Boom times for US green energy as federal cash flows in

- Published

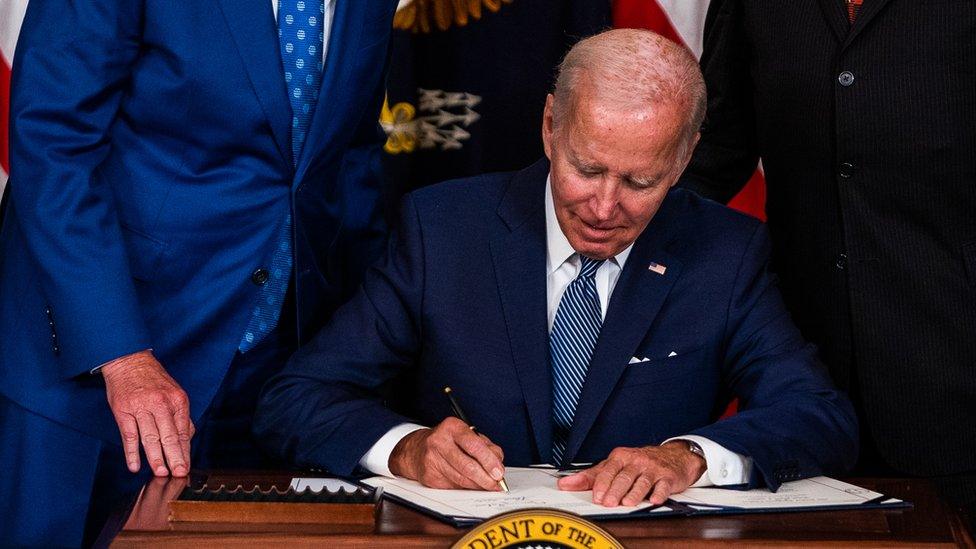

President Biden signed the Inflation Reduction Act into law in August 2022

In February US company LanzaJet, which produces sustainable aviation fuel (SAF) from ethanol, announced that it intended to build a second, larger plant on US soil.

The Inflation Reduction Act (IRA) was a "big influence", says Jimmy Samartzis, its chief executive.

The second plant would add to its facility in Soperton, Georgia - the world's first commercial scale ethanol-to-SAF plant.

"We have a global landscape that we are pursuing…[but] we have doubled down on building here in the United States because of the tax credits in the IRA, and because of the overall support system that the US government has put in place."

Signed into law by President Biden in August 2022, the IRA, along with the so-called Bipartisan Infrastructure Law (BIL) enacted in November 2021, are intended, amongst other things, to funnel billions of federal dollars into developing clean energy.

The aim is to lower greenhouse gas emissions, and incentivise private investment, to encourage the growth of green industries and jobs: a new foundation for the US economy.

With a 10-year lifespan, and a cost originally estimated at $391bn (£310bn) but now predicted to reach, external over $1tn - the final figure is unknown - the IRA offers new and juicer tax credits, as well as loans and loan guarantees for the deployment of emissions reducing technology.

The tax credits are available to companies for either domestically producing clean energy, or domestically manufacturing the equipment needed for the energy transition, including electric vehicles (EVs) and batteries.

Consumers can also receive tax credits, for example for buying an EV or installing a heat pump. The tax credit for SAF producers like LanzaJet is new in the IRA and, offers between $1.25 to $1.75 per gallon of SAF (though it only lasts five years).

Complementary is the BIL, which runs for five years and provides direct investment largely in the form of government grants for research and development and capital projects. Under the BIL, about $77bn (£61bn) will go to clean energy technology projects, according to the Brookings Institution which monitors the law, external.

Ascend Elements extracts useful materials from old batteries

One company to benefit so far is EV battery recycling company Ascend Elements.

It has won BIL grants totalling $480m (£380m), which it is matching a similar amount in private investment to build its second commercial facility in Hopkinsville, Kentucky.

"[The IRA and BIL] are massive investments… larger than the infrastructure related provisions in the New Deal," says Adie Tomer from the Brookings. "There is a clear sense that America has become more serious about transitioning to a cleaner economy."

