Student loans: Would the proposed changes help poorer students?

- Published

A government-commissioned review of funding for over-18 education has come out with its recommendations.

There has been much discussion of whether the changes are progressive (better for lower earners) or regressive (better for higher earners).

The key proposals for higher education are:

reducing the maximum annual fees that universities can charge - from £9,250 a year to £7,500

instead of any unpaid loans being cancelled 30 years after graduation, deductions would continue for 40 years

reducing the amount graduates can earn before they have to start repaying - from £25,725 a year to £23,000

reintroducing maintenance grants for poorer students.

At first glance, you may think lowering fees would be good for all students - but that is not true because so few of them are expected to pay off their loans in full.

The Office for Budget Responsibility (OBR) estimates, external that only 38% of the money and interest will be repaid, while the Sutton Trust estimates, external that 81% of students will not pay off their loans in full.

And if you are a middle earner who would not have paid off your loan in full under the old system, making you pay for an extra 10 years and making you pay more each year is probably going to cost you more than you are going to save from paying lower annual fees.

To its credit, the review has gone into considerable detail of the impact of the changes. It says:

The highest earners would still pay the most but would pay less than they do under the current system

Middle-earning graduates would make higher contributions each year and more of them would pay off their debt in full

Low-earning graduates would still not pay anything if they did not earn above the threshold, although the threshold would be lower

So while the new system would still be progressive overall, it would be less progressive than the old system and it would be reasonable to describe the changes as regressive.

Example students

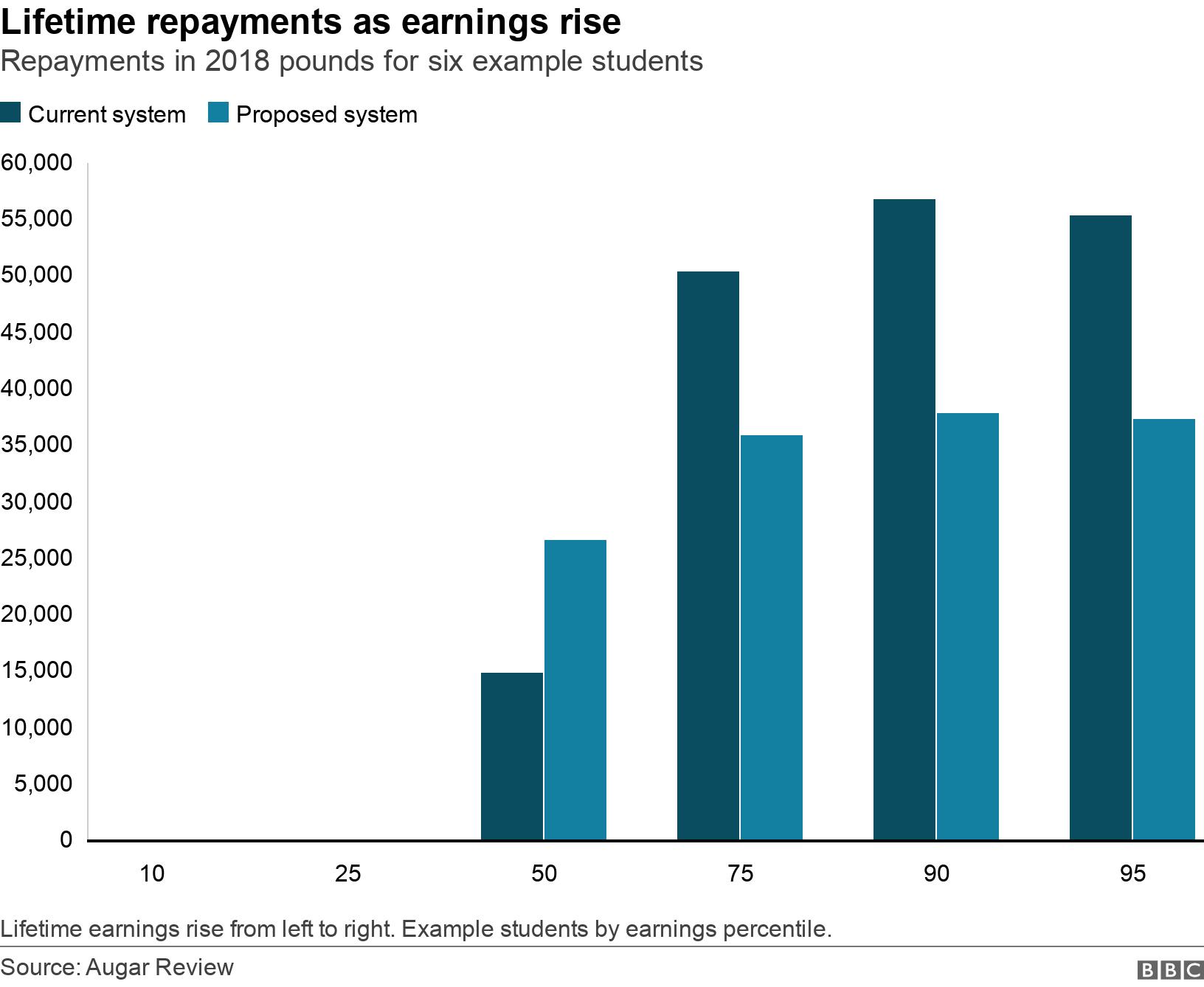

The review also looked at the impact of the proposed changes on the lifetime repayments of six example students with different earnings.

So if you imagine looking at all the graduates who have borrowed money in order of their annual earnings, the first example is 10% of the way along, the second is 25% of the way along et cetera.

So, the lowest earners are on the left of the chart and the highest are on the right.

Again, it is clear that the changes are regressive.

The lowest earner on the chart would not have earned enough to start making repayments under the old system and would not do so under the new system either.

The next student along, who is at the 25th percentile, would also not have made any payments at all under the old system and would make only very small repayments under the new one because of the lower threshold.

It is the middle earner who would really being hit by the new system, with estimated lifetime payments rising from £14,844 to £26,667, as a result of the lower payment threshold and having to pay for an extra 10 years.

All of the higher earners would find themselves better off under the proposed system as a result of the lower annual fees and paying their loans off faster as a result of the lower threshold, which means they pay less interest overall.

They may also benefit from a proposed cap that limits the amount of interest that may be paid by preventing anyone paying more than 1.2 times their original borrowing after adjusting for inflation.

Having a maintenance grant rather than a loan is a progressive move under the proposed changes, although it is based on the student's family income at the point when they are considering going to university.

As such, it is harder to consider alongside the rest of the system, which considers progressiveness based on earnings after the student graduates.

So if a student from a poor background goes on to be a low earner, having a grant rather than a loan would not have made a financial difference because they would not have made any repayments anyway.

- Published30 May 2019

- Published16 December 2018