Lloyd's of London 'deeply sorry' over slavery links

- Published

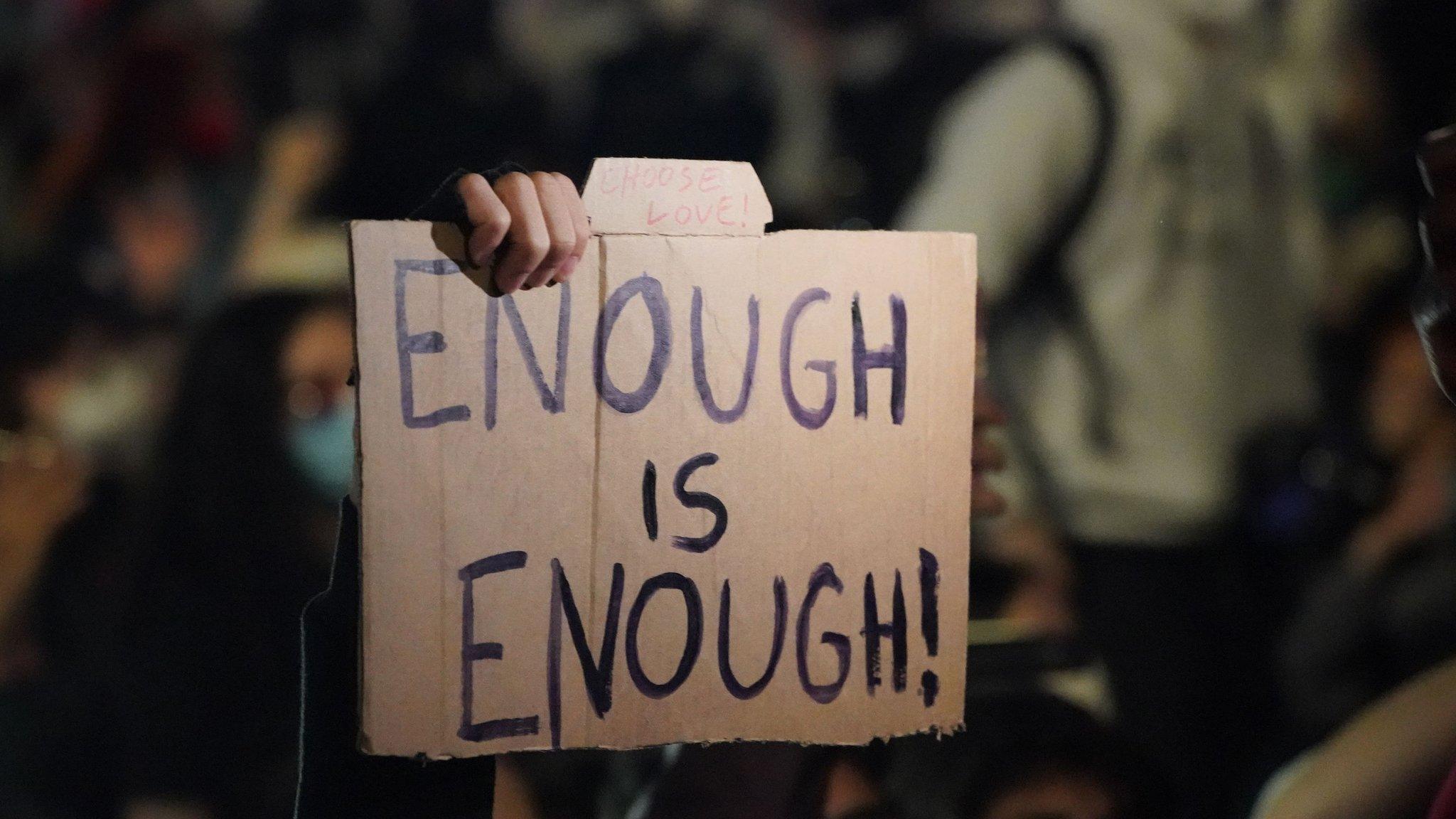

In 2020, demonstrators gathered outside Lloyd's of London to protest against institutions that profited from the slave trade

City firm Lloyd's of London has said it is "deeply sorry" for its links to the slave trade.

An independent report found the 335-year-old insurance market had played a "significant role" in enabling the transatlantic trade.

Lloyd's said it was committed to tackling inequality and will invest £40m in helping impacted communities.

But campaign groups accused Lloyds of "reparations washing" and said it needed to do more.

After protests swept across the world in 2020 following the death of George Floyd, an unarmed black man who died in police custody in the US, pressure mounted on companies to address links to slavery and tackle racial inequality.

At the time, Lloyd's apologised for its historical links to the slave trade and commissioned the independent report.

It said it had no editorial control over the review, which was conducted by academics at Johns Hopkins University in Baltimore and independently funded by the Mellon Foundation.

Alexandre White, one of professors behind the study, examined material from the Lloyd's archive, including ledgers for insurance for ships leaving Liverpool as part of the slave trade.

He said it made clear that Lloyd's formed part of "a sophisticated network of financial interests and activities" which made the transatlantic slave trade possible.

But he said the material offered very little about the people who were "captured and enslaved under the practices facilitated by the Lloyd's market".

"While the activities of insurers in the city of London may seem far removed from the plantations, ships and the violent spaces of imprisonment along the coast of Africa, the financial architectures developed at Lloyd's helped maintain the institution of slavery," he explained in a video posted online.

The transatlantic slave trade was the largest forced migration in history. Between 1500 and 1800, around 12-15 million people were taken by force from Africa to be used as enslaved labour in the Caribbean, North, Central and South America.

It is estimated that over two million Africans died on the journey to the Americas.

"The insurance of ships, cargo and captured enslaved persons facilitated the growth of the transatlantic slave trade," said Mr White, concluding that customers of to Lloyd's, as well as members of its governing body, had "significant connections to the transatlantic slave trade".

Lloyd's of London, which was founded in 1688, is often lauded as the world's leading insurance market, focusing on specialist areas such as marine, energy and political risk.

Responding to the review, chairman Bruce Carnegie-Brown said: "We're deeply sorry for this period of our history and the enormous suffering caused to individuals and communities both then and today".

"We're resolved to take action by addressing the inequalities still seen and experienced by black and ethnically diverse individuals."

The firm has promised a "comprehensive programme of initiatives" to help people from diverse ethnic backgrounds "participate and progress from the classroom to the boardroom".

It also said it would spend around £12m on boosting BAME recruitment and career progression in the commercial insurance market.

But Kehinde Andrews, Professor of Black Studies at the University of Birmingham, described the move as a "PR exercise" and "frankly offensive".

"If they were serious they would be proposing a transfer of wealth to the descendants of the enslaved (i.e. reparations), not a diversity scheme for so called 'ethnically diverse' people, which any corporation should be doing," he told the BBC in an email.

The Runnymede Trust, a race equality think tank, welcomed Lloyd's work to acknowledge past mistakes.

But it questioned the insurance market's commitment to diversity, highlighting Lloyd's ethnicity pay gap - which measures the difference between ethnic groups' average earnings.

"This gap needs to be addressed not just through more 'inclusion and diversity' but through active anti-racist policies that address inequalities in income and pay now," said Dr Shabna Begum, its interim co-chief executive.

- Published21 February 2021

- Published18 June 2020

- Published7 June 2020