Reality Check: Why is VAT charged on school uniform?

- Published

As children across the UK are settling into the new school year, many families are facing hefty bills for compulsory school uniforms.

For older children - or those who are taller than average - school uniforms, as well as all other clothing and shoes, attract the full standard VAT rate of 20%.

Reality Check explores why these families are paying more and why successive governments haven't acted.

What are the current rules?

Clothing and shoes for young children have been charged a zero rate of VAT since the introduction of the tax on 1 April 1973.

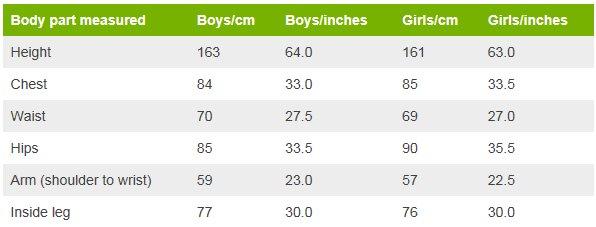

The problem is that there is no definition of the term "young children" in VAT law. Instead, the VAT relief is based on the maximum size an average child will be on their 14th birthday.

So clothes for older children, as well as many children under the age of 14 who are larger than average, are taxed at 20%. And this includes school uniform.

Maximum measurements for VAT zero-rated clothing

Why doesn't the government cut the rate?

The policy would be very popular with parents, and it has been considered in the past, but it has never been taken up.

Way back in 1980, HM Customs & Excise considered the possibility of scrapping VAT on school uniforms, external, but concluded that the zero rate, aimed at children, would be exploited by adults in the larger sizes.

After all, the uniform in a great number of secondary schools includes plain trousers, skirts and shirts - items that adults could wear too.

There were proposals that elements of school uniform clearly identified as being from a particular school, by a logo for example, could be made exempt from VAT.

In 1997, Conservative MP Tim Loughton proposed that such a policy could be policed by the production of a school identification card, or the uniform could be ordered through the school. But the Labour government of the time did not support it.

Other MPs have raised the issue since then.

Last week, Labour MP Sarah Jones asked Steven Baker, a minister at the Department for Exiting the European Union, whether Brexit might result in a change in policy.

How is the EU involved?

EU countries have been co-ordinating VAT rates since 1992 to ensure there is no unfair competition across national borders.

Under EU rules, countries must apply a minimum standard VAT rate of 15%, but 0% VAT is also allowed for the goods which were taxed at that rate before 1991. So children's clothing and footwear in the UK are protected.

The UK's standard VAT rate is 20% and the EU rules would not stop the government from reducing the standard rate by five percentage points now, if it wanted to.

But if the government wanted to add all school uniform to the list of the goods that are taxed at 0%, it would need the agreement of all other EU countries to do so. No UK government has ever tried this.

After the UK leaves the EU, there is unlikely to be such a restriction.

Mr Baker said any future decisions on VAT would be taken by the chancellor as part of the normal Budget process. He pointed out that VAT raised £120bn last year and provided funding for public services including education.

For now, it seems unlikely that any change in policy would be on the cards even after Brexit.

Exceptions to the rules

If a school is exclusively for pupils under 14 years of age, the zero rate can be applied irrespective of the size of the garment, as long as the garment is unique to that school by design, such as a prominent badge.

So, for instance, a uniform for a private prep school which caters for children up to the age of 13 only, attracts 0% VAT irrespective of the size, but the parents of older or taller children in a typical state secondary school with pupils up to the age of 16, have to pay an extra 20% to cover the VAT.

The zero rate also applies to organisations such as Beavers or Brownies, for the clothing items that form the uniform regardless of the size, as long as these organisations cater exclusively for under-14s.