Sunak welcomes foreign firms' £29.5bn 'vote of confidence'

- Published

- comments

The prime minister is hosting a group of leading business figures at Hampton Court to highlight foreign firms' plans to invest in the UK.

Rishi Sunak said £29.5bn of new investment had been promised, which he described as a "huge vote of confidence" in the UK economy.

Last week's Autumn Statement included some measures to encourage more business investment.

But it came against a backdrop of lower growth forecasts.

The Autumn Statement measures were largely designed to persuade domestic firms to invest more.

The government said the UK's track record on attracting foreign investment remained strong.

Last week, Nissan announced that it would build three electric car models at its Sunderland factory as part of a £2bn investment plan which could secure up to 6,000 UK jobs.

However, Mr Sunak recently announced that the HS2 high-speed rail line from the West Midlands to Manchester would be scrapped.

Earlier this month, the government was also forced to restructure a deal to entice energy firms to invest in offshore wind farms after an auction last September failed to attract any bidders.

Labour said the government's policies had been a "total failure" when it came to growth and business investment.

"The past 13 years of Conservative government has been marked by a complete lack of stability, consistency and ambition which has turned potential investors away from Britain," said Jonathan Reynolds, shadow trade and business secretary.

Deanne Stewart, chief executive of Australia's biggest pension fund Aware Super, is attending the summit on Monday and is opening the firm's first overseas office in London to invest in infrastructure, property and private equity.

Commenting on the recent announcements on HS2 and green energy, she told the BBC's Today programme: "Certainly as we have spent time with the government, our understanding is there is a healthy pipeline.

"But in the UK, like in most countries, there is a degree of risk."

Ms Stewart said that Aware Super plans to invest £5bn in the UK, adding: "We would not participate in [projects] if they did not have that really strong certainty and really strong policies around them."

As well as Ms Stewart, 200 other business and investment leaders will attend the summit including Stephen Schwarzman, chief executive of investment giant Blackstone and David Solomon from investment bank Goldman Sachs.

Mr Sunak pointed to the UK's "culture of innovation and thriving universities" and highlighted "clean energy, life sciences and advanced technology" as key areas where he said inward investment was already creating jobs and driving growth.

At the last summit, which was held in 2021, companies promised to invest nearly £10bn in the UK.

However, at last week's Autumn Statement, the UK's economic growth forecasts were downgraded by the Office for Budget Responsibility (OBR), the independent fiscal watchdog.

It now expects the economy to grow by 0.7% next year, down from a previous forecast of 1.8%, while in 2025 it predicts growth of 1.4% compared to an earlier estimate of 2.5%.

Business and Trade Secretary Kemi Badenoch said the UK economy was "doing well despite significant headwinds".

"We are dealing with the same problems that many other countries around the world are dealing with," she told Sky News.

"Investors who I hosted at a reception yesterday were telling me about the concerns they have in the US, in France and so on."

