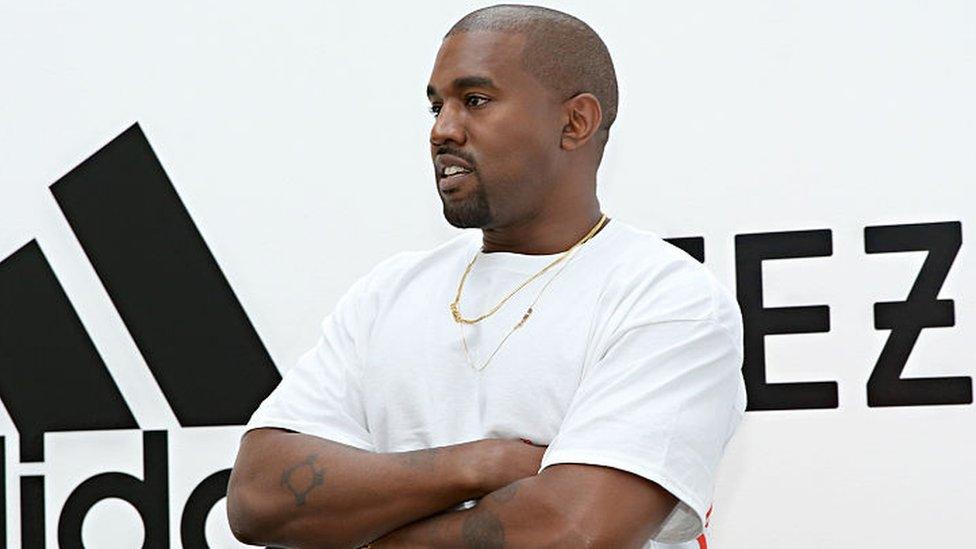

Adidas on front foot after exiting Kanye West deal

- Published

Adidas has emerged from its bruising tie-in with rapper Kanye West and says it expects to make profits of €700m (£598m) in 2024.

In February the German sportswear giant said it planned to sell its remaining Yeezy trainers from its partnership with West for at least cost price.

Tuesday's upbeat comments from Adidas come a month after the company posted its first losses in 30 years.

It makes Samba, Gazelle and Campus shoes.

The company said the revised figures were €200m more than initially predicted and down to a better than expected first quarter of the year.

The company said its quarterly operating profit had reached €336m, up from €60m a year earlier when it was hit by the break-up with West.

Adidas further said it had sold another €150m worth of Yeezy products in the quarter, at a profit of around €50m.

It said the remainder of its Yeezy stock would probably be sold for about €200m later this year, but without any further profit.

Last year it pledged to donate some of the proceeds of the sales to charities who work on combating hate.

Adidas cut ties with West in November 2022 over antisemitic comments he made on social media, but the company still has a diverse fan base with rich and powerful clients.

Sunak's 'fulsome' apology

Last week Adidas and its Samba brand were thrust into the headlines after it emerged British Prime Minister Rishi Sunak had been one of its customers for "many, many years".

Conscious that his serious reputation might not be to other Samba wearers' liking, Mr Sunak issued a "fulsome" apology on LBC radio, external but said he was a "long-time devotee" to the Adidas brand.

But while the global firm has warned its profits will be dented by the Yeezy affair it has also drawn attention to the devaluation of the Argentine peso at the end of 2023.

Adidas has been the maker of shirts for Argentina's national football team for decades.

Rival sportswear firm Puma has also said Argentina's currency devaluation hit its financial results as the region was its biggest and fastest-growing market.

Related topics

- Published1 February 2024

- Published3 August 2023