Welsh shoppers shell out the most for Easter eggs

- Published

- comments

Shoppers in Wales have spent the most on Easter eggs while people in Scotland shelled out the least, figures suggest.

Kantar, a research firm which tracks thousands of till receipts, said that on average the Welsh spent £14.18 while the Scots handed over £12.68.

Overall, consumers bought four chocolate eggs on average compared to six over Easter last year.

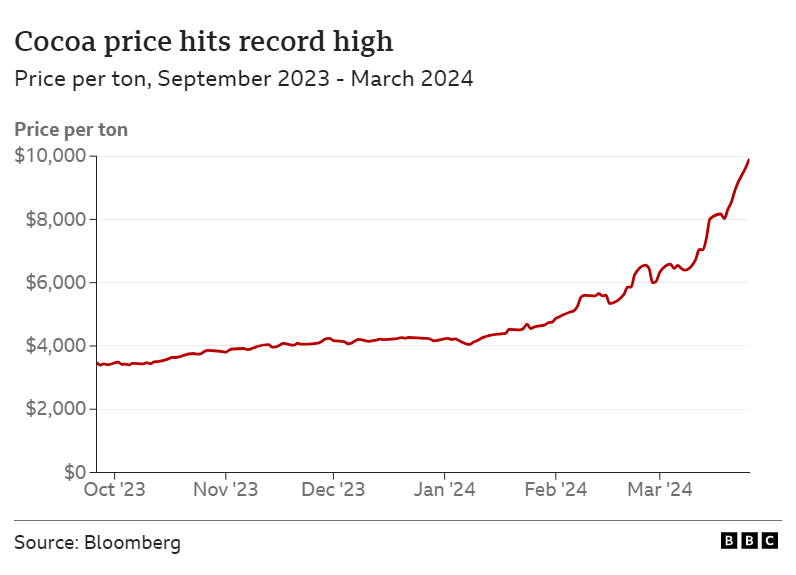

The price of chocolate has been rising as adverse weather and disease blights cocoa crops in West Africa.

Cocoa prices in New York have surged to a fresh record after the Ivory Coast and Ghana, which are responsible for 60% of the world's cocoa, produced less of the crop.

On Tuesday, Ocado Retail, which owns an online food joint venture with Marks & Spencer, said that it expected cocoa prices "to peak at some point". But Ocado Retail's chief executive, Hannah Gibson, said the firm expected prices to "remain high for some time".

Overall, food inflation - which measures the pace at which prices are rising - has been slowing. But Kantar said that prices of confectionary made with chocolate or sugar are growing at a faster pace.

This year on average, people across the UK spent £13.52 on four Easter eggs over the three months to 17 March, Kantar said. Last year, the average spend was just under £14 for six eggs.

After Wales, Northern England was the second biggest spender on chocolate treats at an average £13.84. On the lower end of the scale, Londoners were only marginally ahead of Scotland with an average spend of just over £13.

Food inflation

Kantar said grocery inflation eased to 4.5% in the four weeks to 17 March. That was the lowest rate since February 2022, just before Russia's invasion of Ukraine which sent energy and food prices soaring.

"Grocery inflation has come down significantly since hitting an eye-watering peak of 17% in March 2023," said Fraser McKevitt, Kantar's head of retail and consumer insight.

"However, despite this continued slowdown, many British households are still feeling the squeeze."

Kantar said shoppers were actively searching for cheaper deals and "are using promotions to help manage budgets".

Nevertheless, analysis shows sales of branded goods pushed ahead of supermarket's own labels, and premium own-label lines saw significant growth of 16.1% - the quickest rate in nearly three years.

- Published21 March 2024

- Published9 February 2024