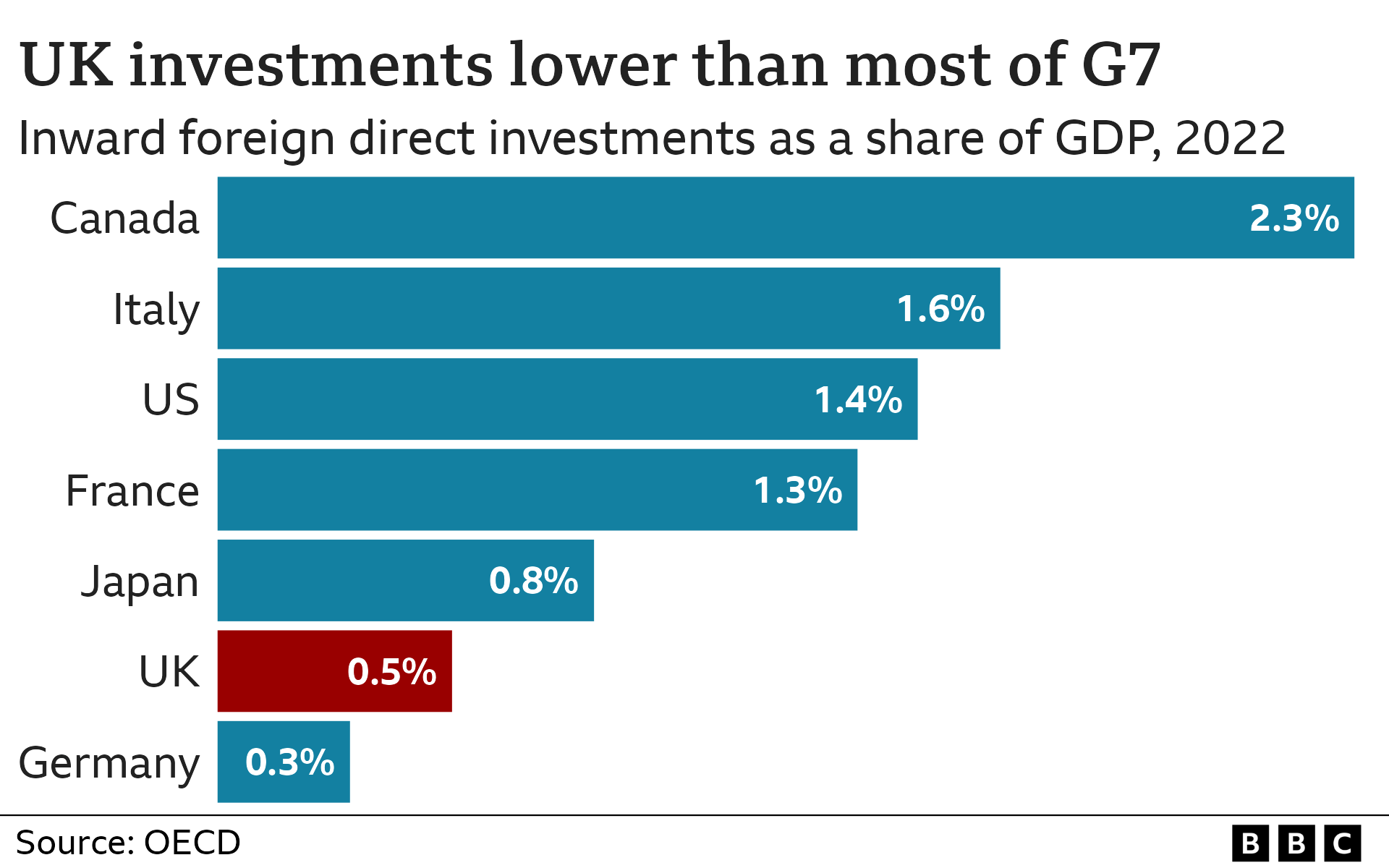

Figures from the OECD show that foreign direct investment into the UK rose in 2022 to $14bn (£11bn) compared to a $71bn drop in the previous year.

France was the only other G7 country to show an increase, rising to $36.3bn last year from $30.8bn. Other countries such as Germany saw a sharp fall, down 76% to $11bn.

But as a percentage of GDP, foreign direct investment in the UK is the second lowest in the G7.

According to accountancy firm EY, France reported the largest number of foreign direct investment projects in 2022, totalling 1,259, ahead of the UK's 929 projects.

That was followed by Germany which had 832 foreign direct investment projects last year.

During the Autumn Statement, Chancellor Jeremy Hunt announced that tax breaks for firms who invest in their business would be made permanent. It means that companies who spend on equipment, plants and IT can claim back 25p for every £1 they invest.

But many businesses are paying a higher rate of corporation tax after it rose from 19% to 25% earlier this year.

Jamie Dimon, chairman and chief executive of JP Morgan, who is attending the summit, said: "I think you're doing all the right things to try and grow the economy which helps all of the citizens.

He said the UK government wanted "innovation, they want growth, they want reform, they want foreign direct investment, they want all the things that help grow an economy".

Labour Party leader Sir Keir Starmer and shadow chancellor Rachel Reeves also met business leaders on Monday morning.

Labour said businesses discussed what they needed for the UK to attract investment, including "the need for stability and certainty" as well as planning reform to speed up the delivery of infrastructure projects and "access to talent with the skills businesses in the UK need".

Projects to be confirmed on Monday are expected to include a £10bn investment from Australia's IFM Investors into infrastructure and energy projects and a commitment to build a new lab in Cambridge from BioNTech, the firm which pioneered the mRNA Covid vaccine.

Some of the sums on the list of projects that are being announced at the summit are ones that investors had previously disclosed, and which are now ready to attach a specific investment figure to.

Others, such as IFM's investments, have already begun, and future investment sums are now being clarified. Other firms are adding new investments to existing portfolios.

Among the projects being highlighted are a £7bn boost to the amount Spain's Iberdrola is investing in UK electricity transmission and distribution and £2.5bn from Microsoft in AI infrastructure.

Related topics

- Published23 November 2023

- Published22 November 2023

- Published22 November 2023