Reality Check: How do London mansions pay for Scottish nurses?

- Published

The Scottish Labour Party has published its general election manifesto and one of its key features was a commitment to use "mansion tax" money to pay for more nurses in Scotland. So, how is that possible?

Simple messages sometimes boil down complex election issues. So much so that they can get skewed.

Scottish Labour has done a lot of boiling down of its claims that London mansion owners will pay for nurses in Scotland.

Jim Murphy has said that a tax will be levied on homes valued at more than £2m, most of them in south-east England, that this will pay for 1,000 nurses in Scotland, and that he doesn't care if Londoners don't like that.

There are quite a few links in that statement which require explanation, because it's not all that it might seem. And the Lib Dems are proposing their own version of the "High Value Property Levy".

How does this Robin Hood-style wealth redistribution work?

First, let's be clear how taxation is fed through - almost none of it is directly channelled or earmarked in the way implied by the Scottish Labour leader.

A general, national tax is paid into the Consolidated Fund, external - a very, very large current account at the Treasury. Spending then comes out of that fund. When it does so, it's impossible to identify which tax that spending money came from.

For election rhetoric, it is attractive for politicians to tell a story about money being raised from those who won't vote for you anyway (in Scottish Labour's case, that's people who live in the most expensive parts of London) and to promise it will be used for a purpose close to the hearts of the people who might vote for you (NHS Scotland).

The "mansion tax" is intended, Robin Hood-style, to get more tax out of the rich few, to provide public services for the hard-pressed many. It is a blunt instrument with which to do so.

Labour's plan is that owners of homes worth £2m to £3m should pay £3,000 extra tax per year. Above £3m, the tax rate would rise steeply. It's estimated this would raise between £1.2bn and £1.6bn, depending on the rates set.

Which areas would pay most?

The controversial bit is that this policy weighs heavily on London and south-east England. Only 0.3% of the total tax bill would be paid in Scotland, where people at Zoopla, the online property website, estimate there are about 895 homes in that category.

In the past 10 years, 102 properties in Scotland have sold for more than £2m (though please note: this tax is not about the buying or selling of homes, but an annual tax for owning one).

In London, there are many more. Zoopla issued calculations last September suggesting that London would pay 88% of the total.

Of 108,500 homes worth more than £2m in Britain, the capital has about 85,500, and the average one is worth £3.6m.

They are not spread evenly. The London borough of Kensington and Chelsea is reckoned to have more than 22,000, and would pay 35% of the total take on this UK tax.

South-east England (outside London) has another 14,000, at a lower average value, and would pay 8% of the total.

Is this just a vindictive tax?

There is criticism that this looks like a tax on living in London, where prices are driven up by the international property investment market, rather than being a tax on being rich.

And of course, while owning a £2m property outright means you're rich, having a mortgage to own it makes you exceptionally indebted. Neither guarantees that you've got a big disposable income - though Labour says you would be able to defer payment until you sell, if your income is below £42,000.

In selling this as a transfer from London to Scotland, Jim Murphy has been attacked by London mayor Boris Johnson for being "fiscally vindictive", and by Labour MP Dianne Abbott for being "unscrupulous".

That's all about politics. It suits Jim Murphy to be portrayed as standing up for Scotland against London, while taking a different line from the Labour Party in London. In fact, the policy is set by the Labour Party in Westminster, and the distribution of the funds is likely to follow a decades-old pattern.

The Lib Dem plan for a mansion tax, external foresees £1.7bn per year. This would be raised by councils, on top of council tax, and would be in bands, at rising rates in each band - similar to those for council tax.

The Institute of Fiscal Studies, external has looked at the plans, and raised several doubts about the projections for what it could deliver.

Its main conclusion is that more valuable properties should be charged a higher share of council tax take, but that the way to go about that is through a revaluation of property (updating from 1991 values).

That would spread the cost much more across valuable properties worth less than £2m, and more evenly across the country. But as they found in Wales, revaluation is politically toxic, which is why the values are so far out of date north and south of the border.

Can "mansion tax" money be used on anything in Scotland?

Once collected, that "mansion tax" goes into the Consolidated Fund, and government ministers then decide how it is allocated. So if Labour have promised in their manifesto that it should go into the health service, then they can allocate it to the Department of Health in Whitehall. Or they could change their minds, if another pressure arises in another department.

If it goes to health, the Barnett Formula then goes to work. Now aged 37, the Treasury formula means that portions of that extra funding is distributed to Scotland, Wales and Northern Ireland.

The formula shares vaguely reflect different levels of need (in the late 1970s, and not revised since then) along with different costs of running public services in devolved (often rural) areas. The percentage is changed when there are relative changes in population.

That sum is added to the block grant that comes to Scotland, and is known in the jargon as a "Barnett consequential".

It is then up to the Scottish government and parliament to decide how that money is used. Even if the equivalent allocation of funds is used for the NHS in England, it can be used in Scotland to fund other priorities - student tuition, for instance, or policing.

How much would 1,000 additional nurses in Scotland cost?

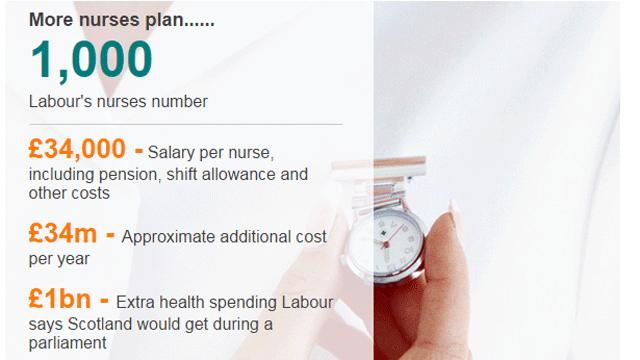

More nurses plan......

1,000

Labour's nurses number

-

£34,000 - Salary per nurse, including pension, shift allowance and other costs

-

£34m - Approximate additional cost per year

-

£1bn - Extra health spending Labour says Scotland would get during a parliament

If you want to hire another 1,000 nurses, then here's a rough calculation - the starting salary of a registered nurse is between £24,000 and £26,000. With other employment costs, such as the pension and shift allowances, the cost to the taxpayer is nearly £34,000.

Multiply by 1,000 nurses, and you get close to £34m per year. Of course, that's a simplistic way to see how staffing can be increased. They would need more senior staff to manage them, so not everyone would be at the starting salary.

Based on Labour's calculations, just under £100m of mansion tax money would go to Scotland. And other proposed Labour tax changes would deliver £1bn to Scotland's NHS across a parliament.

But if Jim Murphy says the money should be used for more nurses, he's talking about a choice for next year's Holyrood election.

The link between the "mansion tax" on London homes and paying for nurses in Scotland requires both a Labour-led government at Westminster to raise the tax and a Labour-led administration at Holyrood to decide how it's spent.

Election 2015 - Reality Check

What's the truth behind the politicians' claims on the campaign trail? Our experts investigate the facts, and wider stories, behind the soundbites.

Read latest updates or follow us on Twitter @BBCRealityCheck, external