Fraud victim's two-year fight with bank ends in victory

- Published

Alex Luke (left) says she was determined to fight her bank after it initially blamed her when criminals emptied her account

After a two-and-a-half-year fight, a fraud victim has forced her bank, Santander, to return more than £100,000 stolen from her account.

Alex Luke was scammed by thieves using a sophisticated con in December 2016 and tricked into helping them transfer the money.

She said a loophole in her bank's security system was exploited by criminals which led to the fraud.

But her bank, Santander, disagreed and accused Alex of gross negligence.

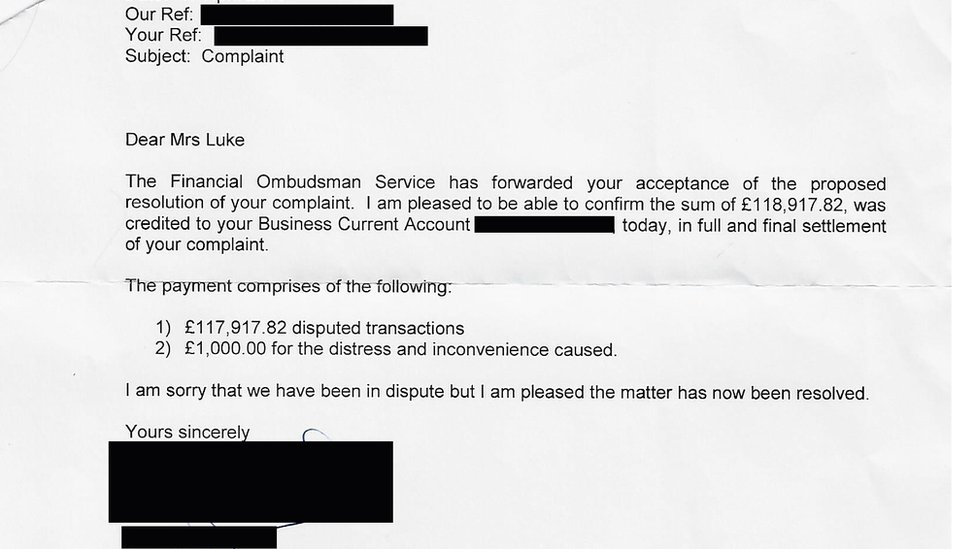

Now, however, the Financial Ombudsman Service (FOS) has agreed with Alex and ordered the bank to pay her the money back in full.

'A disgrace'

Speaking to Radio 4's Money Box in January 2017, shortly after the fraud was discovered, Alex said that her account had been "drained of funds" and she'd had to alert Santander, on 29 December, of the problem.

"If I hadn't called them, they would have just left my account at zero and I never would have heard from them, so I think it's a disgrace."

The fraud had taken place some days earlier. Scammers had called Alex and tricked her into giving them access to her account, before emptying it of money. She only found out she had been targeted a week after the money was taken, when she checked her balance.

Returning from a holiday, she logged into her business account and saw dozens of withdrawals, each one for thousands of pounds.

