University strike: How big is the pension black hole?

- Published

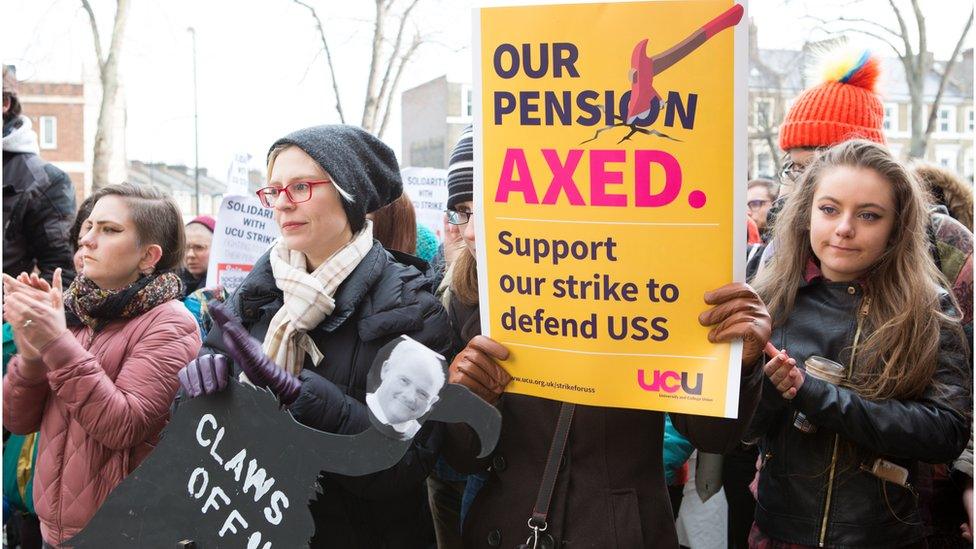

At the heart of the pensions dispute between university staff and their employers is a disagreement over how much the pension pot is in deficit.

The universities want to change the Universities Superannuation Scheme (USS) from a defined-benefit scheme, which gives a guaranteed retirement income, to a defined-contribution scheme, where their pensions would be subject to changes in the stock market.

Most defined-benefit pension schemes like this one have already closed.

The managers of the scheme argue this is necessary because the fund is £6.1bn in deficit - in other words, that's the size of the gap between how much it has and how much it thinks it will owe to members in the future.

But the University and Colleges Union (UCU) has been disputing these figures, saying it could be as much as £8.3bn in surplus.

The numbers are important because this multi-billion pound "black hole" in the fund has been used by universities as the reason it is not financially sustainable and must close.

So who's right?

The problem is, any figure given on how much a pension is in deficit is by nature an estimate.

Not an exact science

Imagine you promise a roomful of people that you will give them as much cake as they want at some point in the future - but you don't know how much cake you're going to have or how hungry they will be. That gives you a vague idea of the challenges facing pension schemes.

Valuing how much a pension fund has and how much it owes is not an exact science.

The amount owed depends on factors such as how long its members live and therefore how many years they draw a pension for. Life expectancy could rise or stagnate.

And the amount of money it has depends on what happens with its investments.

So there is a lot of guesswork involved in all of the numbers you hear.

'Overly prudent'

To calculate how much the fund is in deficit, the USS trustees look at how much they estimate they will owe to all the current members of their scheme in the future. That's their liabilities.

They then discount this figure by how much return they expect to make on their investments (the "discount rate").

From this, they subtract the amount of money they currently have in assets (£60bn). That gives us the £6.1bn figure.

So that's the gap between what they have and what they owe - the gap they need to try to close.

Having a deficit is not an immediate problem, because not all the pensions in the scheme have to be paid out at the same time.

But the scheme's managers do have to show the Pensions Regulator they have a plan to deal with it.

The UCU describes this calculation as "overly prudent".

Schemes such as this one are essentially promises to pay someone money made over a very long period of time.

Young academic staff already in the scheme are being promised they will be paid a certain level of pension in 40 or 50 years' time.

Uncertainty

In that period of time, it's possible that the stock market could grow and the investments could do well and the money in the pot would be enough to cover staff pensions.

But in the case that investments don't perform well, the amount of money you have to have in the pot to ensure enough money in the future goes up.

Former Pensions Minister Baroness Ros Altmann says this uncertainty is one of the biggest issues facing any pension scheme.

To see how difficult it is to establish what's happening with a pension fund, she points at the latest government figures on overall pension liabilities, which uses a discount rate of 5% - the measure of the estimated amount of money investments will make.

If they had used a rate of 4%, she says, their liabilities (the gap between what they have and what they owe) would have been a quarter more.

All of this is how you get such drastically different figures thrown around, none of which is wrong.

It just depends what level of risk the universities are willing to take - and that's what the union says needs to be looked at again.

Correction 27 April 2018: An early version of this story stated that the valuation of £8.3bn in surplus was a best-case scenario. It has been amended to make clear it is a best estimate.