Patisserie Valerie: Four face fraud charges over collapse

- Published

Four people have been charged with fraud connected to the collapse of bakery chain Patisserie Valerie in 2019.

The abrupt closure of 70 stores led to the loss of 900 jobs when "its debts were revealed", the Serious Fraud Office (SFO) said.

All four are charged with allegedly inflating the amount of cash the pastry shops had, and hiding debts of £10m.

They will appear in court on 10 October.

Christopher Marsh, former director and chief financial officer of Patisserie Holdings - the company behind Patisserie Valerie - and his wife, accountant Louise Marsh, face charges from the SFO.

They were also brought against financial controller Pritesh Mistry and financial consultant Nileshkumar Lad.

They are also accused of providing false documentation to the company's auditors and giving the chain's investors and creditors false information, which led to its shares being suspended in October 2018.

Accountancy firm Grant Thornton was fined £2.3m in 2021 for failures relating to its audits of Patisserie Valerie.

The fine covered audits carried out between 2015 and 2017. The Financial Reporting Council said Grant Thornton had "missed red flags" and failed to "question information provided by management" of the chain.

What happened at Patisserie Valerie?

In October 2018, Patisserie Holdings announced that its board had been notified of potentially fraudulent accounting irregularities.

The company subsequently entered into administration, leading to the closure of 70 stores and about 900 job losses.

The collapse followed the discovery of a huge black hole in the firm's accounts, eventually valued at £94m.

After it went into administration, the café chain was found to have overstated its cash position by £30m and failed to disclose overdrafts of nearly £10m.

Lisa Osofsky, director of the SFO, said: "Patisserie Valerie's abrupt collapse rocked our high streets - leaving boarded-up shops, devastating job losses and significant investor losses in its wake.

"Today is a step forward in getting to the bottom of this scandal."

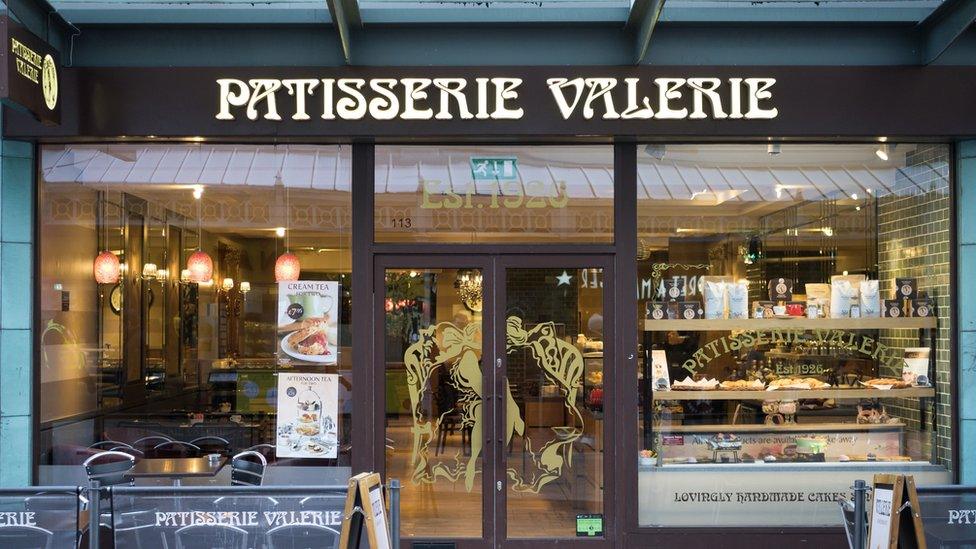

Patisserie Valerie was well-known for its colourful cakes and pastries and had a prominent presence on popular High Streets, including Oxford Street and Edgware Road in London. The company listed on the stock exchange in 2014.

The first Patisserie Valerie store was opened in the Soho district of London in 1926 by a Belgian woman, Madame Valerie.

Some of its stores remain open and it plans to open two more in Bristol and Cambridge in the coming months.

But there is criticism over how long it has taken the SFO to bring charges forward. It also does not have the best track record of winning in fraud cases, most notably the high-profile case against G4S, which the SFO abandoned in March. Critics have blamed the agency being under resourced.

Richard Sallybanks from BCL Solicitors said: "Given it has taken five years for charging decisions to be made in this [Patisserie Valerie] case amid general concern at the duration of SFO investigations and the well-publicised delays in the court system, it could still be several years before the individuals stand trial."

Related topics

- Published22 January 2019

- Published27 September 2021