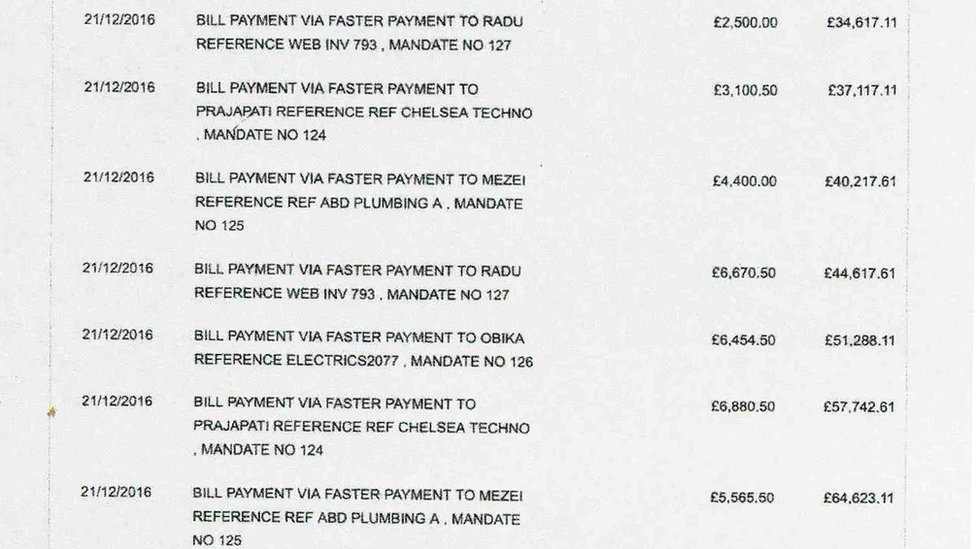

It had taken the criminals less than 24 hours, using 33 fraudulent payments, to empty her account of about £180,000.

Criminals emptied Alex's account in less than 24 hours

Having started a small business in 2008, she'd managed to save up the money as a nest egg which she'd planned to use for her and her children's futures.

But before she knew it, the money had gone, stolen by thieves who'd tricked Alex into believing they were calling from BT before persuading her to hand over sensitive security details to gain access to her account.

Speaking at the time, she said: "I got back [from holiday] on 29 December to move some money across and realised the whole lot had gone.

"It's been a disaster, I'm just trying to exist day to day."

That was two-and-a-half years ago and the start of Alex's fight.

'Utterly delighted'

Although £63,000 was traced and returned to Alex in the following weeks, it still left about £118,000 unaccounted for - a life-changing sum of money.

But Alex says she was determined to fight Santander, to prove its security systems, and not her, were at fault.

All the transactions made by the criminals were extremely unusual and Alex believes Santander's fraud IT systems should have spotted the danger and alerted her to them.

But that didn't happen, so she decided to take on the bank.

"It was actually quite slow to begin with, it just took so long. We had no success from Santander actually offering to refund me at all," she says. "We then had to present a case to the [Financial] Ombudsman, which we did in May 2017. It's only the ombudsman that has managed to get my money back."

It took Alex two and a half years before she got the last of her stolen money refunded

Over Easter 2019, Alex finally got confirmation in writing from the ombudsman that it was ordering Santander to refund her the remaining missing money, £118,000.

"It [getting the refund] has brought back some of the negative memories I've got, but I'm so utterly delighted and grateful. I'm a different person.

"It's made us think about how we spend our money as a family and that's probably been a positive lesson. We're much more careful and we're trying to be sensible with money going forward."

Better protection

The ways in which banks and financial institutions deal with fraud are changing.

For instance, data from the banking industry body, UK Finance, shows there were more than 43,000 cases of so called authorised push payment fraud (similar to Alex's case) in 2017 with losses totalling £236m.

But a new voluntary code of practice about the circumstances in which victims of fraud should be refunded, known as the Contingent Reimbursement Model, is being adopted on 28 May.

It means people who fall victim to this type of fraud are much more likely to be refunded by their banks, which have agreed to fund any compensation until the end of this year at least.

But it's expected a more permanent funding system to help victims will be introduced early next year.

One High Street bank, TSB, has already gone one step further, pledging to refund victims, regardless of the circumstances.

In a statement, Santander said: "Protecting our customers from fraud and scams is a top priority. We have a great deal of sympathy for Alex Luke and all those who fall victim to the criminals who carry out fraud.

"We are committed to the new Contingent Reimbursement Model and our customers can be confident that Santander will abide by the Code.

"Fraud is an industry-wide issue and we are working closely with banks, building societies and other relevant bodies to identify a sustainable long-term solution to the issue of 'no-blame' funding."

Click here to listen to Alex telling her story to Paul Lewis on BBC Radio 4's Money Box.

Follow Money Box, external and Dan, external on twitter.

- Published15 April 2019

- Published21 March 2019

- Published1 March 2019