House prices rise again as mortgage rates ease

- Published

- comments

House prices rose again last month and there are signs that activity in the market is picking up, according to the UK's biggest mortgage lender.

Halifax said prices rose by 0.5% in November, the second increase in a row.

It said recent figures for mortgage approvals suggested "a slight uptick" in activity among buyers as the cost of home loans eases.

However, prices are still lower than a year ago, and Halifax said the market would remain under pressure in 2024.

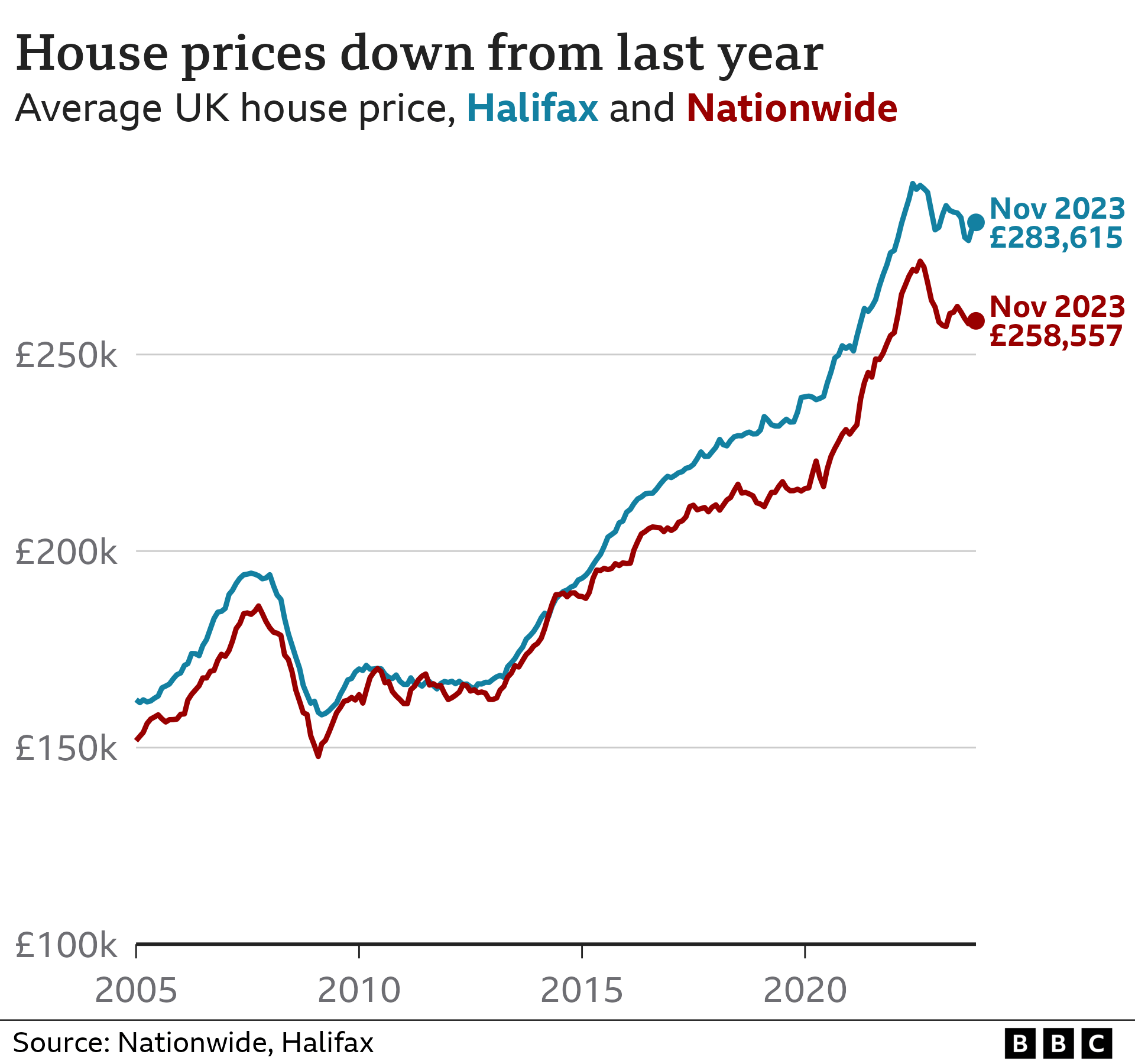

Property prices are 1% lower than in November last year, the lender said, with the average property costing £283,615.

Halifax's findings, external echo that of rival lender Nationwide, who said last week that prices had risen in November but remained lower than a year earlier.

Kim Kinnaird, director at Halifax Mortgages, said prices had "held up better than expected" over the past year.

However, she added that house prices continued to be "underpinned by a shortage of properties available, rather than any significant strengthening of buyer demand".

Despite this, increasing numbers of mortgage approvals suggest that the recent falls in mortgage interest rates "may be leading to increased buyer confidence, seeing people more inclined to push ahead with their home purchases".

The Bank of England has raised interest rates steadily over the past two years in an attempt to slow down inflation, which is the rate at which consumer prices rise.

The Bank's main rate now stands at a 15-year high of 5.25%, and this has pushed up mortgage rates, making it more expensive for people to buy homes.

However, expectations that interest rates have peaked has led to a fall in mortgage rates in recent weeks, although the Bank of England has repeatedly warned against suggestions that it will be cutting rates anytime soon.

Latest figures from research firm Moneyfacts show the average two-year fixed residential mortgage rate is now 6.01%, down from a rate of 6.86% it hit in July this year.

Figures released by the Bank last week revealed the number of mortgages approved for homebuyers picked up in October to 47,400, from an eight-month low of 43,300 in September.

Ms Kinnaird warned that uncertainty over the outlook for the economy meant it was difficult to know how long any pick-up in the housing market would last.

"Other pressures - like inflation, the broader cost of living, overall employment rates and affordability - mean we expect to see downward pressure on house prices into next year," she said.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said there was "every chance this is a blip rather than a bounce back" in the market.

Forecasts suggest the economy will continue to stagnate next year, she said, "which could mean job losses and wage freezes".

"This would remove two of the most important things underpinning the market right now, so we are still expecting 2024 to be tricky for the property market."

While Halifax is the UK's biggest mortgage lender, its figures only take into account buyers with mortgages and do not include those who purchase homes with cash or buy-to-let deals.

According to the latest available official data, cash buyers currently account for over a third of housing sales.

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

You must contact your lender as soon as you realise you are going to struggle to make repayments - the earlier the better

Your lender must make reasonable attempts to reach an agreement with you

Halifax said that Northern Ireland was the strongest performing nation or region in the UK. House prices there are up by 2.3% from a year earlier, with the average property costing £189,684.

Prices were unchanged in Scotland from a year earlier, while in Wales they fell 1.5%.

The sharpest annual fall was seen in south-east England, where prices were 5.7% lower than a year ago, with an average price of £373,943.

London remained the most expensive region for property with an average house price of £524,592, although this was down 3.8% from last year.

Related topics

- Published1 December 2023

- Published29 November 2023