Thames Water troubles swell as parent firm defaults on debt

- Published

- comments

Thames Water has seen its troubles deepen after its parent company defaulted on part of its huge debt pile.

Kemble Water has formally told lenders it failed to meet a deadline to pay interest on £400m of debt due on Tuesday.

The water giant has also asked lenders not to take any action as it explores its options.

Thames Water's 16 million customers will not be affected.

This notification confirms an announcement on 28 March that Kemble would be unable to repay its lenders as interest and principal payments - including a loan repayment of £190m due at the end of April - come up.

It has issued a formal notice to its bondholders, but asked them to take "no creditor action" in order to enable a "stable platform" for negotiations. Companies sell bonds to investors to raise the funds they need, paying the money back over time with a premium.

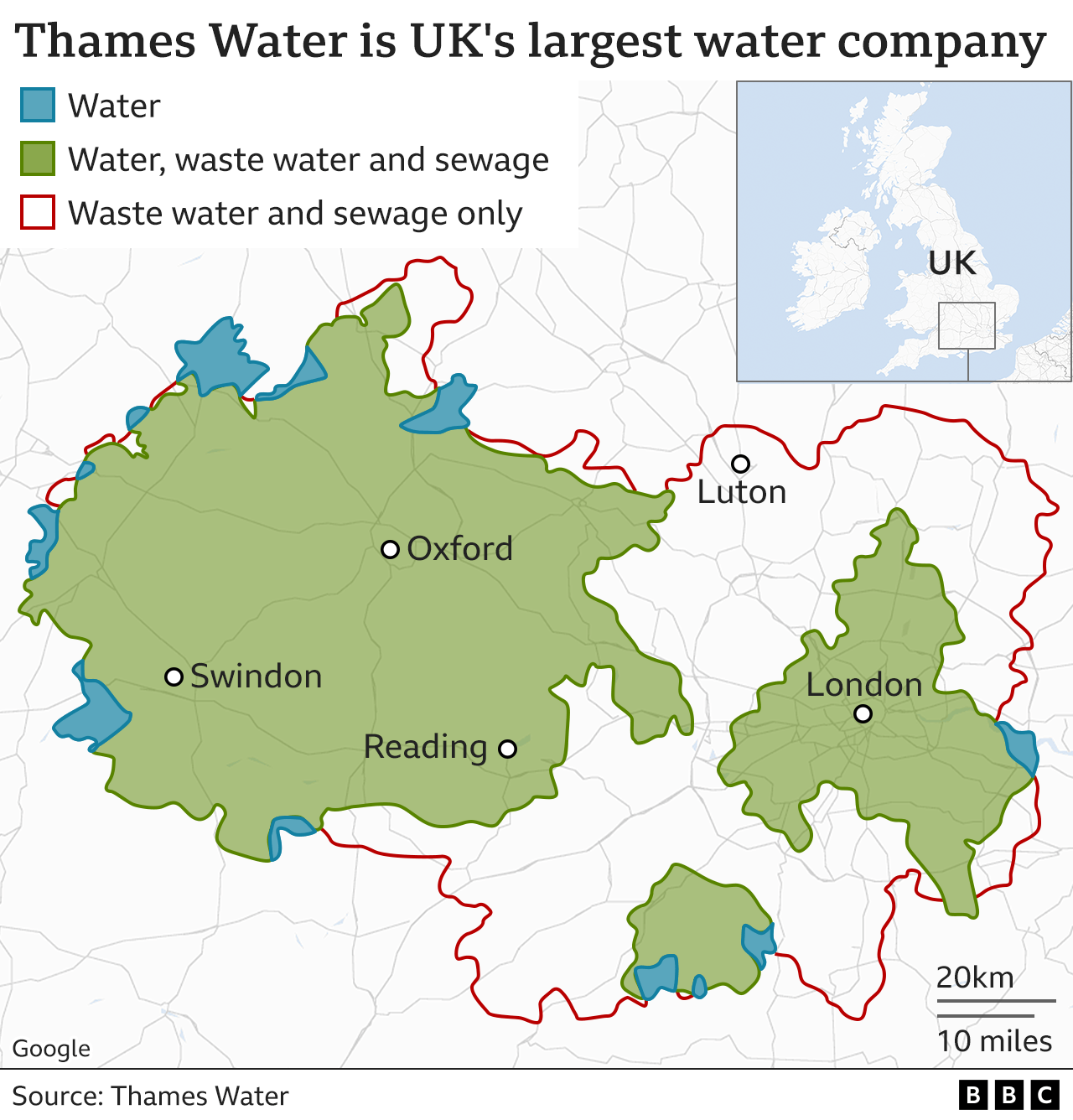

Being in default renders Kemble Water effectively insolvent but that will not affect the underlying utility business that supplies water and waste services to 1 in 4 people in the UK.

The company has been engulfed by a crisis which has seen shareholders refuse to pay a £500m lifeline injection that would have shored up its finances, as well as fierce criticism over Thames Water's handling of leaks and sewage treatment.

The future of Thames Water has been uncertain since fears emerged that it could collapse last June, with the latest developments raising questions around a potential restructure.

The company has been struggling with debts of £14.7bn.

But the new boss of Thames Water - and the regulator Ofwat - insist that the company has enough cash and overdraft facilities to see it through to May of next year.

While the dominos are falling at the parent company, these will fall short of triggering a collapse.

However, at some point Thames Water will need to raise new money. The current shareholders which include UK and Canadian pension funds as well as Chinese and Gulf State investors pulled the planned £500m cash injection when Ofwat rejected proposals to raise customer bills by 40% above inflation by 2030.

Kemble, which is funded entirely through dividends paid out by Thames Water, said it expects it will be able to provide a further update in "the coming weeks".

Regardless of what happens, water supplies to Thames Water's customers will continue as normal.

Related topics

- Published2 April 2024