Reality Check: Will taxes rise £3,028 under Labour?

- Published

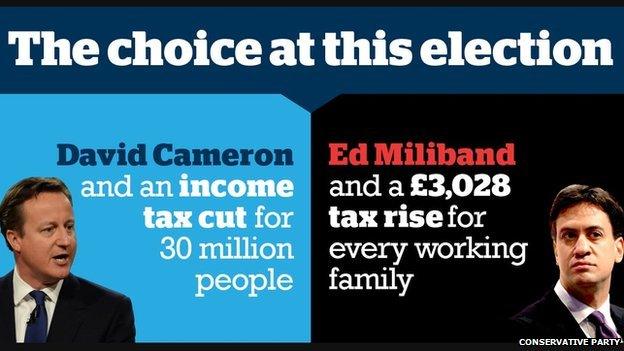

The election campaign proper kicked off this morning with the claim from the Conservatives that a Labour government would raise taxes for every working family in Britain by £3,028.

First of all, that's a remarkably specific figure, but clearly it was supposed to communicate the precision with which the Tories had reached this number.

Labour describes the figure as "totally made-up", so we'll have to try to get to the bottom of it ourselves.

The Office for National Statistics says, external that there are about 11.8 million working households in the UK and another 5.6 million "mixed" households (that's the households with at least one person working and at least one person not).

The statement was about working British families, though, so removing Northern Ireland cuts the total down to about 17 million.

You would usually divide a tax rise between all households, but if 17 million households paid an extra £3,028 each then they would raise about £51bn.

The Conservatives' explanation of the need for the extra money is that Labour has committed to save £30bn a year as part of its support for the Charter for Budget Responsibility.

Labour denies this - it's one of the areas where the two parties' differing positions on borrowing is relevant. The Conservatives don't want to be borrowing any money at all - Labour is prepared to borrow to invest.

We know that some taxes would go up under a Labour government, such as the top rate of income tax rising to 50 pence, but the different definition means it probably does not need to raise nearly as much as £30bn.

But regardless, let's keep going for a while and see where it takes us. The Tories say that Labour has to raise the £30bn by either raising taxes or cutting spending and that Ed Miliband has said he wants a 50:50 split between the two - Mr Miliband has denied committing to a 50:50 split.

Anyway, if that is the case, then it seems that Labour would have to raise £15bn a year in extra taxes, and not £51bn.

So where does the £3,028 come from? Enter the Institute for Fiscal Studies (IFS), which explains, external that the figure is a result of adding up the accumulated tax rises over the years until 2020.

It says: "Cumulating numbers like this over several years is, at best, unhelpful. Ignoring the existence of non-working households doesn't help provide sensible averages either."

It also estimates that Labour's rules mean that it needs to raise £6bn, not £30bn.

We started election year with the Conservatives publishing a document in which they laid out the things they thought that Labour had committed to spend money on. Now, we've started the campaign period with the Conservatives announcing how much Labour would have to raise taxes. All of this is hotly denied by Labour.

So the campaign is off to a cracking start.

Election 2015 - Reality Check

What's the truth behind the politicians' claims on the campaign trail? Our experts investigate the facts, and wider stories, behind the soundbites.

Read latest updates or follow us on Twitter @BBCRealityCheck, external

- Published30 March 2015

- Published30 March 2015

- Published30 March 2015

- Published30 March 2015