped from 3.8% in the previous three-month period.

Mr Morgan told the BBC's Today programme that the increase in unemployment was driven by men, and by those out of work for up to six months.

"It seems that people who are re-entering the jobs market after telling us they are unavailable for work or they've lost their job, are taking longer to find work compared to what we saw earlier in the year," he said.

At the same time, the number of job vacancies has dropped below one million. Interest rate rises are having an impact on slowing the jobs market. While that has not yet filtered through to lower wage claims, it should do eventually.

The Bank of England policymakers who want to raise rates further will focus on record earnings rises, in cash terms. However, it is important to note that zero growth for real earnings, using the Consumer Prices Index measure, is still far from normal for a measure which, before the 2008 financial crisis, grew by 2% in a typical year.

Those Bank policymakers who think we have perhaps had enough rate rises for now, will focus on rising joblessness and fewer vacancies. All eyes will now be on the inflation data next week, before the latest interest rate decision by the Bank of England next Thursday.

Reacting to the latest figures, Chancellor Jeremy Hunt said: "It's heartening to see the number of employees on payroll is still close to record highs and that our unemployment rate remains below many of our international peers."

He said wage growth "remains high", but added: "For real wages to grow sustainably we must stick to our plan to halve inflation."

Sharon Graham, Unite's general secretary, said the data was "firm proof that collective bargaining with employers reaps rewards for working people".

"The stark reality is though, millions of workers will still be looking at their payslips and wondering how they're going to afford rising rents, mortgage payments and bills. The battle to push up pay is far from over and we will continue to fight hard, because, as we've seen today - it works."

Jon Boys, senior labour market economist for the CIPD human resources body, said there were signs in alternative data from HMRC that pay growth "may have peaked in June".

"It's clear that the labour market has cooled from the red-hot heat of the post-pandemic period and this cooling will act against a potential rate rise by the Bank of England," he said.

The most politically important number to emerge today, however is 8.5% - the total growth in earnings in cash terms, and the figure that is normally used to determine the rise in the state pension next April thanks to the triple lock.

However, nobody in government has confirmed that the 8.5% increase will go ahead and it is understood that some thought is being given as to whether to use a lower measure to calculate the increase.

The latest earnings figures have been affected by one-off public sector bonus payments, therefore boosting the overall figure.

The triple lock was temporarily suspended after the Covid pandemic distorted average wage figures, but it has since been restored.

'A really good uplift'

Joanne Martin said a pay rise has made work and home life less stressful

Joanne Martin works at LED designer and manufacturer Marl International in Ulverston, Cumbria where some staff have had pay rises of up to 20%.

"It's been a really good uplift," she said. "I think sometimes taking the stress away from home, having that extra little bit of money definitely makes it less stressful.

"It makes you less stressed at work as well, because you're not worrying too much all the time. So it's definitely been a positive impact."

Tips for getting a pay rise

Choose the right time - Scheduling a talk in advance will allow you and your boss time to prepare, and means you're more likely to have a productive conversation

Bring evidence - have a list of what you've achieved at work and how you've developed yourself

Be confident - Know your worth and don't be shy about speaking up

Have a figure in mind - look at job adverts online to see the salaries for comparable jobs

Don't give up - keep talking to your employer if it doesn't work this time and if you can't get what you want be prepared to look elsewhere

Has your pay risen this year? Are you struggling to find a job? You can get in touch by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

- Published12 September 2023

- Published10 September 2023