GDP: Economy grew in February increasing hopes UK is out of recession

- Published

- comments

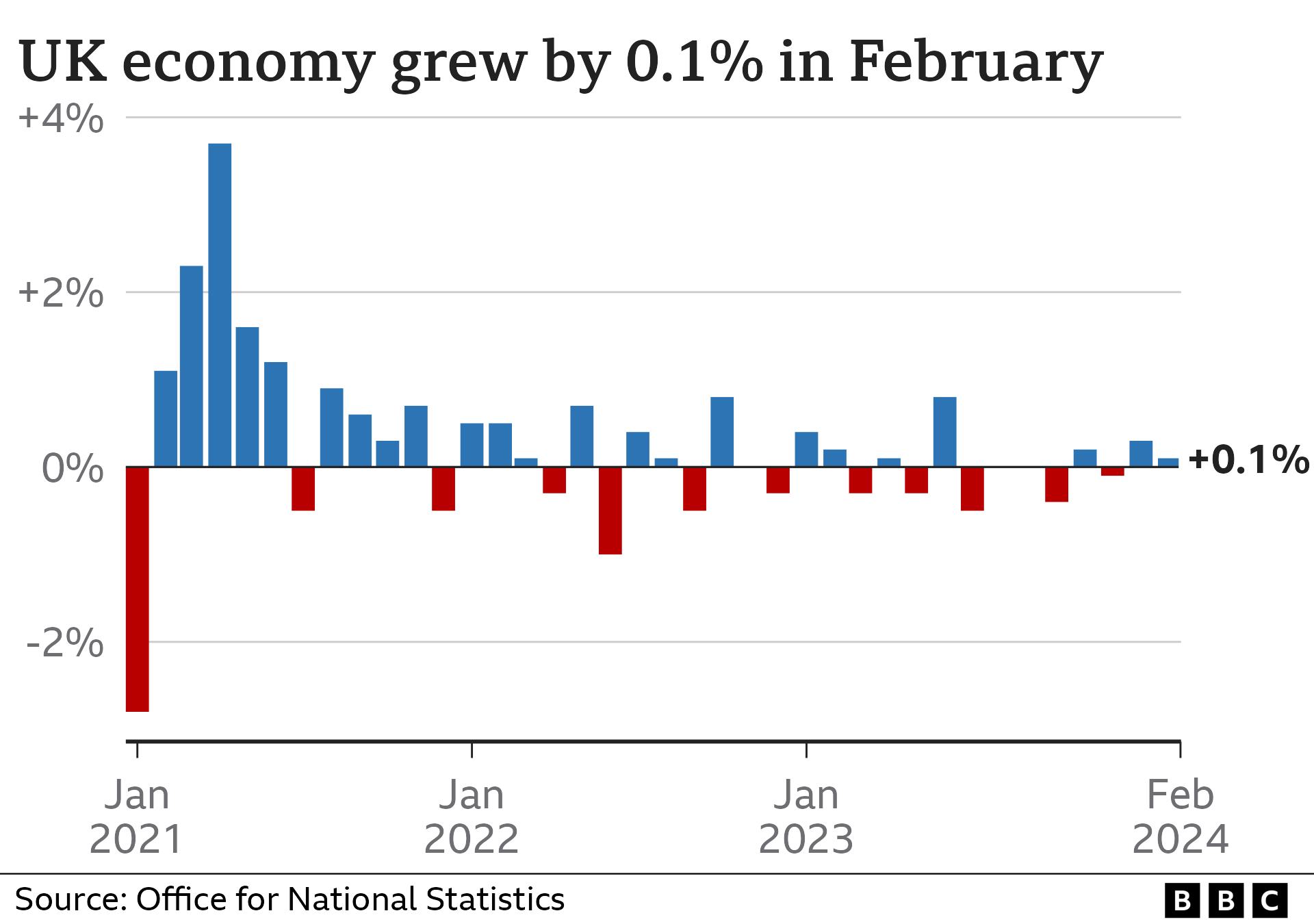

The UK economy grew slightly in February increasing hopes it is on its way out of recession.

The economy grew by 0.1%, official figures show, boosted by production and manufacturing in areas such as the car industry.

The Office for National Statistics (ONS) said that construction was dampened by wet weather though.

This is an early estimate, but signals how the UK, which entered recession at the end of 2023, is faring.

Liz McKeown, director of economic statistics at the ONS, said that looking across the three months to February as a whole, the economy grew for the first time since last summer.

'Turning a corner'

Chancellor Jeremy Hunt suggested that the new figures were a "welcome sign that the economy is turning a corner".

"We can build on this progress if we stick to our plan," he added.

Growing the economy was one of five key pledges that Prime Minister Rishi Sunak made last year as consumers and businesses were squeezed by higher prices and interest rates.

Labour shadow chancellor Rachel Reeves, however, argued that "Britain is worse off with low growth and high taxes".

She added: "The Conservatives cannot fix the economy because they are the reason it is broken."

Most economists, politicians and businesses like to see gross domestic product (GDP) overall rising steadily because it usually means people are spending more, extra jobs are created, more tax is paid and workers get better pay rises.

The official statistics body also revised its previous estimate for gross domestic product (GDP) in January from 0.2% growth up to 0.3%.

In February, output from the UK's production industry led the economy's growth, rising by 1.1%, compared to a fall of 0.3% in January.

The construction sector saw output fall by 1.9% though as persistent rain hampered building projects.

The services sector, which includes things like hairdressing and hospitality, also grew a little with public transport and haulage having a strong month.

Yael Selfin, chief economist at KPMG UK, said that February's overall figures offered a strong signal that the recession, which is defined as when an economy shrinks for two three-month periods in a row, may already be over.

Growth is likely to have been boosted by cuts in National Insurance and slowing price rises, meaning that businesses and households will have more confidence in their finances and therefore spending.

But she added that consumer spending is still fragile and business investment could be dented by uncertainty around a general election.

Andrew Watson says the metal manufacturing firm he works for has seen growth overall

Andrew Watson is chief financial officer at Goodfellow, a metal manufacturer based in Cambridge which supplies research and development around the world.

He said last year the firm was hit by disruption from attacks on shipping vessels in the Red Sea and supply chains were tight after the pandemic, "but overall we saw growth".

"You've got this weird mix of the economy not doing so well in terms of GDP and yet we feel like we've got opportunities to grow - and we just have to push forward and access those opportunities," he said.

He suggested that growth in the UK had been "anaemic" since covid, with more opportunities presenting themselves in the United States.

Other countries' economies have also faced energy price shocks and supply chain delays in the wake of the pandemic driving up costs, as well as the potential knock-on effects from conflict overseas, but the UK has seen growth stagnating for some time.

'Industries still struggling'

Dr Roger Barker, director of policy at the Institute of Directors, suggested that there were few signs of a "strong" economic reboundin the UK and that some parts of the services industry like hotels and hospitality were still struggling.

Other economists pointed out the impact of previous interest rate rises by the Bank of England was still feeding through to the economy.

Currently, experts are split on when the UK's central bank may start cutting interest rates over the summer, potentially providing some relief to mortgage-holders and borrowers.

The Bank's Monetary Policy Committee takes into account a range of economic figures when making its decision on its base rate, although monthly figures such as February's can be quite volatile and are "unlikely" to do much change to its thinking, said Danni Hewson, head of financial analysis at AJ Bell.

How changes in the economy affect you: