What's behind Rishi Sunak's surprising optimism?

- Published

Watch: Sunak challenged on 2024 being 'bounce back' year

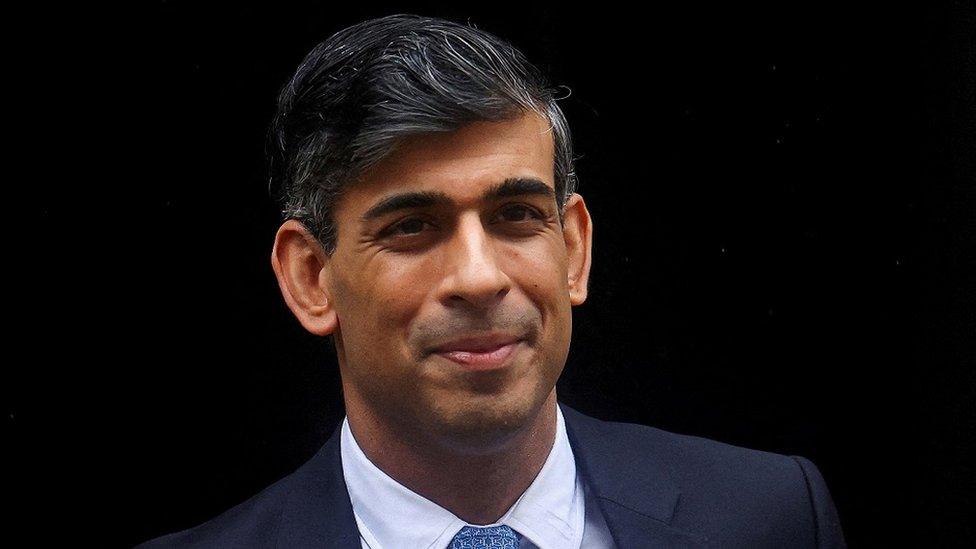

As I arrived in Downing Street to interview the prime minister earlier this week, his aides were whispering about some mysterious last minute "artwork" that was yet to appear.

When Rishi Sunak walked into the room, a hitherto blank screen flashed with a multi-coloured line chart pointing downwards with the words "Inflation. Halved".

Mr Sunak and his team are going to great effort to project a turnaround in the UK economy. In a wide-ranging interview on the economy, he spoke of turning points and bounceback, and insisted it's "not just me" who saw green shoots of recovery up and down the country.

"Wages are up. Energy bills are falling. Pensions are going up. Tax cuts are now already happening and benefiting people. That all just gives me the confidence that the future is brighter," he said.

"2024 will prove to be a bounce back year for the UK economy."

While his political position means the PM has no other choice than to say he expects a thumping economic recovery, I was somewhat taken aback by the extent of his sunny optimism.

Three key dates

This buoyancy comes against a backdrop of consistently dire opinion polls for both Mr Sunak and the Conservative party, and the rapidly approaching local elections in England on 2 May.

But the prime minister's eyes are focused on three other dates that month.

On the 10 May, the recession could be officially declared over, when GDP figures for January to March are expected to show that the economy is growing again.

On 22 May, we will get inflation figures for April, with the headline rate forecast to be below the Bank of England's 2% target for the first time in three years.

But it is the next interest rate decision on 9 May that may explain Mr Sunak's sanguineness.

Up until this week, the expectation has been that an interest rate cut would come in the summer or later, when the Bank was absolutely sure that the inflation shock had been defeated.

But Bank of England governor Andrew Bailey went further in his interview with me on behalf of UK broadcasters on Thursday after rates were left unchanged at 5.25%, their highest for 16 years.

When I asked him whey he had not cut rates yet, he replied: "We're on the way."

He said that the Bank did not have to wait until after inflation was below 2% to cut. He also said that market predictions of two or three cuts were "reasonable".

So a cut is now in play for May.

