US inflation picks up more than expected in December

- Published

Consumer prices in the US rose again in December, driven by higher costs for housing, dining out and car insurance.

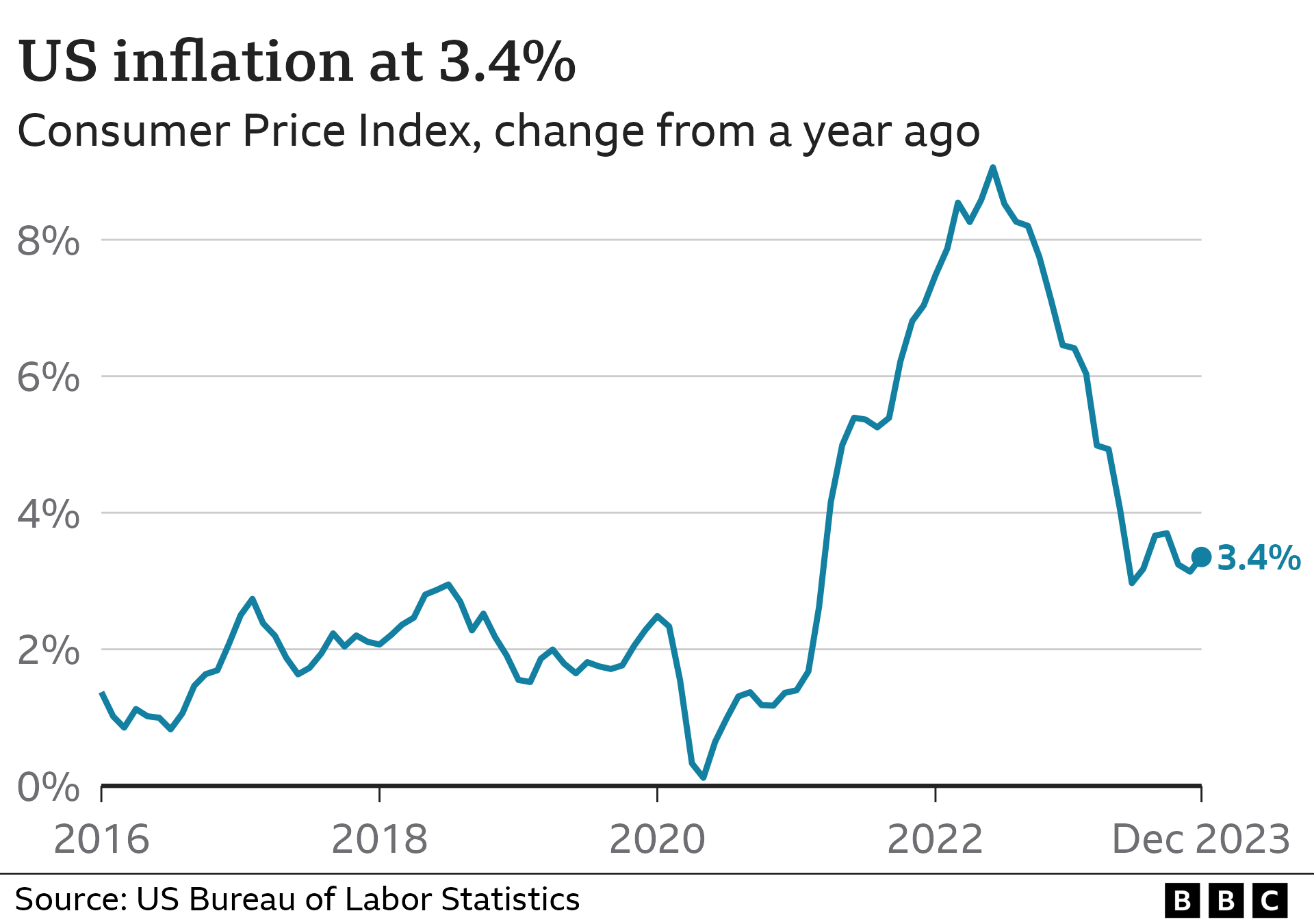

Inflation - which measures the rate at which prices are increasing - hit 3.4% over the year, the Labor Department said.

It was up from 3.1% in November, accelerating more over the month than many analysts had expected.

The figure is likely to keep the US central bank cautious about declaring victory in its fight against inflation.

The US Federal Reserve has an inflation target of 2% and, until last summer, had been raising interest rates to cool price rises.

Seema Shah, chief global strategist at Principal Asset Management, said the latest inflation figures are "not bad numbers, but they do show that disinflation progress is still slow and unlikely to be a straight line down".

Inflation in the world's largest economy has dropped sharply since peaking at 9.1% in June 2022, when the war in Ukraine sent energy costs soaring.

Despite the uptick in December, many analysts said they expected inflation to improve in the coming months.

"This is another [Consumer Price Index] report that shows inflation has moderated and will likely continue to decelerate," said Ronald Temple, chief market strategist at Lazard.

But while price increases for goods have cooled, as supply bottlenecks from the pandemic clear, the report suggests that progress in other areas is proving more difficult, said Brian Coulton, chief economist at Fitch Ratings.

Prices for car insurance were up 20% compared with December 2022 while rents climbed 6.5%, according to the US Labor Department.

It said that grocery prices gained a modest 1.3%, which compares to a 5.2% rise in prices for people choosing to dine out.

The cost of some food to eat at home soared, with steak up 11% over the year.

Mr Coulton said the report suggested that hopes that the Federal Reserve will move quickly to begin cutting interest rates could prove premature.

"This will give the Fed grounds for caution and they are unlikely to cut rates as quickly as the markets currently expect," Mr Coulton said.

For now, the improvement in the situation has largely failed to persuade the American public, which continues to report glum economic sentiment.

Last year, high petrol prices prompted 28-year-old Harish Kunchala to halt his regular car journeys to see his brother.

Mr Kunchala, who is pursuing a graduate degree in computer science in California, said he has since resumed visits to his sibling but still felt budgetary stress in other areas. , He and his roommates keep lists in their apartment trying to keep track of where to find the best prices for meat and other items.

Harish Kunchala said he is still feeling hit by higher prices despite inflation easing from highs

"If it's not one thing, it's the other," he said.

- Published5 January 2024