Lower UK government borrowing raises prospects of tax cuts

- Published

- comments

Lower than expected government borrowing last month has increased the possibility of tax cuts in the Budget, analysts say.

Borrowing - the difference between spending and tax income - fell to £7.8bn in December, the Office for National Statistics (ONS) said.

Interest payments dropped sharply due to a rapid decline in inflation.

Analysts said the latest figures could give the chancellor more "wiggle room" for tax cuts.

Speaking at the World Economic Forum in Davos last week, Jeremy Hunt hinted that he wanted to cut taxes.

This has raised expectations that he will seek to do so in the Budget in March, ahead of a general election expected later in the year.

December's borrowing figure was £8.4bn less than a year earlier, and the lowest figure for the month since 2019.

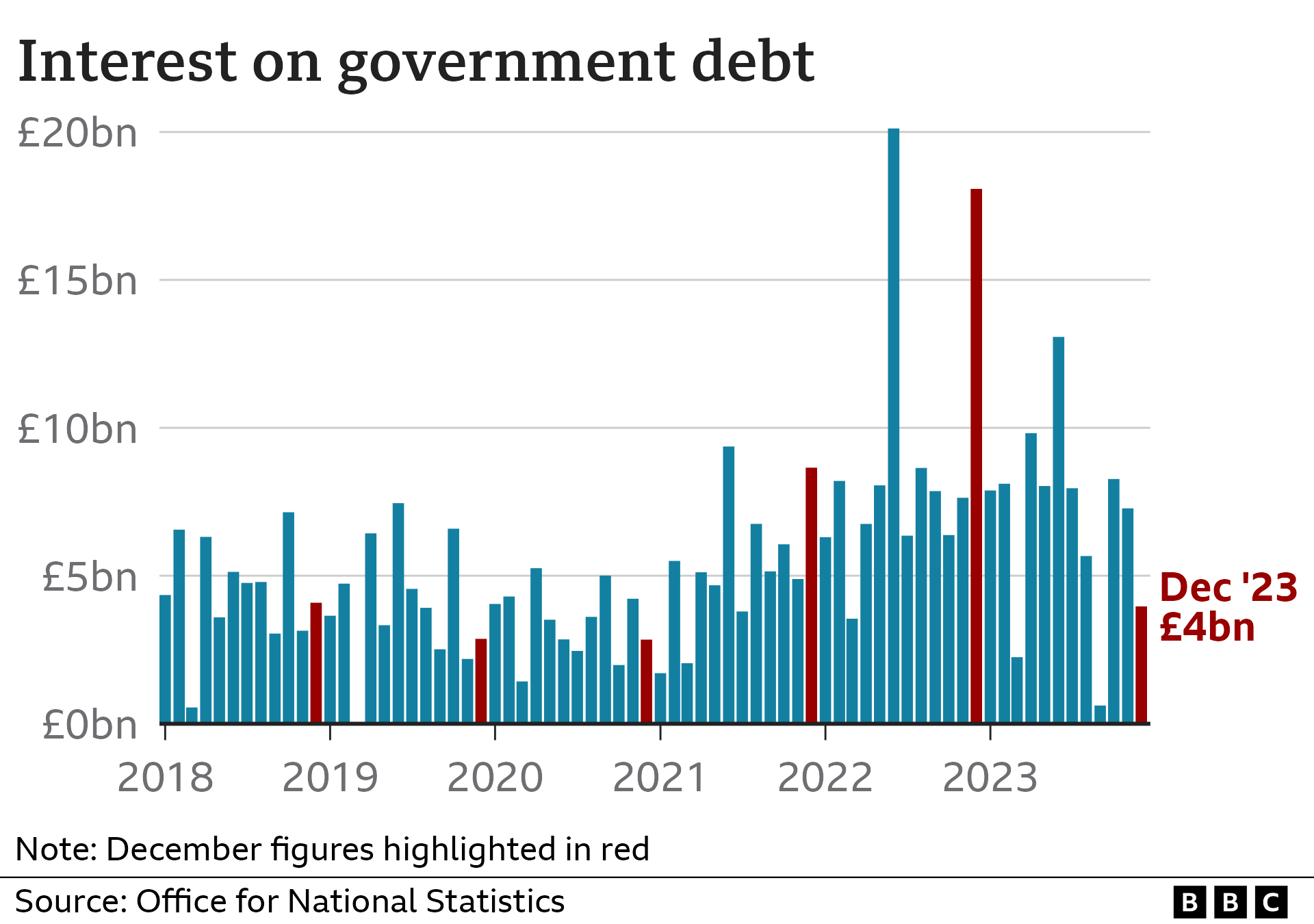

Interest payments on government debt fell to £4bn, down by £14.1bn from December 2022.

It was helped by the fall in inflation last year. The government's interest payments are linked to the Retail Prices Index measure of inflation.

Ruth Gregory, deputy chief UK economist at Capital Economics, said the better-than-expected figures for December would give the chancellor "a bit more wiggle room for a big pre-election splash in the spring Budget on 6 March".

The ONS data showed that borrowing for the nine months to December 2023 was £119.1bn. While that was £11.1bn more than in the same period the year before, it was lower than the amount forecast by the government's economic watchdog, the Office for Budget Responsibility (OBR).

Ms Gregory said borrowing was on track to undershoot the OBR's full-year forecast of £123.9bn by £5bn.

Lower inflation has also led to expectations that interest rates will be cut at a faster pace than when the OBR made its last forecast in November.

Ms Gregory said the change to interest rate forecasts meant "we suspect the OBR will revise down its borrowing forecast significantly from 2025-26".

She added this could give the chancellor more scope to cut taxes while still meeting the government's self-imposed spending rules.

"That will probably allow him to unveil a freeze in fuel duty in April 2024 (costing about £6bn a year) but perhaps also to announce more crowd-pleasing measures, such as a 1p cut to income tax (costing £6.9bn a year), while still maintaining fiscally prudent appearances," Ms Gregory said.

Martin Beck, chief economic adviser to the EY Item Club, said the lower expectations for interest rates should cut the predicted spending on debt interest by about £10bn a year.

"Some high-profile tax cuts in the spring Budget appear likely," he said.

Total debt - which is the overall amount of money owed by the government that has built up over years - was £2.67 trillion at the end of December.

That is the equivalent of 97.7% of the size of the UK's economy as measured by gross domestic product (GDP), remaining at levels last seen in the early 1960s, the ONS said.

Government borrowing has increased sharply in recent years. The government spent billions on measures to support the economy during the Covid pandemic, and then also subsidised energy bills when costs surged after Russia's invasion of Ukraine.

Chief Secretary to the Treasury Laura Trott said: "Protecting millions of lives and livelihoods during Putin's energy shock and a once in a century pandemic has created economic challenges.

"However, it is right that we pay back these debts so future generations are not left to pick up the tab."

Labour's shadow chief secretary to the Treasury, Darren Jones, said: "National debt is now at the highest level since the 1960s - and has more than doubled since 2010.

"Britain cannot afford another five years of this low-growth, high-tax Conservative government that is leaving working people worse off."

Liberal Democrat Treasury spokesperson Sarah Olney said: "The brutal truth remains that as a result of Conservative ministers crashing the economy, the British public is now saddled with debt and endless tax hikes."

Related topics

- Published19 January 2024

- Published19 December 2023