While rules for some tax credits are still being finalized, tens of billions in actual public spending is flowing into the economy, says Trevor Houser at the Rhodium Group, an independent research provider. Rhodium, together with the Massachusetts Institute of Technology, runs the Clean Investment Monitor, external (CIM) to track US clean technology investments.

According to recently updated CIM data, in the 2023 fiscal year, the federal government invested approximately $34bn (£27bn) into clean energy, the vast majority through tax credits.

The extent to which the policy instruments are so far spurring not just announcements - of which there are plenty, external - but real extra private investment is harder to know: clean energy investment has been on a general upward trend anyway and the IRA hasn't been around long. But experts believe it is rising.

Total clean energy investment in the US in the 2023 calendar year including from both private and government sources reached a record $239bn (£190bn), up 38% from 2022 according to the CIM data.

Clean energy investment in the US, as a share of total private investment, rose from 3.7% in the fourth quarter of 2022 to 5% in the fourth quarter of 2023.

The IRA has had two main positive effects thus far, says Mr Houser.

It has "supercharged" private investment in more mature technologies which were already growing very rapidly like solar, EVs and batteries.

Emerging technologies like CO2 capture have seen "dramatic" growth in investment

It has also, combined with the BIL, led to a "dramatic growth" in investment in emerging climate technologies like clean hydrogen, carbon dioxide capture and removal and SAF. While the total magnitude of those investments are still relatively small compared to the more mature technologies, "the IRA fundamentally changed the economics" says Mr Houser.

But the IRA is failing to reach some parts of the green economy: so far it hasn't lifted investment in more mature technologies which have been falling like wind and heat pumps, though Mr Houser notes things may have fallen further without the IRA.

On the industry's mind is the fate of the laws, particularly the longer-to-run IRA, should there be a change of government in the US November elections.

Repealing or amending the IRA (or BIL) would require Republican control of the Presidency, Senate and House - though wholesale repeal would likely face meaningful opposition from within. The rub is many of the projects that the IRA is incentivising are being or will be built in Republican states or counties.

Yet a Republican president alone could potentially frustrate things, external for example by slowing or deferring loans or grants, or amending the rules which serve the laws. "A Trump presidency would definitely chill the atmosphere and possibly more," says Ashur Nissan of Kaya Partners, a climate policy advice firm.

The Heritage Foundation, a conservative think tank and purveyor of hard-right ideas, external for the next conservative President, advocates repeal for both the IRA and BIL. For the organization's Diana Furchtgott-Roth, a former Trump administration official, it is fiscally irresponsible for the US, with its vast deficit and debt, to be spending like this.

It is also time, she says, that renewable energy such as solar and wind, into which subsidies have been poured for years, stood on their own feet.

Yet others argue the US can't afford not to take this path. And the point of the loans program is to take risks to help unlock new solutions that scale. "It would be failing if there weren't any so called 'failures' within it," says Richard Youngman, of Cleantech Group, a research and consulting firm.

Meanwhile, the US's approach is putting competitive pressure on Europe to do more.

Some European clean energy manufacturing companies are now building facilities in the US to take advantage of the tax credits that otherwise would have been built in Europe including solar panel maker Meyer Burger and electrolyser manufacturers Nel and John Cockerill.

"The US wasn't a market for some of these companies in the past because Europe was more active," says Brandon Hurlbut, of Boundary Stone Partners, a clean energy advisory firm.

The EU's Net Zero Industrial Act (NZIA) is expected to enter into force this year. It doesn't involve new money, but seeks to coordinate existing financing and introduces domestic favourability for the first time - putting in place a non-binding target for the bloc to locally manufacture 40% of its clean energy equipment needs by 2030.

In the UK, chancellor Jeremy Hunt has made clear he isn't interested, nor can the UK afford to copy the IRA's approach in some "distortive global subsidy race" and will stick to other ways of helping. The Labour party recently scrapped its $28bn green investment plan seen as a stab at leaning into an IRA style policy.

A global audience will be watching as the US's clean energy juggernaut unfolds. And if it leads others to ask what more they can do to produce clean energy products - even if just for reasons of economic opportunity - it will be good for humanity's sake, says Mr Hurlbut.