Both the PM and the chancellor have been at pains not to actually tell the independent Bank of England what to do. That said, one can only imagine the rain dances being done in Downing Street for a series of rate cuts before a general election.

'It's not better... it's stopped getting worse'

Higher insurance costs will hit Mr Tench's expansion plans

Yet when I was near Crewe earlier this week and asked I asked businesses and families whether they were seeing a turnaround or even stabilisation in the cost of living crisis, I got a uniformly negative response.

Shaine Ashley Tench, who runs A Star Taxis, said a recent quote to insure his fleet was in the tens of thousands. "We can't just put that onto the customers' price, because we need to be an affordable, reliable taxi company in this area," he said.

A second-hand car salesman told me some customers were telling him they could afford a car but were put off buying because of insurance costs. At the Wheelock Hall farm shop, a man told me the standing charge on his energy bills had gone up and his car insurance had doubled. "It's getting worse," he said.

A nurse conceded that her gas and electric prices had stopped rising, but said: "It's not getting better, it's just stopped getting worse." She then listed all the other bills that will go up in April - mobile phone, broadband, water and council tax.

The psychology of personal finances is very interesting. Can people really feel a declining inflation rate as good news or is that outweighed by prices being much higher than they were? And would a household feel it more if they had smaller bills but with above-inflation price rises, or if they saw a fall in their large energy bill?

In Downing Street, they point out that members of the public on radio phone-ins or TV are bound to find some areas where they feel personal finance pain.

But the way this has been measured across the economy for decades has been by consumer confidence numbers. The GfK measure of overall consumer confidence is still in clear negative territory, but in new numbers for March, people's perceptions of their own personal finances over the next 12 months went positive for the first time since January 2022.

It is a chart being followed very carefully by the prime minister.

Cautious opposition

For the Shadow Chancellor Rachel Reeves, the situation is clear. The economic situation is grim in absolute and relative terms, and whoever wins the upcoming election will inherit the worst overall set of circumstances since World War Two.

In a lecture this week, she firmly committed to get debt falling in five years' time, taking on the same self imposed straitjacket that currently constrains the Conservative government.

Much was made of her comment about a 1979 moment, suggesting Thatcherite reforms. This reference, she told me, was about cutting red tape on planning to allow more new homes.

But in the absence of huge government investments, the heavy lifting that would need to be done by planning reform would be huge. Each of my questions about what this might mean for public spending or tax cuts was met with an answer about the need to get growth.

The opposition remains very cautious on policy details, wary of doing anything risky to endanger the precious poll lead in the months before the election.

Could that really be sustained if there is a widely felt turnaround, a series of interest rate cuts and the end of the UK recession?

Election hope?

Back in Downing Street I put to the PM that even if there was a turnaround his problem was that the mini-budget with £45bn of unfunded tax cuts had trashed the economic credibility of his party in the eyes of key swathes of the electorate, especially those who had taken on mortgages in the near-zero rate era.

He replied that the economy was dealing with "lots of different challenges" and pointed to his pandemic furlough scheme as evidence he "knows how to run the economy".

I also asked him if he was infuriated that plotting in his party aimed at removing him from office was coming from some of the same people who backed the mini-budget.

He didn't dispute the premise of the question, laughing: "These things don't infuriate me, because fundamentally I'm just not interested in Westminster gossip."

When I asked him if he would still be PM after the local elections in May, he laughed and said yes. He has lasted longer than the last person I asked that question, then Chancellor Kwasi Kwarteng who was fired a day later.

So the recession over, inflation below target, the first of two or three interest rate cuts over summer, helping consumers over summer and offering space for pre-election tax cuts in September. The more hazily optimistic Conservative strategists might throw in Harry Kane lifting the Euros in Berlin in July.

The reality is that a window for some sort of change in the economic weather does appear to be opening up. But the real question is whether it happens quickly and visibly enough to shift the dial with the electorate.

Related topics

- Published20 March 2024

- Published21 March 2024

- Published20 March 2024

- Published20 March 2024

- Published19 March 2024